What makes a good dividend stock? One important element is dividend growth.

A company that has lifted its payout year after year is one you may want to have in your portfolio. That's because it's shown its commitment to rewarding shareholders. And that means it's likely to continue along those lines.

The best place to find these stocks is in the list of Dividend Kings. These companies have increased their dividends for at least 50 years. Along with a solid dividend track record, you'll want to look for companies with an impressive earnings track record -- and potential for growth.

Sounds like a lot to ask? Not necessarily. Here are three exceptional stocks that fit the bill.

1. AbbVie

AbbVie (ABBV 0.54%) has increased its dividend by 270% since its inception. Today, the company pays a dividend of $5.92, representing a 3.92% dividend yield. That's significantly higher than the pharmaceutical industry average yield of 2.15%, according to data from NYU's Stern Business School.

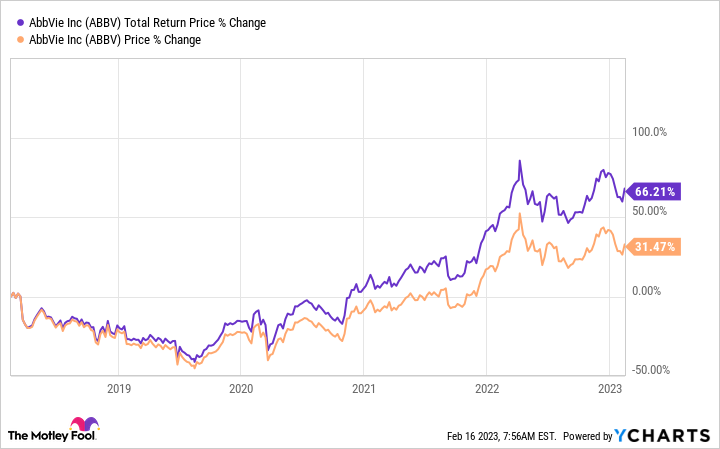

If you held AbbVie over the past five years, your total return -- that's the gain including dividends -- would have been more than double AbbVie's share-price performance during that time period. So dividends clearly are a compelling part of the AbbVie story.

ABBV Total Return Price data by YCharts.

As for earnings, AbbVie has delivered there, too. That's thanks to mega-blockbuster immunology drug Humira and a portfolio of other top-selling treatments.

The bad news is Humira's sales are set to decline because the drug just started facing competition in the U.S. So AbbVie is expecting an earnings trough this year or next year.

The good news is AbbVie's newer immunology drugs, Rinvoq and Skyrizi, are set to surpass Humira's peak of more than $20 billion in annual revenue. AbbVie expects that to happen in 2027. But sales of both drugs already are soaring in the double-digits to blockbuster levels.

If you get in on AbbVie now, you'll benefit from dividends right away -- and a new phase of growth down the road.

2. Target

Target (TGT +0.33%) is set to pay its quarterly dividend next month. It will represent the retailer's 222nd straight dividend since 1967. Target's annual dividend totals $4.32 per share at a yield of 2.45%.

In the third-quarter earnings call, the company emphasized the importance of dividend growth. It aims "to support our dividend and build on our 50-year record of annual dividend increases," said Chief Financial Officer Michael Fiddelke.

NYSE: TGT

Key Data Points

This comment came as Target faces headwinds from today's economic woes. Higher inflation increases Target's costs and weighs on shoppers' wallets. As a result, Target has seen pressure on margins and a decline in profit.

But here's why there's reason to be optimistic about the company: Customers keep coming back -- and this shows in various metrics. The third quarter was the 22nd straight quarter of comparable-sales growth. And Target saw unit-share gains across all five of its merchandising categories. Meanwhile, Target implemented an efficiency plan that could save as much as $3 billion over the coming three years.

All of this means Target still has what it takes to deliver dividend and earnings growth over time. That's why it's a great idea to get in on this stock before it truly takes off.

3. Johnson & Johnson

Johnson & Johnson (JNJ +0.10%) is another pharma player with a dividend yield that beats the industry average. It pays an annual dividend of $4.52, representing a yield of 2.84%.

J&J has increased its dividend for the past 60 years. Including share repurchases and dividend payments, the company returned more than $14 billion to shareholders last year. So investors can benefit from holding J&J shares -- regardless of the stock performance during a particular year.

Like the other companies I've mentioned, though, you'll want to own J&J for its earnings potential, too. The company has reached an important turning point right now. It will spin off its consumer health business into a separate entity called Kenvue later this year.

NYSE: JNJ

Key Data Points

This is great news because consumer health is a slower-growing business than J&J's two other units, pharmaceuticals and medtech, and weighs on the company's overall growth. Last year, for example, consumer revenue rose only 3.9% on an adjusted operational basis (this excludes effects of foreign currency exchanges and acquisitions). Pharmaceuticals and medtech each climbed more than 6%. Without consumer health, overall growth should strengthen.

Considering all of this, J&J, which trades at about 15 times forward earnings estimates, looks like a bargain right now.