Eli Lilly (LLY 0.16%) is a top healthcare company with a rich history that goes back to 1876. The Indiana-based business markets its products in 120 countries and has nearly 9,000 employees who are involved with research and development. Its top product is diabetes treatment Trulicity, but with a vast pipeline that features dozens of medicines, that could change.

The company is continuing to grow and it looks like an unstoppable investment, up 30% this year as it has easily outperformed the markets. The following three charts show why there could be even greater gains ahead for this investment, and why it isn't too late to buy shares of Eli Lilly.

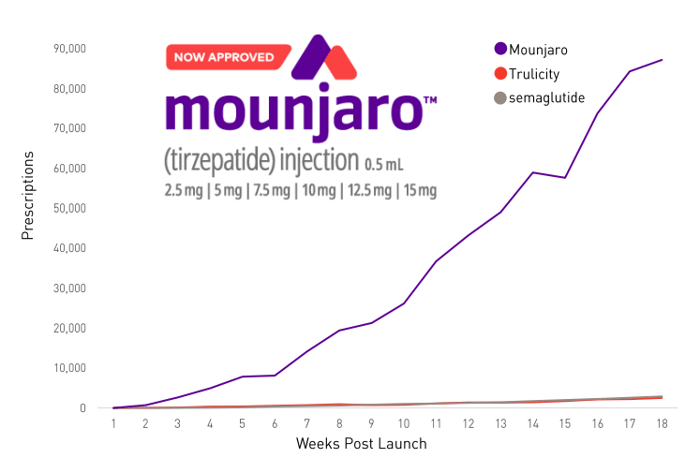

1. Mounjaro prescriptions are soaring

Earlier this year, the Food and Drug Administration approved Mounjaro, a type 2 diabetes treatment that could provide Eli Lilly with plenty of long-term growth. Since its launch, the uptake has been significant and volumes are much higher than that of other top diabetes medications, including Trulicity and semaglutide.

Image source: Eli Lilly Q3 earnings presentation.

Plus, Mounjaro still has significant opportunities as a weight loss medication. In total, the drug could generate upward of $25 billion annually for Eli Lilly at its peak and be a game changer for the business.

2. Profit margins are impressive

Another reason Eli Lilly looks like a solid, long-term buy is that it consistently generates impressive profit margins. This is particularly important during a downturn and when facing inflation as it gives the company plenty of a buffer to deal with rising costs and ensures that it can still post a strong profit.

LLY Profit Margin (Quarterly) data by YCharts

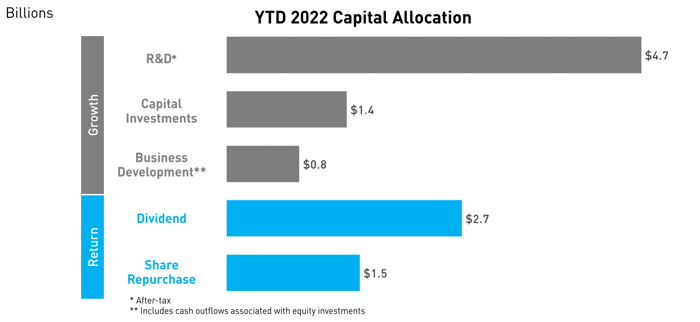

3. Strong free cash flow ensures both dividends and growth

Eli Lilly is not only profitable, but the business also generates a ton of free cash flow -- some $5.3 billion over the trailing 12 months. That can help the company pay dividends, buy back shares, and invest in the business itself. And Eli Lilly has been doing all of that:

Image source: Eli Lilly Q3 earnings presentation.

This means investors don't have to sacrifice a dividend for a promising growth stock.

A buy even though it's near its 52-week high

Eli Lilly's stock doesn't look like a deal -- it's trading at a whopping 53 times earnings. But that only tells you how the stock is priced relative to its recent performance. When factoring in analyst expectations for the coming year, Eli Lilly is trading at around 40 times its future profits. And as the healthcare company continues to grow, its valuation could look a whole lot better -- that's why for long-term investors, the stock could still be a great buy today.