It isn't easy to transform a company. It's why so many books and articles have been written about how Apple (AAPL -0.59%) has been able to do it again and again. A mere $100 invested in its 1980 initial public offering (IPO) is now worth $1.24 million.

Its most recent resurgence is thanks to the services businesses it has created. Wall Street loves them. But the segment's contribution could be stretched to its limit. Here's why the upcoming earnings release might reveal the ceiling has been hit and what that could mean for shares down the road.

Image source: Getty Images.

Market share was never the strategy

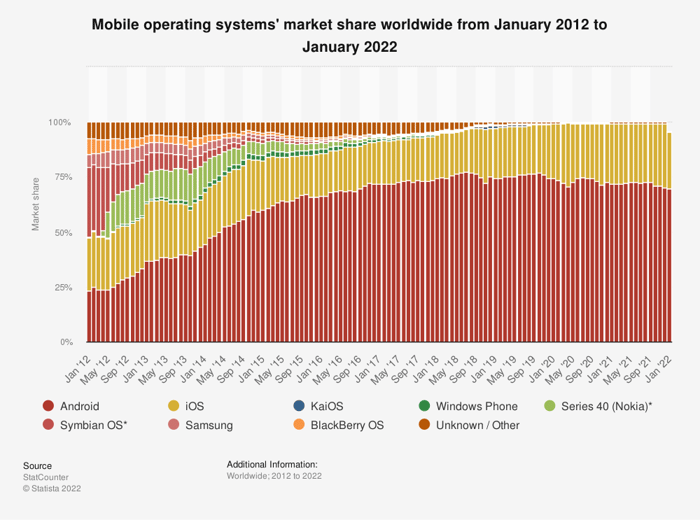

Since the early days of the iPhone, analysts, several media outlets, and one famous rival CEO came up with plenty of reasons the iPhone would fail. When it didn't, the narrative became about market share. After its release, Google's Android -- now a unit of Alphabet (GOOG 1.47%) (GOOGL 1.45%) -- quickly became the dominant operating system for smartphones globally. Most saw that as the path Apple would need to take to maintain growth.

It turned out to be false. Not only has the iPhone been wildly successful, but it also became a gateway for consumers into the company's ecosystem of devices, software, and third-party applications.

Higher margins translated to higher valuation

From its fiscal year 2013 through 2020 -- Apple's year ends in September -- the company's gross margins were consistently between 38% and 40%. And its price-to-earnings (P/E) ratio held between 10 and 20.

As it turned the page on 2020, the narrative changed. The word "margin" was mentioned twice as many times in the end-of-year call as it had been to close out 2019. Margins were climbing, and with it the P/E ratio investors were willing to assign shares. There was an obvious driver.

AAPL PE Ratio data by YCharts

Services provided the boost

The company's services segment -- whose offerings include Apple Pay, Apple Card, Apple Music, Apple TV+, and iCloud -- was growing into a larger part of the business. And those services cost much less to deliver than a physical product. That means gross margins are much higher.

In the company's most recent quarter, gross margin for services was 72.4%. That's almost double the 38.4% management reported for its various physical products.

Data source: Apple. Chart by author.

But growth might have peaked

The services business has been an unquestionable success. But it seemed to have reached a ceiling in terms of its contribution to the overall revenue. And using trailing-12-month numbers, the growth is no longer accelerating.

To be fair, 27% is an awesome pace for a $72 billion business unit to be growing. But it isn't accelerating. That probably means the tailwinds it provided to gross margin and the valuation may have reached their limit.

Data source: Apple. Chart by author. TTM=trailing 12 months.

Apple is a phenomenally well-managed company with products customers love and an ecosystem of services that keep them buying its devices when it's time for an upgrade. But the P/E ratio is up more than 50% in the past three years. That's accounted for a chunk of the stock's 200% run over the same span. Services have been a huge catalyst for the reset. In the future, the shares are less likely to get the same boost. This week's earnings could provide the first clue.