Cloudflare (NET 0.59%) made a name for itself speeding up and protecting websites. The company's edge network now spans 275 cities around the world, with nearly all Internet users within 50 milliseconds of a Cloudflare server. The company slots itself in between end users and servers, caching data and absorbing malicious traffic.

What makes Cloudflare special is its immense optionality. Its vast edge network is useful for so much more than boosting website performance. The company continually launches new products and features that leverage its network, including a full-blown serverless computing platform. It's possible for a developer to deploy an application entirely on Cloudflare, eschewing the major cloud platforms completely.

Its long-term potential is enormous, and the company is growing fast. Revenue soared 51% in 2021, and over 1,400 customers are spending at least $100,000 annually on Cloudflare's platform. The company estimates that its total addressable market will reach $100 billion by 2024. With annual revenue of $656 million last year, it has barely scratched the surface.

A great story is not enough

But a good company doesn't automatically imply a good stock. Shares of Cloudflare have tumbled along with other growth stocks over the past few months, shedding around 60% of their value since peaking in late 2021. It might seem tempting to scoop up shares after such a big decline. But the size of that decline is irrelevant.

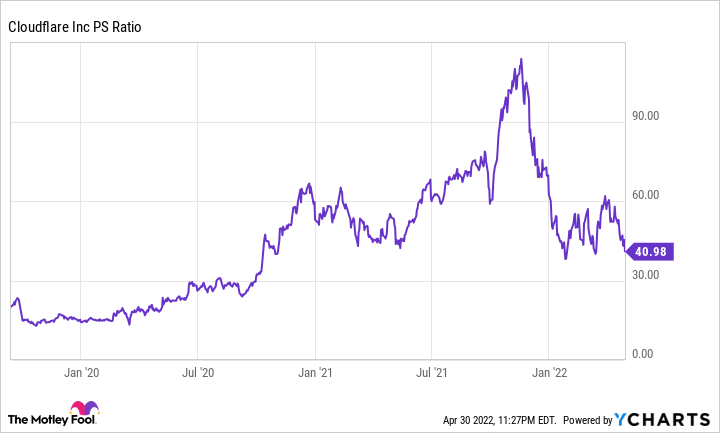

Given how growth stocks have performed recently, it seems likely that the days of investors awarding obscene valuation ratios to fast-growing companies are over. At its peak in late 2021, Cloudflare traded for more than 100 times annual sales. Not profits -- there are no profits. Sales.

NET P/S Ratio. Data by YCharts.

The price-to-sales (P/S) ratio has come down quite a bit, but Cloudflare is still priced beyond perfection. Even after the steep decline, it trades for around 40 times sales. To put that in perspective, the pre-pandemic P/S hovered around 15.

You could argue that Cloudflare's long-term potential has improved over the past two years, given the new products and services it's launched. But a P/S of 40 just doesn't seem reasonable in the current environment.

A cautionary tale

You only have to look at Zoom Video Communications (ZM 1.74%) to get a sense of what can happen when a growth story starts showing cracks. Zoom was the quintessential pandemic darling, at one point trading for over 120 times annual sales.

Zoom's growth was impressive, but things started to slow down as the urgency of remote work began to fade. It is still growing: The company expects to increase revenue by around 11% this year. And it is still highly profitable. Yet the stock now trades for just 7.5 times annual sales.

ZM P/S ratio, Data by YCharts.

There was a point in mid-2021 when you could have made the argument that Zoom was a bargain because it had fallen so far. The stock was down around 45% from its all-time high, trading around 30 times sales. The company was still growing fast and producing impressive profits. Well, it's down another 75% since then.

Of course, Cloudflare and Zoom are different companies, but you get the idea. Cloudflare is a very expensive stock, and the fact that it's already fallen so much does not matter at all. Valuation matters. Even a whiff of a slowdown could send the stock much lower.

At the right price, Cloudflare would make a great investment. The company has so much potential, and it could genuinely disrupt the cloud computing market with its serverless platform. But I don't think the current price is anywhere close to the right price.