Down more than 70% in the last 12 months, the brutal fall of the industry-tracking AdvisorShares Pure U.S. Cannabis ETF (MSOS) is an undeniable sign that cannabis stocks are enormously struggling. Leading companies like Tilray Brands (TLRY 11.03%), Trulieve Cannabis, and Cresco Labs are reporting shrinking quarterly earnings compared to a year ago, and their struggles with becoming and remaining profitable are as pronounced as ever.

If you're a cannabis investor and the above doesn't bother you, it probably should, as there are a handful of factors like market saturation driving the declines in top lines and stock prices alike.

However, not all is lost, and there are actually a few opportunities to make bank with a timely purchase of the right competitors, provided that you're able to sleep at night while holding a substantial amount of risk. Let's discuss what's going on in cannabis right now, and we'll get to how to take advantage of the circumstances a bit later.

Earnings reports bring grim tidings

Cannabis investors should indeed be starting to sweat, especially if they're invested primarily in U.S.-based marijuana businesses.

In short, the U.S. marijuana industry is following the same trajectory that the Canadian industry did over the last couple of years, in which companies like Tilray, Canopy Growth, and Aurora Cannabis ravenously expanded most elements of their operations to chow down on the freshly legal market for weed, sending revenue soaring. Eventually, cultivation and manufacturing output scaled up to the point of exceeding demand, at which point inattentive investors got a nasty shock when losses ballooned thanks to excessive overhead costs.

That necessitated some sharp production cuts to decrease the rate they burned money. At the same time, the oversupply of cannabis led prices per gram to crash, precisely when some like Canopy were attempting to premiumize their product lineups to squeeze more money out of each gram sold.

Take a look at this chart of these three Canadian players:

TLRY Revenue (Quarterly) data by YCharts

Notice how all three companies ramp up quarterly revenue in a short period of time, then eventually level off before pulling back in the last few quarters?

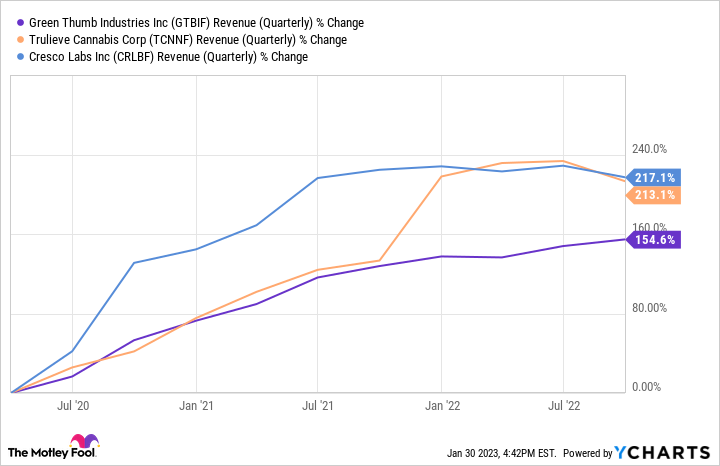

Now take a gander at this other figure, which features the U.S.-based multi-state operators (MSOs) Trulieve, Cresco Labs, and Green Thumb Industries:

GTBIF Revenue (Quarterly) data by YCharts

As you can see, the situation in the American cannabis market is now very much the same as it was in Canada in the last couple of years. And while the prices of these U.S. cultivator stocks peaked in early 2021 during meme-stock mania, they mostly kept growing their top line at a decent clip through the rest of the year, even as their share prices kept falling.

The flat growth of 2022 offered little respite for shareholders, but the real problem is that the contraction is only now starting with gusto -- and most companies failed to become consistently profitable when higher average selling prices for cannabis would have made the task a bit easier.

What's more, smaller competitors are showing signs of distress, and some might go belly up, which would signal to investors that more trouble is coming for the larger businesses. For example, Innovative Industrial Properties (IIPR -0.24%) buys and rents out cultivation floor space for marijuana growers, and it recently had trouble collecting rent from no fewer than three of its tenants.

In sum, it's a highly risky time to start a new position in marijuana stocks, as the next year or so will simultaneously see more revenue headwinds, a fierce marketing and branding fight for market share, stagnant or declining stock prices, and perhaps other issues like labor shortages too.

Legislative changes could be a wild card

There are a few silver linings for shareholders and prospective investors to appreciate. First, the fact that the U.S. cannabis market is saturated at this moment does not detract from its prospects for future growth. The industry will eventually right-size itself relative to the level of demand, and it's reasonable to expect the level of demand to keep rising over time.

So if one of your holdings is in the red, there is still some hope for recovery if you're willing to wait for long enough without selling. It might even be advisable to load up on shares of your preferred companies in the meantime, provided that you can stomach their value falling for a while after your purchase.

The second silver lining is that marijuana legalization could eventually occur at a federal level, which would massively expand the size of the market overnight. Even in the absence of federal legalization, in the next election cycle, more states could opt to legalize on their own, which would also provide a boost.

But legalization isn't the only legislation that could push the entire industry to rally; bills that make it easier for cannabis companies to access traditional financial institutions and sources of capital would also be catalysts if passed.

So if you're sweating about the future of your investments, take heart that a recovery could be around the corner, though a more reasonable perspective is to assume that the industry will take a year or two to bounce back.