Consumer spending is alive and well, inflation and economic recession worries or not. The January 2023 U.S. Census Bureau's consumer spending report showed retail sales were up 4.4% year over year, led by restaurants, sporting goods and hobby stores, and clothing.

Overseas travel is also still making a comeback, and early signs show that cross-border travel spending volume may have finally recovered back to 2019 levels in the first few weeks of 2023.

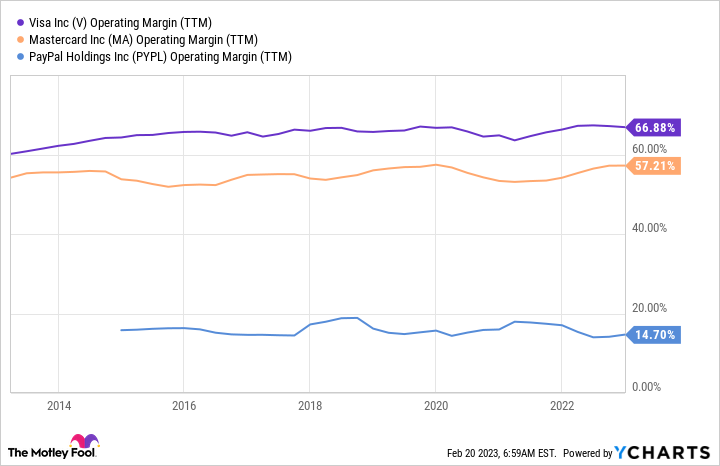

All of this bodes well for digital payment leaders Visa (V 0.33%), Mastercard (MA -0.07%), and PayPal Holdings (PYPL 0.64%). Digital payments already proliferate throughout the global economy, so all-out revenue growth isn't what it was. However, there's still plenty to like from these three top fintech stocks.

The pandemic rally is all over, and that's OK

With much of their global payment volumes tied to in-person spending and global travel, Visa and Mastercard were hit hard in 2020 and early 2021. However, as the world began to reopen from lockdowns, revenue returned to a high-growth mode for the two leaders in digital payments.

Data by YCharts.

That snapback in debit and credit card activity is now complete, and Visa and Mastercard's growth moderated back toward what will be closer to the long-term norm going forward. Visa's revenue was up 12% year over year to $7.9 billion in the final three months of calendar year 2022 (for Visa, its fiscal 2023 Q1). Mastercard's revenue was up 12% in Q4 2022 to $5.8 billion.

Considering their massive size, as well as ongoing pressure from the soaring value of the U.S. dollar (which lowers the value of international revenue when converted back into dollars), Visa and Mastercard are still doing very well.

PayPal's boom time is over, and that's also OK

PayPal was in a very different boat during the early pandemic. Much of its users' spending is tied to e-commerce. Stuck at home for the better part of two years, these users were a boon for PayPal's business in 2020 and 2021.

But like Visa and Mastercard's growth rates as of late, PayPal is also coming back down to earth. The app-based money movement company's Q4 2022 revenue was up just 7% year over year to $7.4 billion, far lower than the 13% growth rate reported for the same period in 2021 (and 18% reported for full-year 2021).

PayPal has had some missteps in forecasting its expansion in the last year as e-commerce has cooled, but the good news is that it's still growing. In a world where smartphones are also increasingly becoming a digital wallet that can be used to access money, PayPal is well-positioned to continue its long-term expansion.

Focus on all that cash

Given the deceleration in growth, I'll admit that Visa, Mastercard, and PayPal stocks aren't exactly cheap by some metrics. However, the global consumer is still spending in key categories (especially travel) despite inflation.

|

Valuation Metric |

Visa |

Mastercard |

PayPal |

|---|---|---|---|

|

Trailing-12-month price-to-earnings per share (EPS) |

31 |

35 |

36 |

|

Trailing-12-month price-to-adjusted EPS |

28 |

34 |

18 |

|

Trailing-12-month free cash flow |

27 |

35 |

17 |

Data source: Visa, Mastercard, and PayPal financial statements and YCharts.

So why would an investor be willing to pay a premium for these three digital payments giants? In a word: consistency. As U.S. and global consumer spending rises, and digital payments continue to replace cash payments, all three will steadily grow. Visa and Mastercard are also ridiculously profitable and continue to find new ways to add to already incredibly high profit margins.

As for PayPal, it's beginning to embark on this journey of unlocking higher profit margins from its digital payment apps. Revenue growth paired with increasing profit margins can be a powerful combination for long-term shareholder returns.

Data by YCharts.

Additionally, all three companies return large amounts of excess cash to their shareholders via stock repurchases -- including PayPal, which recently started buying back stock again in earnest. Share repurchases can boost earnings-per-share growth over time, and increase investors' stake in a business by lowering overall share count. The result has been consistent profit growth for investors on a per-share basis.

Data by YCharts.

Thus, I'm happy to continue holding Visa, Mastercard, and PayPal as consumer spending continues to chug higher. PayPal, in particular, looks like a timely buy to me, given how cheap it is on a free-cash-flow basis (and management's expectation that profits will soar in 2023 with cost-cutting measures in place). I expect all three of these stocks to add consistent growth to my portfolio over the next decade.