On Sept. 6, Enbridge (ENB -0.72%) stock fell to its lowest level since January 2021 after announcing the $14 billion acquisition (including debt) of three natural gas utilities from Dominion Energy (D 1.75%). Even before the sell-off, Enbridge had one of the highest yields of the major North American pipeline companies. But now, Enbridge's dividend yield is 7.9%, which is more than five times the dividend yield of the average stock in the S&P 500.

Let's take a look at the Dominion deal to see if it makes sense for Enbridge and if investors are making a mistake by selling this high-yield dividend stock.

Image source: Getty Images.

The new Enbridge

Enbridge expects the deal to close in 2024. "It'll take us till [20]25 to get it in the barn and then we'll drive forward, so I think it's a bit of a Superbowl if you will of utilities," said Enbridge CEO Greg Ebel in an interview with CNBC.

Ebel's Superbowl reference isn't an exaggeration. Gas distribution makes up 12% of Enbridge's 2023 estimated EBITDA. If the newly acquired assets were immediately rolled into Enbridge in 2023, then gas distribution would make up 22% of the company's estimated 2023 EBITDA. Enbridge's gas distribution, which was almost entirely in Ontario before the acquisition, is now split 51% in Canada and 49% across Ohio, Utah, Wyoming, Idaho, and North Carolina.

All told, the business is now essentially half oil and half natural gas.

|

Business Unit |

Current Mix |

Post-Acquisition Mix |

|---|---|---|

|

Liquids pipelines |

57% |

50% |

|

Gas transmission |

28% |

25% |

|

Gas distribution |

12% |

22% |

|

Renewable power |

3% |

3% |

Data source: Enbridge.

Much like a pipeline, gas utilities benefit from long-term contracts and provide steady cash flow that can support dividend growth. Enbridge said that 98% of post-acquisition EBITDA will be generated by low-risk businesses. Enbridge's business is resilient to oil and gas prices in the short term thanks to these contracts. However, over the long term, it certainly benefits from higher oil and gas demand.

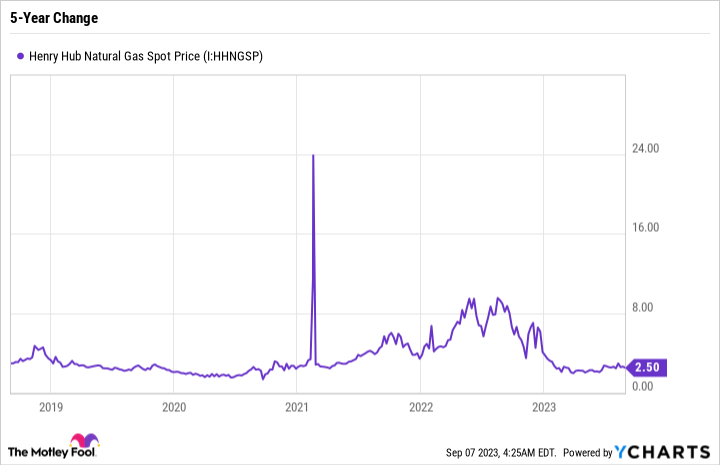

Henry Hub natural gas spot prices, which are typically used as the U.S. benchmark, are down over 70% so far this year. It's a bit of an unfair comparison seeing as natural gas prices are lapping inflated levels during the summer following Russia's invasion of Ukraine. But if we zoom out, natural gas spot prices are still down over 14% in the last five years.

Henry Hub Natural Gas Spot Price data by YCharts

Given the weakness in the natural gas market, now looks like a good time for Enbridge to make a sizable acquisition. However, natural gas distribution assets (like those Enbridge is buying from Dominion) include the infrastructure associated with distributing natural gas to commercial and residential customers. In other words, exposure to natural gas prices is marginal. Most of the growth in the natural gas market is coming from industrial use and exports, not the residential and commercial side of the business.

Nevertheless, Enbridge believes it got a good price for these assets. Enbridge CEO Greg Ebel had the following to say during the company's Sept. 5 investor presentation:

The assets come with attractive rate-based growth profiles, adding capital efficient low risk annual investment, which further de-risks our previously disclosed growth outlook. A quick cycle from capital investment to earnings and cash generation these assets provide set us apart from our sector peers. Lastly, the utilities each have low carbon initiatives that are similarly aligned with Enbridge's ESG goals and provide longer term growth opportunities. In short, we see this being an extremely rare opportunity to acquire gas utilities of scale in support of jurisdictions at an extremely attractive price.

Ebel seems to be exaggerating the deal Enbridge got on these assets. In July, Dominion divested the remaining 50% non-controlling interest in Cove Point LNG to Berkshire Hathaway Energy for $3.5 billion, or 10.8 times estimated 2025 EBITDA. By comparison, Enbridge is buying very low-growth gas distribution assets from Dominion for 16.7 times 2024 estimated operating earnings times, a significant premium to the Cove Point deal.

An excellent dividend stock

Enbridge's dividend is up 116% over the last 10 years. Supporting that dividend is a massive increase in free cash flow (FCF).

ENB Free Cash Flow Per Share data by YCharts

As you can tell by the chart, Enbridge's dividend is taking up about 90% of FCF. Buying gas utility assets from Dominion is one way to grow FCF and support future dividend raises. Since Enbridge already has such a high yield, there's not a lot of pressure to make dividend raises. Even incremental raises or keeping the dividend flat would be fine at this point. But over time, Enbridge should be able to leverage its assets to support its high dividend.

During its Tuesday investor call and presentation regarding the acquisition, Enbridge reaffirmed its goal to organically grow by 1% to 2% a year and 5% overall after 2025. It's also targeting a dividend payout range of 60% to 70% of distributable cash flow.

Even after the acquisition, Enbridge doesn't expect to kick its earnings or FCF growth into high gear. Rather, the investment thesis centers almost entirely around the dividend, and for good reason. Enbridge isn't in the S&P 500. But if it were, it would be the third-highest-yielding stock behind Altria Group and Walgreens Boots Alliance.

The long-term average return of the S&P 500 is around 10% a year. But there's a lot of variance and volatility that comes with that average. So if a company can pay an 8% low-risk dividend per year like clockwork, effectively a 2% yield quarterly, that's an extremely attractive investment for folks looking to supplement income. Put another way, the stock price could remain unchanged and Enbridge would still be a great investment if it is able to support its dividend.

Enbridge's dividend looks secure

Enbridge has the cash flow, business model, and position to maintain its dividend. But investors should expect incremental raises, not big raises, for the years to come. The business works assuming very little growth, so Enbridge is already factoring in a challenged oil and gas industry. In other words, it's not betting on oil and gas outpacing renewables, it's merely betting on the sustained relevance of oil and gas and a growing North American oil and gas export market.

Given the state of the global energy mix, this seems like a very reasonable bet. In many cases, oil and gas have renewables beat in reliability, affordability, and security -- factors that have grown increasingly important since Russia's invasion of Ukraine. For newer projects, the levelized cost of energy is lower for solar and onshore wind than even combined cycle natural gas power plants.

But the transportation industry, as well as industrial, commercial, and residential customers are still heavily dependent on oil and natural gas. Add it all up, and Enbridge is the right play if you're looking for passive income and have a decent level of confidence in North American oil and gas.