Recursion Pharmaceuticals (RXRX +6.81%) is a clinical stage company that mixes healthcare with technology and artificial intelligence (AI). Its drug discovery platform, Recursion OS, is the key to making the company a success. The company uses machine learning and believes it can help modernize drug discovery.

Earlier this year, hype around the business reached a fever pitch after it announced an investment from tech company Nvidia. But is there more to Recursion than just hype? Is this stock the real deal, and is it worth investing in right now?

Recursion's business is a risky one

Recursion doesn't generate much revenue today -- not nearly enough to cover its expenses. It has multiple programs in its pipeline, which focuses on rare diseases and cancer, but nothing is beyond phase 2 trials right now. This means that investors may have to wait years for the company to generate significant revenue -- assuming it is successful in its efforts.

Recursion makes no secret about that, either. On its most recent quarterly filing, it states that it "does not expect to generate significant revenue until the company successfully completes significant drug development milestones with its subsidiaries or in collaboration with third parties, which the company expects will take a number of years."

At the same time, the company says that its cash balance is sufficient to last it for "at least the next 12 months." That suggests dilution is a real risk here (unless it opts to take out debt at potentially high interest rates). If the company is saying it may be several years before any big payoff for its top line, while its cash balance may last approximately a year or more, that sounds concerning.

One obvious problem is that its expenses are significantly higher than the revenue it is bringing in, which primarily comes from collaborations.

RXRX Revenue (Quarterly) data by YCharts

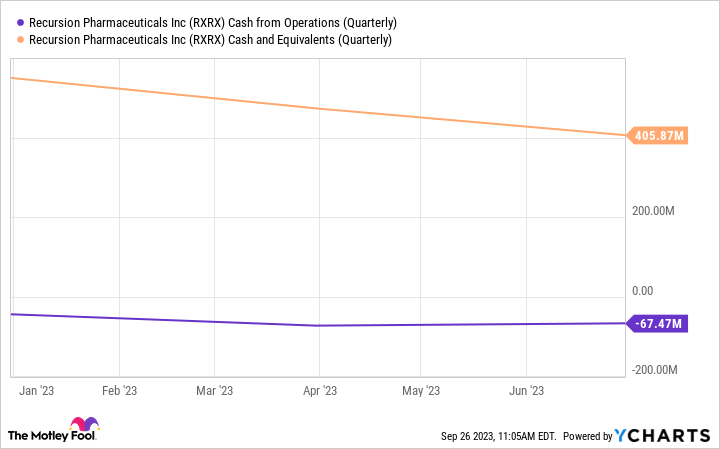

Given the large shortfall, it's also unsurprising that the company has been burning through plenty of cash.

RXRX Cash from Operations (Quarterly) data by YCharts

While the roughly $70 million cash burn could theoretically last the company about five quarters based on its current cash balance, clinical trials can get more expensive as they progress and involve more people. Investors shouldn't assume that Recursion's cash burn won't worsen and that it won't need an influx of cash within the next year.

NASDAQ: RXRX

Key Data Points

Is the stock destined to be tied to AI hopes?

Recursion Pharmaceuticals was a hot stock earlier this year. It announced on July 12 that it received a $50 million investment from tech giant Nvidia. The two companies also plan to collaborate on drug discovery. It's an exciting development for investors to hear amid the hype over AI.

But the market overreacted to the news in a big way, with shares of Recursion skyrocketing to a 52-week high of $16.75. While Nvidia is a top tech company, it doesn't have experience with bringing drugs to market. And although the agreement may sound promising, it doesn't mean Recursion is more likely to succeed in its efforts.

As the AI hype cooled off, the healthcare stock proceeded to decline. Now, at less than $8 a share, the stock's year-to-date returns are flat as the valuation has come back down to reality. An interesting factor for investors to watch in the future is whether Recursion's stock will move similarly to other AI stocks. Both Recursion and Nvidia have been on a similar trajectory over the past month.

That's just a one-month interval. But given Recursion's focus on machine learning, AI, and partnering with Nvidia, it's a trend that could continue, especially since Recursion is a fairly speculative investment at this point.

Is the stock a buy?

Recursion isn't an investment that would be suitable for most people. Its high rate of cash burn and the long wait for significant revenue growth makes it a risky investment to hold.

Using AI to help with drug discovery may sound promising, but it's also not a guaranteed recipe for success. Recursion's business is still unproven. Investors are better off waiting on the sidelines as this can be a volatile stock to put in your portfolio right now.