With its popular Marlboro brand, Phillip Morris has generated gargantuan levels of profit over the last 100 years. But did you know that the brand split its domestic and international operations back in 2009? This left two publicly traded companies -- Altria Group (MO 0.24%) and Phillip Morris International (PM 0.44%) -- that investors could own for exposure to the brand.

Currently, investors are very pessimistic about Altria's future. Even though the company's operating profits climbed to record highs last year, investors have major concerns over cigarette volume declines in the United States, botched acquisitions, and looming competition from non-tobacco nicotine products.

The stock's price-to-earnings ratio (P/E) is well below the market average, and the company now sports one of the highest dividend yields in the world. This indicates that investors don't believe it's sustainable over the long term.

Altria's ultra-high dividend yield of 8.3% is more sustainable than Wall Street believes it to be. Here's why the stock is a great low-risk pick for income investors today.

Cigarette volume declines? Not the end of the world

The United States may lead the way in other unhealthy lifestyle habits, but for whatever reason, the population has done a much better job kicking the cigarette habit than other countries.

In 2001, it's estimated that there were just under 400 billion cigarettes sold in the United States. In 2020, that number was cut in half to 204 million, with declines occurring again in 2021 and 2022.

Since Altria only sells cigarettes in the United States, investors are worried that it's quickly losing its core customer base. Even if the company retains market share (which it has) with its leading Marlboro brand, it's going to see declining sales volume year after year. However, over the last 10 years, Altria's consolidated operating income is actually up significantly:

MO Operating Income (TTM) data by YCharts.

How did Altria increase its operating profit from around $7.5 billion to $12 billion over the last 10 years when it consistently lost customers? Two words: price increases.

Altria, in the face of volume declines, has been able to steadily raise prices on cigarette packs at a higher rate than inflation. This stabilizes its revenue base, but actually leads to growing operating income since it's now earning a higher profit per pack.

Suffice it to say, it's likely that cigarette usage will continue to decline in the United States over the next 10 years, just as it has for the previous 50. But that doesn't mean Altria's profits will decline. In fact, if the company can keep raising prices at a faster rate than inflation, I wouldn't be surprised if its operating profit from smokeable tobacco -- which made up 89% of its consolidated operating income last year -- was the same or higher in 2033.

Exploring new risk-reduced products

Calling Altria's prior management "misguided" with its expansion outside of tobacco would be a kind characterization. The company wasted $12.8 billion acquiring a stake in vaping company Juul around five years ago that has since been written down to zero. It made an investment in Canadian cannabis producer Cronos Group, which has not worked out at all.

Finally, Altria fumbled its relationship with Phillip Morris International on bringing the safer heat-not-burn tobacco product called Iqos for United States distribution. Phillip Morris International paid Altria $2.7 billion to end its partnership, which is a nice little cash infusion but opens the door open for its international partner to start stealing market share in the United States.

Today, with a new management team in place, Altria continues to make investments in risk-reduced products. It just spent $2.7 billion to acquire 100% of vaping company Njoy, has a joint venture with Japan Tobacco to bring its Plume reduced-risk tobacco product to the United States, and is exploring cannabis products to bring to market if/when the federal government finally makes it federally legal.

Its most successful risk-reduced product has been its On nicotine pouch brand, which sold 82.5 million cans last year. It now makes up 5% of the entire oral-tobacco market in the United States.

The nicotine pouch market has a lot of promise and could start becoming a decent profit pool for Altria within the next five to seven years. The other investments are highly speculative and very unpredictable, which is unfortunate for any investor buying Altria shares, as it is unknown whether all this money will just go to waste. However, I do like that Altria is getting a lot of shots on goal with these non-tobacco and risk-reduced products that will hopefully replace cigarette volume declines.

A 10-year payback?

Altria's future in risk-reduced products is murky. But I don't think you need to see much success within this division in order to make money owning the stock. Let's do some dividend math to show why.

Today, Altria's quarterly dividend per share is about $0.94. Annually, that's a $3.76 payout for every share you own. If that payout remains the same for 10 years, you'll get $37.60 back in cash for owning Altria stock over that time period. At this writing, shares trade at around $44, so you'll get close to your entire cost basis back in dividend payments within 10 years if Altria never raises its dividend again.

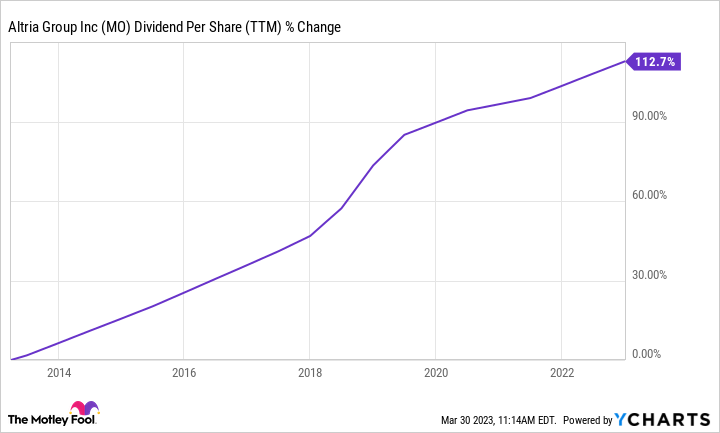

MO Dividend Per Share (TTM) data by YCharts.

If the past is any indicator, Altria isn't going to stop raising its dividend-per-share payouts. Over the last 10 years, its dividend per share increased 113%. If that repeats over the next 10 years, the stock will have an annual dividend payout of $8 per share, or an 18% annual yield at the current stock price.

Even if the cigarette business has much smaller volumes 10 years from now, I still think Altria can produce fantastic income returns for shareholders at current prices.

What should you do with the dividend proceeds? That's up to you. But it will give you a steady stream of income from your portfolio to help you build wealth for the next 10 years and beyond.