Cava Group (CAVA 4.96%) went public in June, and it has been a hot buy since then, rising by 24%. The restaurant company provides customers with healthy, Mediterranean menu options. It has a wide appeal, and the business has been generating some solid growth in recent years. Is this a no-brainer stock for investors to add to their portfolios today, or should you hold off on Cava?

On the path to profitability?

Cava's business has been growing significantly. Since 2016, sales have risen at a compound annual rate of 49%. The problem is that its bottom line remains in the red. In fiscal 2022 (which ended on Dec. 25, 2022), the company reported a net loss of just under $59 million. That's up from a loss of $37 million a year earlier.

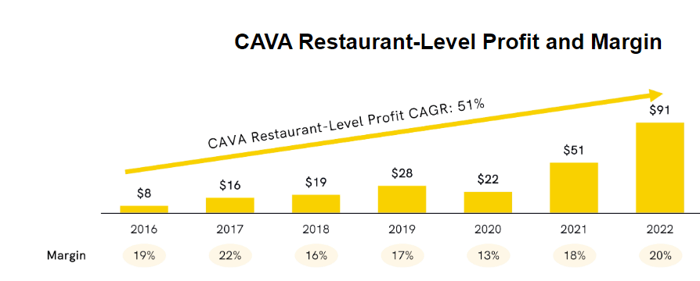

The business boasts that it is profitable -- but at a restaurant level, with margins improving in recent years.

Source: Company's S-1 filing. Figures in millions.

There are, however, more expenses that impact its bottom line besides costs that are directly attributable to individual restaurants. General and administrative expenses, for instance, are key costs for many businesses, and Cava is no exception.

Last fiscal year, the company's general and administrative costs totaled $70 million, which was 12% of its revenue. Once you add that on top of the company's restaurant operating expenses of $466 million, the total of $536 million is already close to the $564 million it reported in revenue. And there are still other costs to consider, including depreciation and restructuring costs, that can pull the bottom line even lower.

Restaurant businesses aren't highly profitable, to begin with, so Cava may have some work to do if it is to get into the black. And while its sales are growing, so too are expenses. In fiscal 2022, sales were up around 13%, while operating expenses, which totaled 624 million, rose at a similar rate. If that trend doesn't change, it could prove to be difficult for Cava to get into the black.

A likely need to raise more money

One risk that growth investors always need to consider is the risk of dilution. And while Cava does have growth opportunities it can pursue, including launching in more states (it's currently in 22), its financials aren't strong enough to suggest it will be able to do that without having to raise more money.

For the quarter ended April 16, the company's operating cash flow was positive at under $26 million. But Cava also spent $39 million on investing-related activities. And as of the end of the period, its cash and cash equivalents totaled less than $23 million. There's already a shortfall with more cash going out than in, and without a big buffer in the event that the company accelerates its growth, it does appear likely that there will be offerings in the near future.

Does the valuation make sense?

At $6.1 billion, Cava is currently trading at more than 10 times the revenue it generated in its most recent fiscal year. By comparison, a high-growth restaurant stock that it often gets compared to is Chipotle Mexican Grill, for which investors are paying less than six times sales. Plus, Chipotle is also profitable.

Investors are paying a bit of a premium for Cava right now in the hopes it does become the next big restaurant stock. But even analysts aren't that bullish just yet as the consensus price target for the stock is less than $46, suggesting that Cava's stock could fall by more than 16% from where it is now.

Is Cava stock a buy?

Cava has been a hot buy since going public. It may have picked the right time to do so with growth stocks picking up momentum and a lack of attractive new stocks debuting on the market. But with its valuation already looking a bit high and the risk of cash burn still considerable, the prudent option for investors may be to hold off on buying this red-hot stock right now.

The business is doing well, but it needs stronger financials to be able to support its growth without having to rely on stock offerings or debt to fund its operations. Given the current macroeconomic conditions (e.g., rising interest rates and a potential recession on the horizon), that could be a recipe for disaster. Investors may want to wait and see how the company does as the year goes on before rushing out to buy the stock.