I'm old enough to remember having shopped at Alexander's, which was a department store "way back when." Today, however, what's left of that business is a set of properties owned by a real estate investment trust (REIT) that bears the Alexander's (ALX 0.70%) name. It is offering investors a huge 10%-plus yield today, but you really need to understand the risks here before you buy it.

Out with the old, in with the new

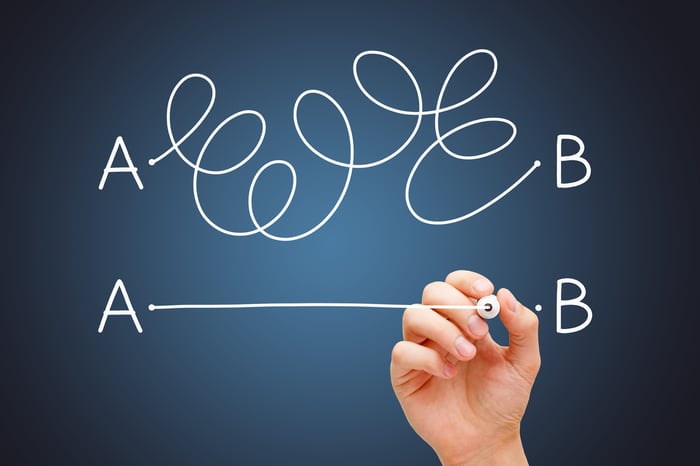

Sometimes, in the retail sector, the most valuable asset a store or restaurant owns is the land underneath the business. That was clearly the case for Alexander's department store, which went out of business many years ago. The name survived because the retailer's property was redeveloped for other uses. And, thus, Alexander's was transformed into a REIT.

Image source: Getty Images.

Its properties are in and around New York City. The portfolio is modest, with just six properties, including office, apartment, and retail assets. Despite its diminutive size, with a market cap of around $850 million, it actually owns some attractive real estate (more on this below).

What most income investors will find interesting here, however, isn't the backstory. It's the over-10% dividend yield. That's huge considering that the average REIT, using Vanguard Real Estate Index ETF as a proxy, is only offering a 4.1% yield. The broader market's yield is even lower, with an S&P 500 Index ETF likely to get you just 1.5% or so. That massive disparity should bring up some questions.

A complex entity

The first thing that investors need to know is that Alexander's is an externally managed REIT. That can lead to concerns about conflicts of interest that many investors prefer to avoid. The external manager in this case is Vornado Realty (VNO -1.36%), a well-respected office landlord that focuses on New York City. Vornado itself owns nearly 33% of Alexander's stock, while a company headed by the CEO of Vornado owns another 26%. That's nearly 60% of the shares, so the 10-K annual report's warning that "There may be conflicts of interest between Vornado, its affiliates and us" should be taken seriously.

To make things even more complex, Alexander's properties are technically leased to Vornado. Vornado is the one that operates them on a day-to-day basis. The lease to Vornado is one-year long and automatically renews annually. This is not your typical REIT setup.

If that weren't enough complexity, Alexander's generates roughly two-thirds of its rental income from a single property, 731 Lexington Avenue. It's a trophy-level property, but it is substantially leased to just one tenant, Bloomberg, which represents 55% of the REIT's rent roll. That's a lot of concentration risk, particularly at a time when the office sector is in a state of flux thanks to the work-from-home trend left over from the COVID-19 pandemic.

As if all of that weren't enough to get investors worried, Alexander's first-quarter 2023 funds from operations (FFO), which is like earnings for a REIT, was $3.63 per share, down from $4.25 a year earlier. The dividend in the quarter was $4.50 per share, meaning the REIT is paying out more than it earns. Investors usually don't like to see that. In 2022, the REIT reported FFO of $16.99 per share, down from $17.52, and paid full-year dividends of $18 per share, so paying out more than is earned isn't exactly a new phenomenon.

Probably not worth the hassle

Given all of the moving parts at Alexander's, the risk/reward balance is probably just not worth it for most investors. There are just too many REITs with generous yields and far less complexity, like 6%-yielding W. P. Carey, for example.