Markel (MKL 0.00%) is a mid-cap specialty insurance company that is a favorite among many value investors because of its conservative nature and business model that resembles Berkshire Hathaway. The company has become relatively popular among conservative investors over the past year, as many insurance companies have a reputation for outperforming during times of high inflation and rising interest rates.

Even the Oracle of Omaha, Warren Buffett, thought Markel was a wise investment last year. So he put his seal of approval on it when his company, Berkshire Hathaway, purchased the stock twice in 2022. But is Buffett correct in his assessment?

When Markel released its fourth-quarter 2022 earnings on Feb. 1, many investors viewed the results as mixed. Some parts of its business are doing well, while others are disappointing. As a result, the stock dropped 7% the next day. So does it continue to warrant a buy?

Let's take a look.

Reasons to be wary of investing in Markel

Although high inflation and rising interest rates were theoretically supposed to boost Markel's results, that has yet to prove true in the short term. The problem is that the inflation rate management assumed for its loss reserves was lower than the actual inflation rate. Thus, what it ultimately paid out in claims in 2022 was higher than expected.

Markel is fighting two inflation rates, the first being the economic inflation rate that raged across the second half of 2021 into 2022. The second is social inflation, an insurance term that refers to the rising cost of an insurance claim beyond the economic inflation rate.

You can see the negative impact of inflation in its combined ratio, a measure of profitability. For instance, Markel's consolidated combined ratio was 92% in 2022, still a profitable underwriting operation but missing management's goals and less profitable than in 2021, when the ratio was 90%. A combined ratio above 100 means the insurance operations are unprofitable, so the further the ratio goes below 100, the more profitable the underwriting.

Part of investors' risk with this company is that management could underestimate economic and social inflation, resulting in unprofitable underwriting results in the future. On the other hand, if leadership is too conservative and raises the loss reserves too high, it will result in lower underwriting income.

Another issue is that its equity investments failed to pay off in 2022 -- Markel realized almost $1.6 billion of losses in its equity portfolio in 2022. Additionally, these losses reduced its book-value-per-share in 2022.

MKL Book Value (Per Share) data by YCharts

Should you choose to invest in this company, you need to be aware that the company is far from immune from the effects of inflation, rising interest rates, and recession.

There are some positives

Markel does have some positive things going for it. First, rising interest rates and a slowing economy forces weaker insurance companies to either exit insurance lines or leave the industry altogether. Consequently, with fewer competitors looking to undercut each other on price, it becomes easier to raise premiums -- the industry calls this rate hardening.

In November 2022, the Swiss Re Institute forecasted that non-life real premium growth would recover to 1.8% in 2023 and 2.8% in 2024 after growing only 0.9% in 2022. Should that occur, it would benefit Markel's insurance underwriting business immensely.

Another positive is that Markel reversed the fortunes of its reinsurance business in 2022 by producing a 92% combined ratio compared to 105% a year ago. In other words, the business swung from a loss to a profit.

Lastly, although its equity investment unit produced a full-year loss in 2022, it ended the year with a bang. It made investment gains of almost $600 million in the fourth quarter. Many interest rate observers believe the Federal Reserve will hike interest rates twice more in 2023 before pausing. And since the stock market historically rallies once the central bank ceases raising interest rates, Markel's 2022 equity investment portfolio losses could quickly turn to gains in 2023.

Markel is a solid hold

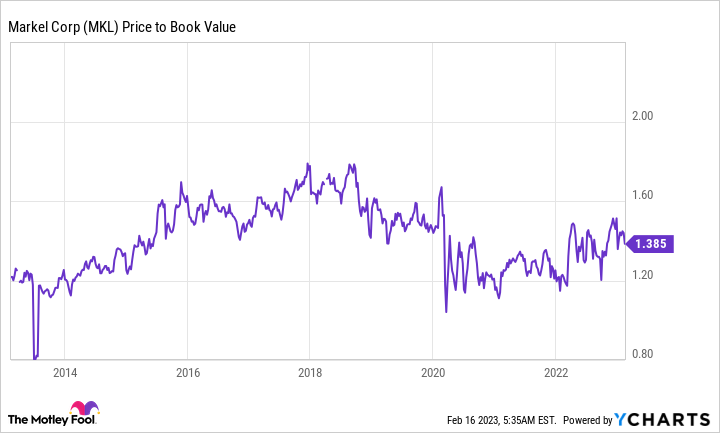

Historically, investors would have maximized their gains if they had bought Markel under a price-to-book of 1.2 and sold it above 1.6.

MKL Price to Book Value data by YCharts

The company currently sells for a price-to-book ratio of 1.36, roughly midway between the ideal valuations to buy and sell the stock or fairly valued. Considering the high uncertainty in today's market, it would be best for most investors to neither buy nor sell but hold the stock if they are already shareholders.