With the market on track to end 2022 with a loss, many investors are fearful, but also hopeful, about what will happen next.

The S&P 500 has posted a loss in six of the past 25 years, not including this year, which is less than a quarter of the total. Of those loss years, three were in a row, and the others rebounded between 9.5% and 29% the year after. The S&P 500 is down about 17% this year, which would be the third-worst loss in the past 25 years. Although there are no guarantees for 2023, based on how the market typically works, it's likely to rebound next year.

In other words, as uncomfortable as it feels to see your portfolio in the negative, it's important to keep in mind that the pain should be temporary. Even more, you can view the end of the year as a time to find great opportunities to buy stocks that should soar when the market returns to growth. MercadoLibre (MELI 2.07%) is one top stock down about 36% this year, and you should consider buying it before it shoots back up.

Enormous opportunities in Latin America

MercadoLibre runs an e-commerce web presence in 18 Latin American countries that's similar to Amazon. It's a leader in all of its markets, with nearly $10 billion in trailing 12-month revenue, including $2.7 billion in the 2022 third quarter, as well as $8.6 billion in gross merchandise volume (GMV). It's nowhere near as big as Amazon, but with a Latin American population of more than 650 million people, it has a huge addressable market.

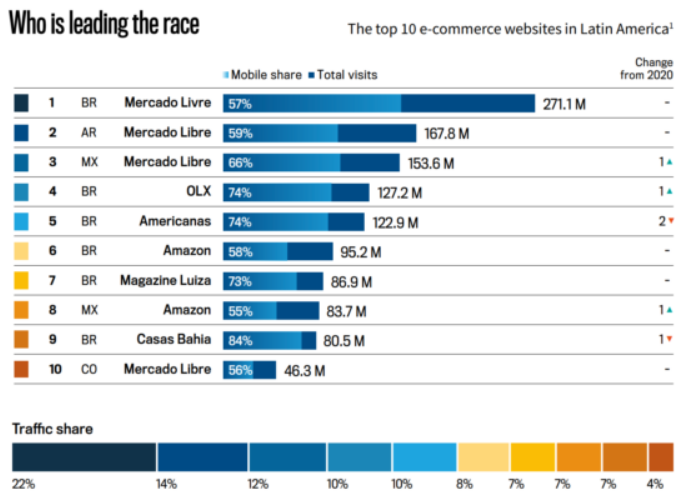

According to Ebanx, e-commerce in Latin America is expected double by 2024, and from 2025 forward large countries are expected to increase e-commerce by 30% annually while smaller countries are expected to increase e-commerce 40% annually. MercadoLibre has 50% of the traffic among the top performers.

MercadoLibre share of traffic in Latin American countries. Image source: eBanx.

Demonstrating incredible performance

MercadoLibre is posting tremendous growth, such as a 61% sales increase over last year in the 2022 third quarter, a nearly 32% increase in GMV, and a 76% increase in total payment volume. E-commerce remains its core business, and MercadoLibre continues to invest in technology and the user experience, which is driving higher usage.

The fintech business, which is its newer and smaller segment, is growing faster and has huge potential. The company's digital payment app, MercadoPago, continues to post triple-digit growth rates, with sales increasing 122% over last year in the third quarter. Unique active users surpassed the 40 million mark. The credit business slowed down, mostly due to lower approvals as default risk rises along with interest rates.

Profitability improved as well, although in general this is variable since MercadoLibre is a growth company with many moving parts. Operating margin widened by 5% versus last year to 11%, and net income increased from $95 million to $129 million.

Varied businesses and an attractive valuation

Something I look for in a stock is the ability to enter and succeed at new businesses. MercadoLibre is a star here.

The company started MercadoPago to make it easier for underbanked customers to shop online, and that has grown into a strong revenue generator. MercadoLibre now has a fully loaded financial app with a broad range of financial services in addition to its broad credit portfolio. It's also developing its ad business as part of its e-commerce site, and that's steadily growing as a percentage of GMV.

MercadoLibre stock trades at 5 times trailing 12-month sales, a cheap price for a huge growth stock that's posting incredible growth despite the pressured economy, and is profitable to boot. I would say to grab shares now before the price goes up.