Johnson & Johnson (JNJ 0.24%) officially spun off its consumer health business this month, creating the largest U.S. initial public offering since 2021. Kenvue (KVUE 0.57%) began trading as a stand-alone business and gives healthcare investors a new stock to potentially add to their portfolios. It now controls the production and sale of top products like Band-Aid, Tylenol, and Neutrogena, and it will offer a dividend, just as its parent company does.

There are some intriguing aspects to this business that could make it an attractive investment. Is this a stock worth buying right now?

Johnson & Johnson will have a big stake in the business

Although Kenvue is technically a separate company, Johnson & Johnson will still play a big role in its operations; the healthcare company will own a 90% stake in the business.

That's not necessarily a negative, as it will mean plenty of incentive for the company to be run prudently because Johnson & Johnson will still have a lot of skin in the game. That means less risk-taking and perhaps more conservatism, which caters to the preferences of dividend investors rather than to those looking for an aggressive growth stock.

Kenvue operations are diverse but slow growing

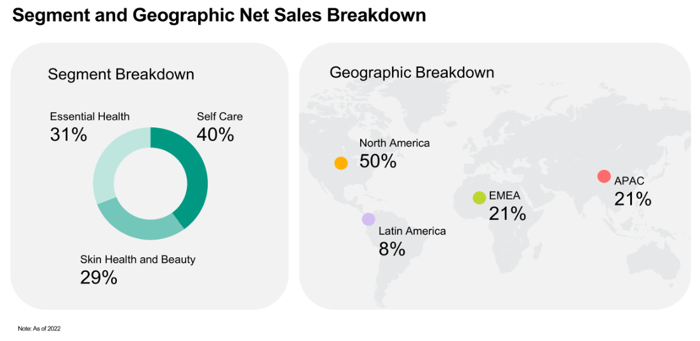

In its prospectus, Kenvue says it holds "leadership positions" in the consumer health market, owning top brands in pain management (Tylenol), facial care (Neutrogena), mouthwash (Listerine), and many other categories. The benefit for investors is that the business has some brand power, which in turn could give it pricing power and make it a potentially resilient company to invest in amid inflation. Strong diversification is one of the things investors can expect to get from owning the healthcare stock.

Image source: Kenvue's prospectus.

But while that diversification will add safety, it won't necessarily make for a good growth investment. Kenvue projects that its top line will grow at a compounded annual growth rate of between 3% and 4% through 2025. That again highlights why the business might make more sense for risk-averse dividend investors than for those seeking attractive growth opportunities.

Kenvue will be exposed to talc liabilities

The one risk that concerns me the most is that investors still face potential liability related to talc-based products the company sold. That has been a big risk for Johnson & Johnson, and while the healthcare giant will be responsible for litigation related to products sold in Canada and the U.S., Kenvue will be on the hook for any such liabilities and litigation from other parts of the world.

Kenvue has already been involved in seven talc lawsuits (at least) since the start of last month, according to Reuters. The danger is that even a handful of claims could potentially yield devastating results for Kenvue, as its assets and revenue stream won't nearly be the size of Johnson & Johnson's. Johnson & Johnson's sheer size makes it a safe stock to buy despite the legal challenges. Kenvue, however, doesn't enjoy that same luxury -- its cash and cash equivalents as of the end of 2022 total $1.2 billion. Plus, there are many more lawsuits that could arise in the future, so that's a big unknown to be hanging over the business right from the start.

Kenvue plans to pay a dividend

One thing investors will like about the stock is that Kenvue stated in its prospectus that it expects to pay a quarterly cash dividend of $0.20 per share later this year. Assuming that is the case and the company pays every quarter, that would result in a yield of around 3.1% based on a share price of $26, which would be higher than the S&P 500 average of 1.7%.

Why I wouldn't rush out to buy Kenvue stock

Kenvue has some strong brands in its portfolio, decent financials, and even plans to pay a dividend. But there's no overwhelming reason to buy the stock. It isn't an attractive option for growth investors, and while the dividend could be relatively high out of the gate, the risk the company faces with respect to talc liabilities negates those positives for me. Investors who are interested in owning the stock may want to see how the company does in its first few quarters before buying shares of the business to see how it performs, as there's certainly no rush to buy it now.