Warren Buffett's Berkshire Hathaway has averaged 20% returns over multiple decades, and there isn't much mystery as to how it has done so: by investing in quality businesses at reasonable valuations. The old buy-and-hold approach is a much safer strategy than trying to jump on the latest meme stock.

Three stocks that wouldn't look out of place in Berkshire's portfolio and that have qualities Buffett would desire include Bristol Myers Squibb (BMY -0.09%), TC Energy (TRP 0.35%), and PayPal (PYPL 0.41%). At relatively cheap valuations, these are stocks you should consider buying today.

1. Bristol Myers Squibb

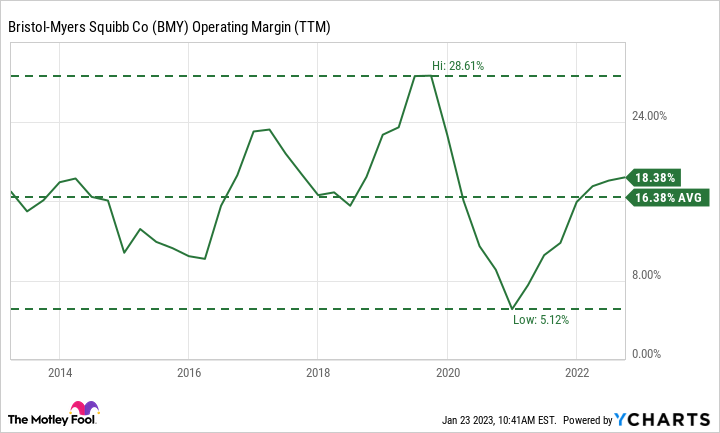

Healthcare companies don't normally take up a big share of Berkshire's portfolio, but one healthcare stock that was in there as recently as last year was Bristol Myers Squibb. Buffett loves consistency, and that's what investors are getting with Bristol Myers. Despite the volatility that came with the pandemic, the business has done a solid job of reporting strong operating margins.

BMY Operating Margin (TTM) data by YCharts

The company also brings in plenty of money, with free cash flow over the trailing 12 months totaling $12.7 billion. Bristol Myers looks to be on track for its third straight year of achieving free cash flow of at least $10 billion.

For a company that's often involved with acquisitions, having ample cash coming in is crucial. Last year, it purchased oncology company Turning Point Therapeutics for $4.1 billion, which is modest compared to the $74 billion purchase of biopharma business Celgene it made in 2019.

On top of all that growth, Bristol Myers stock also pays a dividend yield of 3.1%. For long-term investors like Buffett, it's a stock that can make for a great investment. And at a forward price-to-earnings multiple of only 9, it's a relatively cheap buy right now (the S&P 500 averages a multiple of 18).

2. TC Energy

One sector Buffett has been bullish on of late is oil and gas, with Chevron being one of Berkshire's top three holdings right now. As commodity prices have been rising, these have made some of the best-performing stocks to hold. TC Energy is an example of a similar business that I could see Buffett investing in. The energy infrastructure company's pipelines help transport oil and gas, and TC Energy does so while generating fantastic margins.

Over the past year, Canadian-based TC Energy has reported a profit margin of 22%. And the company is looking to build out its future capabilities, with CEO Francois Poirier stating that "we have an industry-leading $34 billion of fully sanctioned, secured capital projects and an unparalleled opportunity-set that will continue to differentiate TC Energy as a leader in the energy infrastructure space."

And given the strong expected growth, the company also expects to be able to continue to raise its dividend between 3% and 5% annually. At 13 times future profits, TC Energy is another reasonably valued stock that should make for a good buy. Its 6.1% yield only sweetens the deal for long-term investors.

3. PayPal

Buffett normally doesn't buy up tech stocks, but if he felt comfortable with the sector, I think PayPal would be a stock right up there with Berkshire's holdings of Mastercard and Visa. PayPal doesn't issue credit cards, but just like the credit card companies it facilitates transactions and plays a key role in the growth of e-commerce.

PayPal makes it easy for consumers to split bills and transfer money between friends. And it's incredibly popular among online retailers; research and data firm Digital Commerce 360 reports that PayPal is accepted at just under 83% of the online retailers in its Top 1000 rankings. Last year, online retail giant Amazon added PayPal's Venmo payment service as a checkout option.

In the company's most recent results (for the quarter ended Sept. 30, 2022), PayPal's revenue of $6.9 billion grew 11% year over year, while profits jumped by 26%. A year ago, the company's top line was growing at a slightly higher rate of 13%. But overall there hasn't been a significant deterioration in PayPal's growth. And in the long run, the business is likely to thrive as more transactions are done online and the economy expands.

PayPal doesn't offer a dividend, but investing in it would be a great way to "bet on America," as Buffett likes to do. And with the stock down more than 50% from its 52-week high and trading at a forward price-to-earnings multiple of 16, now could be an optimal time for investors to load up on it.