Snap (SNAP -0.06%) owns a top social media platform, Snapchat. But the stock can be dangerous to own, particularly when earnings come out.

Large, double-digit declines in price aren't uncommon as the tech company's business has continued to disappoint investors over the years. On Feb. 1, the day after the company released its year-end results, the stock again fell by more than 10%.

It doesn't take long to figure out what's wrong with the business and why investors are often bearish. Here are three charts that help summarize the problems with the stock.

1. Average revenue per user has been declining

The average revenue per user (ARPU) is a key metric that the company tracks. For the last three months of 2022, it declined by a fairly significant rate of 15%. In the previous quarter, it was also down around 11%.

Image source: Snap Q4'22 Earnings Presentation.

Snap has reported a 17% year-over-year increase in the average daily active users. However, given the headwinds in the economy right now and a weak ad market, it's no surprise that ARPU isn't doing well. And until it improves, Snap's stock may remain in trouble.

2. Sales growth is at a low

ARPU was bad, but the company's sales-growth rate has been arguably even more disappointing. Snap's revenue for the last three months of 2022 was just under $1.3 billion and nearly unchanged from the prior-year period. And lately, a slowing growth rate has been the norm for the business.

SNAP Revenue (Quarterly YoY Growth) data by YCharts.

Unfortunately, the situation doesn't appear to be getting better in the ad market. Snap stated in its earnings letter to shareholders that, "we expect the headwinds we have faced over the past year to persist throughout Q1."

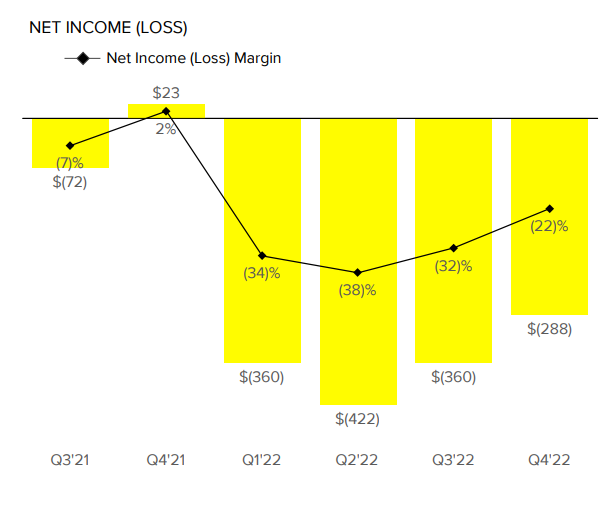

3. The company is nowhere near breaking even

In the current bear market, investors have been eager to sell shares of risky stocks that aren't profitable. Sadly, Snap falls into that category, as its bottom line has been deep in the red in each of the past four quarters. During that time, its losses totaled $1.4 billion.

Image source: Snap Q4'22 Earnings Presentation. Dollar values are in millions.

Is Snap's stock worth buying at its current price?

Shares of Snap are down around 70% in the past 12 months. While it may seem like a potential bargain, there's still the risk that its shares could go lower if ARPU doesn't improve and the tech company's sales continue going in the wrong direction.

Unless there are signs of the ad market improving, investors may be better off waiting on the sidelines. Snap stock is too volatile to buy right now, especially given its high net losses.