Stocks are rarely "on sale" without good reason. In this case, both of these stocks have disappointed the market recently with their earnings reports. That's why their share prices have declined, but I think it looks like a good time to dip the toe in these stocks with a small position to monitor, with a view to buying more as conditions improve. Here's why Zebra Technologies (ZBRA 1.56%) and Allegion (ALLE 0.20%) are interesting stocks to buy.

Zebra Technologies

You only have to look at how management has adjusted its full-year guidance through the year to see just how tough conditions are for the company right now. The company provides hardware, software, and services that digitize and automate workflows. Its solutions include barcode scanners, RFID devices, readers, mobile computers, etc. Key end markets include retail and logistics (notably e-commerce fulfillment centers).

|

Full-Year Guidance |

February |

May |

August |

|---|---|---|---|

|

Sales growth |

3% decline to 1% growth |

6% decline to 2% decline |

23% decline to 20% decline |

|

Adjusted EBITDA margin |

22% to 23% |

22% |

18% |

|

Free cash flow |

$650 million |

$450 million to $550 million |

Negative |

Data source: Zebra Technologies presentations.

Unfortunately, rising interest rates have constrained retail spending and caused retailers to cut capital spending plans. At the same time, logistics spending has naturally retracted from the boom experienced during the lockdown measures. It all adds up to a deteriorating environment for Zebra.

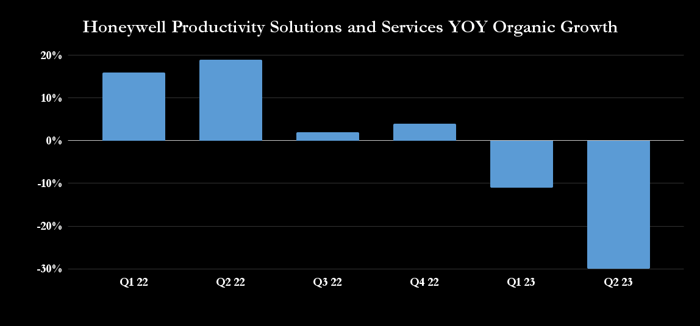

This is confirmed when looking at its competitor, Honeywell International. Its productivity solutions and services revenue growth fell off a cliff in 2023.

Data source: Honeywell International presentations.

Still, the downturn won't last forever, and the need to digitally gather data in retail and logistics isn't going away anytime soon, even if customers pause spending now. The company's conditions could hardly be worse, and 2023 is likely to prove a tough year for Zebra. Management believes it will pass an inflection point in 2024, and Honeywell's CFO Greg Lewis talked of signs of "stabilization" in its short-cycle productivity solutions business.

While there's potential for more near-term disappointment, Zebra's revenue and earnings will surely recover, and it looks like a good time for a small position with a view to monitoring events.

Allegion

Security and access solutions company Allegion is one of those attractive companies that investors look at only to walk away thinking, "great business, shame about the valuation." However, as you can see below, the stock finally looks like a good value.

ALLE EV to EBITDA data by YCharts

The company is an investment in the convergence of electronics and mechanics in security products, namely locks and access doors (a business acquired from Stanley Black & Decker in 2022). Electronic and digitally connected locks offer significant benefits over purely mechanical locks. They allow for locks to be remotely controlled so building owners can grant or deny access to areas while monitoring who is where in a location -- a significant benefit in reducing crime, including theft. In addition, they can be integrated with other control systems in a facility; for example, air conditioning can be switched off if nobody is in an area.

As management notes, the penetration rate of electronic locks in North America is only 10%, with Europe, the Middle East, and Africa (EMEA) only at 5%. As such, there's a significant pathway of growth ahead for Allegion.

The stock has been sold off recently due to management lowering the high end of its full-year revenue guidance on the second-quarter earnings call.

|

Allegion Full-Year Organic Revenue Growth Guidance |

February |

April |

July |

|---|---|---|---|

|

Americas |

4%-6% |

7.5%-9.5% |

7.5%-8.5% |

|

International |

(2%) to flat |

(2%) to flat |

(2%) to (1%) |

|

Total |

2.5%-4.5% |

5.5%-7.5% |

5.5%-6.5% |

|

Adjusted EPS |

$6.30-$6.50 |

$6.55-$6.75 |

$6.70-$6.80 |

Data source: Allegion presentations.

Still, the full-year earnings guidance was nudged higher due to strong pricing momentum (up 9.7% in the first half) and productivity gains as its supply chain improves.

Management expects free cash flow (FCF) of $500 million to $510 million in 2023, the midpoint of which would put the stock on 19 times FCF, based on the current price. That's an attractive valuation for a company with double-digit earnings growth prospects over the long term.