Consumer electronics titan Apple (AAPL 0.53%) isn't considered a dividend stock by most; its association with the other FAANG stocks makes it look like a growth stock. But Apple has steadily evolved from a millionaire-making high flier to a cash cow overflowing with profits.

Here is why dividend investors can buy Apple stock today and enjoy passive income for potentially decades to come.

Gushing cash profits

Apple's growth stock label comes from decades of producing life-changing returns for investors. The stock returned a staggering 2,530% from 1990 to 2010 and another 1,960% from 2010 to today.

Two positive trends have remained steady over the years: First, the company's become more efficient at generating cash profits, now turning $0.25 of every revenue dollar into free cash flow. Second, Apple has become an enormous company with a market cap now at $2.6 trillion.

AAPL Market Cap data by YCharts

It will be harder for Apple to produce these substantial capital gains moving forward because of how big it's become. But shareholders now have a company making $107 billion in free cash flow over the past year, more than most companies do in sales.

Establishing a commitment to the dividend

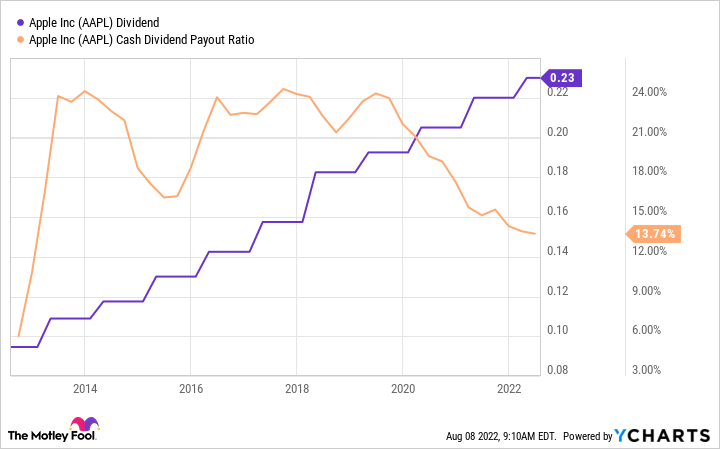

Apple is one of Wall Street's wealthiest companies, so it only makes sense to share its profits with shareholders. Apple's significant share repurchases grab a lot of headlines, but the company has sneakily paid and raised a dividend for the past 10 consecutive years:

AAPL Dividend data by YCharts

It's nothing to brag about today; investors get a dividend yield of just 0.5%. But it's the future potential that should get your attention. The dividend payout ratio is just 13% of cash flow, giving management about as much flexibility as it wants to raise the dividend in the future.

Apple could stop growing immediately and still have the cash to raise the payout for years. But growth hasn't stopped -- annual revenue growth has averaged almost 12% over the past five years. The company's outstanding share count has also shrunk by 21% over the same time frame, allowing it to pay out its dividend to fewer shares.

The combination of growth and fewer shares means that Apple can raise the dividend per share and won't impact the payout ratio as much. The company has the look of a future Dividend Aristocrat, an S&P 500 company with at least 25 years of consecutive dividend raises.

Becoming a more consistent company

The iPhone has been Apple's primary revenue driver for years, and that also makes it a cyclical business. Revenue growth can spike when a new model comes out that has people rushing to upgrade their phones, but sales can also languish the other years:

AAPL Revenue (Quarterly YoY Growth) data by YCharts

Apple's services business, which includes the app store and complimentary subscriptions like Apple TV, Music, News, and Arcade, has steadily become an increasingly more significant piece of the pie, and now ranks second among the company's products:

Source: Statista

Services also happen to be Apple's fastest-growing business, which could eventually mean the segment grows large enough to offset some of the volatility in Apple's growth. Services are subscriptions that users pay for monthly, so they should be more stable than hardware sales.

Apple's massive balance sheet and billions in cash flow have helped the company endure different product sales cycles, enough to raise the dividend each of the past 10 years.

Services could eventually help smooth out Apple's year-to-year growth, and a more steady business would only make it a more robust dividend stock.

Investors shouldn't expect Apple to deliver thousands of percentage points in total returns anytime soon; those days might be over. But Apple can be the type of blue-chip stock that anchors a long-term portfolio. It has enough growth to build wealth for shareholders, and its dividend looks ready to create years of passive income.