Many people are feeling conflicted about investing right now. The stock market has been surging in recent months, with the S&P 500 up more than 8% and the Nasdaq soaring by around 16% since the beginning of the year.

At the same time, though, it's looking more likely by the day that we'll face a recession at some point in 2023. While many investors are feeling optimistic about the market, others are concerned that this rally is only temporary.

There's a lot of uncertainty right now, but there's one thing we do know: A bull market is coming. And there's one mistake that could be especially costly at the moment.

Image source: Getty Images.

How to prepare for a bull market

It's unclear precisely when the next bull market will begin, but no downturn can last forever. One of the worst mistakes you can make right now, then, is to wait too long to invest.

On the surface, it may seem safer to simply wait until the market has stabilized before you invest. After all, if you invest now and prices fall again, it can feel like you're throwing money away.

But the market often begins its recovery ahead of the economy. In fact, in all but one recession over the past 50 years, the S&P 500 started to rebound before the economy reached its lowest point. If you're waiting to invest until the economy is stronger, you may miss the beginning of the next bull market.

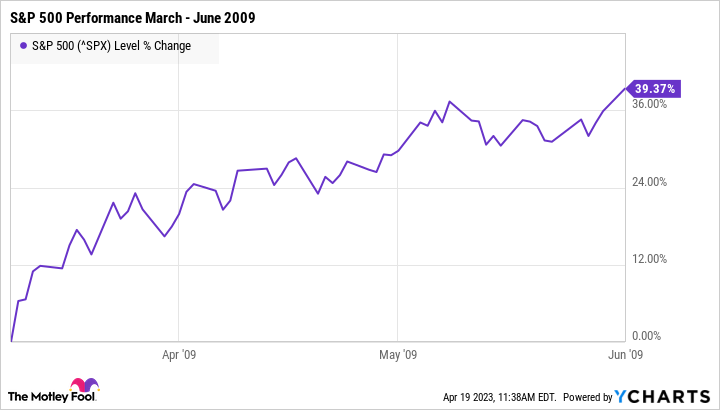

For example, during the financial crisis, the S&P 500 bottomed out in March 2009. But it took until June of that year for the recession to officially end. During those few months in between, the S&P 500 surged by close to 40%.

While it's not always easy, one of the best things you can do right now is to simply keep investing. Stock prices may have further to fall, but the market will recover eventually -- most likely before the economy stabilizes.

Will your investments survive a recession?

Continuing to invest consistently throughout periods of volatility can keep your money safer, but it's equally important to ensure you're investing in the right places. Strong stocks from healthy companies are far more likely to rebound after a downturn.

These types of businesses have solid fundamentals, such as strong finances, a competent leadership team, and a competitive advantage in their industry. The more of these stocks you have in your portfolio, the safer your money will be.

When in doubt, you can always opt for an S&P 500 ETF (exchange-traded fund) or index fund. These funds aim to mirror the performance of the index itself, which has a long track record of rebounding from even the worst recessions.

Regardless of where you invest, it's wise to keep a long-term outlook. A recession may be looming, but the next bull market may come sooner than you think. By continuing to invest consistently, you can take full advantage of it.