Online furniture retailer Wayfair (W -1.94%) has one big advantage over many other retailers: It doesn't hold much inventory because its third-party sellers ship directly to buyers. Inventory doesn't eat up capital at Wayfair, which in theory should be a good thing in this economic environment. Other retailers have been stung by shifting consumer behaviors this year, and have been forced to clear out their bloated inventories by marking down prices.

Unfortunately, Wayfair's inventory-light business model has not saved the company from burning through a good chunk of its cash this year. Demand for its offerings has tumbled as inflation and economic uncertainties have made consumers cautious about spending. Wayfair's revenue plunged nearly 13% year over year through the first nine months of 2022. Meanwhile, its operating costs rose 13%.

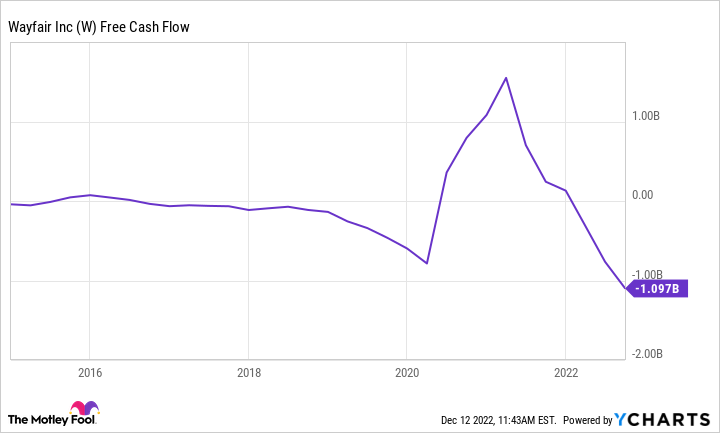

This mismatch has swung Wayfair's free cash flow from a small profit last year to a gigantic loss thus far this year. Wayfair recorded a free cash flow loss of $1.1 billion through the first nine months of 2022. Based on its balance sheet, it won't be able to sustain those kinds of losses for long.

At the end of 2021, Wayfair had about $2.4 billion in cash on the books and $3 billion in debt. At the end of 2022's third quarter, that cash balance had fallen to $1.3 billion, and the company's debt had edged up slightly. The holidays should help, but at its current burn rate, Wayfair has around a year before its coffers start to run dry.

Cutting costs

Wayfair has no choice but to drastically cut its costs. Given the chance that there will be a recession next year, it may take a while for demand to bounce back in a meaningful way, and the company needs to position itself to weather a storm of unknown duration.

It's aiming to get back to cash-flow breakeven as quickly as it can. CEO Niraj Shah said in the third-quarter earnings release that more than $500 million of potential annual cost savings have been identified, and the company plans to deliver those savings in 2023. While that's a significant amount, it won't be enough on its own given the free-cash-flow hole Wayfair finds itself in.

It laid off around 5% of its workforce in August, and it's certainly possible that more layoffs are in the cards if demand weakens further. Beyond these direct cost cuts, management is working on optimizing processes and wringing out cost savings wherever it can. This includes better monetizing returns, reducing the incidence of scams, and optimizing its logistics.

Returns are an expensive problem for e-commerce companies. The e-commerce return rate can be anywhere between 15% and 40%, according to returns software provider Happy Returns. For Wayfair and its bulky furniture, there's probably no good solution. Having customers ship back returns is expensive, and letting them keep items they don't want is expensive as well. The company thinks it can drive tens of millions of dollars in annual savings by improving its returns process, but there's only so much it can do given the types of products it sells.

An unproven business model

Wayfair went public in 2014, but it's important to remember that the company has failed to produce meaningful free cash flow except during the period when demand skyrocketed in the early stages of the COVID-19 pandemic.

W Free Cash Flow data by YCharts.

Wayfair has not yet proven that its business model actually works in anything resembling a normal economic environment. The company wasn't profitable before the pandemic, and there's not much reason to believe it will be profitable in its aftermath. Gaining scale hasn't helped -- annual revenues now top $10 billion.

Wayfair can buy itself more breathing room by cutting costs, so the company is unlikely to find itself in a cash crunch in the near future. But if it does need to raise cash, that process will be tough. With interest rates higher, debt will be expensive, and the stock is down nearly 90% from its all-time high. There likely won't be any good options.

There are two questions anyone considering investing in Wayfair should consider: Can the company survive a prolonged downturn? And if it can, will it ever produce a meaningful, sustainable profit? It could be tempting to bet on a comeback with the stock down so much, but make sure you understand what you're getting yourself into.