Most real estate investment trusts (REITs) are fairly simple to understand, but that's not the case for Annaly Capital (NLY 0.91%). If you are looking at this REIT's oversized 14% dividend yield and thinking you've found a great investment opportunity, you'll want to make sure you know these three things before hitting the buy button.

1. Annaly is a complex investment

A property-owning REIT buys a building and then leases it out to a tenant. That's basically the same thing you might do if you owned a rental property, and it is fairly easy to understand. Annaly is what is known as a mortgage REIT. It buys pools of mortgages that have been brought together into bond-like securities, often called something along the lines of collateralized mortgage obligations (CMOs). Owning a single mortgage is simple -- owning a pool of mortgages that trade as a single entity is not.

Image source: Getty Images.

For example, defaults, late payments, full loan payoffs, and principal-only payments across an entire portfolio would create cross currents that aggregate up to a complex mess. Annaly doesn't have to track those specific events, but they all could have an impact on the return profile of the CMOs it owns. Then there are interest rates and the broader trends in the housing market to contend with. In some ways, Annaly is more like a portfolio manager overseeing a giant portfolio of mortgages than an operating company. And it's certainly nothing like a landlord.

Most investors should probably stick to investments that are easier to wrap one's head around (like property-owning REITs). In fact, Annaly is most appropriate for institutional-level investors with a focus on asset allocation, as it provides exposure to the mortgage debt market. Insurance companies and pension funds are the types of investors that might appreciate this REIT. If you, as an individual investor, choose to own the stock, make sure you dig in deep to understand what you are buying.

2. Rely on the dividend at your peril

The problem here is that dividend investors are often lured like moths to a flame when it comes to giant dividend yields. And Annaly's 14.6% yield is very attractive. There's only one problem: The dividend backing that yield has a terrible streak. Normally, investors count the number of years in which a company's dividend has increased (think Dividend Kings and their 50+ annual increases). For Annaly the opposite is appropriate -- counting the number of years that a cut has occurred.

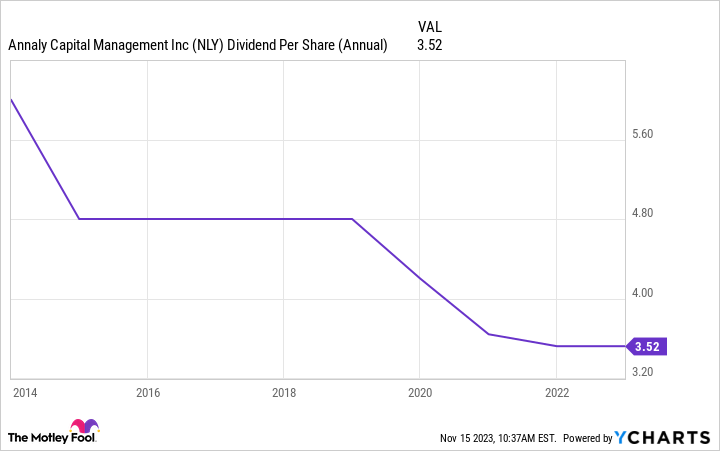

NLY Dividend Per Share (Annual) data by YCharts

For most income investors one cut is usually enough to put a stock on the verboten list. And as the chart above shows, Annaly is a serial dividend cutter. If you are looking to live off of the income your dividend portfolio generates, you do not want to own this REIT. It has a place in some portfolios, as noted in point 1, but not if you need a reliable income stream to pay for your everyday living expenses.

3. Annaly has given investors a double whammy

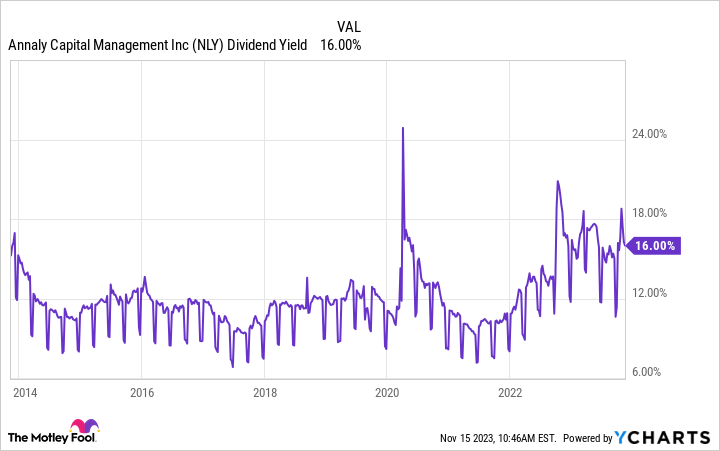

The interesting thing about Annaly's dividend yield is that it is always high, often above 10%. How is that possible if the dividend has been cut repeatedly? The answer goes back to the math behind dividend yield. To calculate yield you divide annual dividend per share by share price. If the dividend goes down, the only way to keep the yield up is to also reduce the share price. That's simple math, but the implications are huge for dividend investors.

As the chart above shows, Annaly's stock has tracked lower along with the dividend. That resulted in the yield staying at lofty levels. The dividend yield chart below for the stock covering the same time span as above shows how the yield math plays out here.

NLY Dividend Yield data by YCharts

From a dividend investor's standpoint, this is the worst possible outcome. You have less income thanks to the dividend cuts, and you have less capital thanks to the stock declines. What's fascinating is that the high yield has resulted in a positive total return over the same span, but total return assumes you are reinvesting your dividends.

That gets to the crux of the issue here about whether or not you should own it. If you are looking to add diversification to a portfolio via the addition of mortgage assets, Annaly could make sense (assuming you are thinking about total return). But if you are looking to create a reliable income stream in retirement, owning Annaly is too big a risk given the terrible dividend record it has amassed.

You've got to do your homework with Annaly

It's never a good idea to buy a stock just because it has a large dividend yield. There's always a story behind that yield that you need to understand, and a business behind the story too. In the case of Annaly, most investors would be better off looking for a far simpler story line.