Enbridge (ENB -0.07%) is offering dividend investors a hefty 7.7% yield today. That's well above the 1.4% or so yield you could collect from an S&P 500 index fund or the 3.5% average yield found in the broader energy sector, using the Vanguard Energy ETF (VDE 0.20%) as a proxy. If you are looking to maximize the income your portfolio generates, Enbridge is as close to a no-brainer dividend stock as you can get. Here are a few reasons why.

1. Enbridge is committed to its dividend

Enbridge pays dividends in Canadian dollars, so the dividend a U.S. investor actually receives will fluctuate along with exchange rates. The graph below seems to be a bit uneven for that reason. The key is that the chart heads steadily higher nonetheless. That's because Enbridge has increased its dividend every single year for 28 consecutive years.

ENB Dividend Per Share (Annual) data by YCharts

In fact, the dividend was just hiked again (by 3%) in November 2023, setting up year No. 29. You don't create a dividend streak like that by accident. Enbridge has proven through its actions that the dividend -- and specifically, growing it over time -- is a vital focus.

2. Enbridge is a diversified business

Enbridge is a midstream company, which means it owns the energy infrastructure that moves oil and natural gas around the world. But its business is actually more diversified than many of its peers'. That's because it owns midstream assets (oil and gas pipelines), natural gas utilities, and clean energy assets. It just agreed to buy a trio of natural gas utilities from Dominion Energy (D -0.71%), which will close throughout 2024, that will further diversify its operations. All of its assets are either fee based, regulated, or driven by long-term contracts, so cash flows are highly reliable.

| Segment |

Percentage of EBITDA |

|

|---|---|---|

|

Pre-acquisition |

Post-acquisition |

|

|

Oil pipelines |

57% |

50% |

|

Natural gas pipelines |

28% |

25% |

|

Natural gas utilities |

12% |

22% |

|

Renewable power |

3% |

2% |

Data source: Enbridge. EBITDA = earnings before interest, taxes, depreciation, and amortization.

While there are other diversified energy companies you can buy, the important takeaway is that Enbridge's business mix provides a solid foundation for its dividend.

3. Enbridge is financially strong

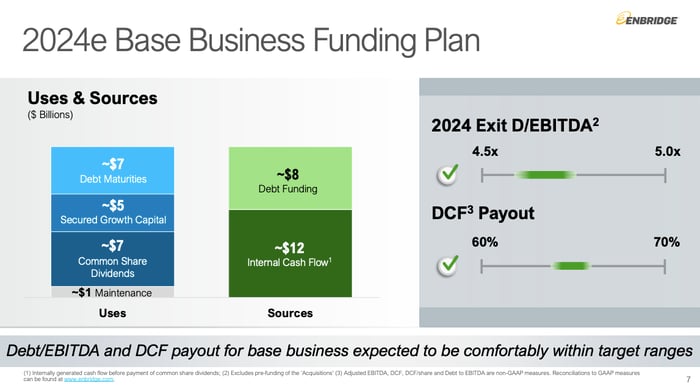

Adding to the strength of the foundation at Enbridge is an investment-grade balance sheet. To put some numbers on that, the company's debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is currently at the low end of its 4.5 to 5 target range. After the acquisition of the natural gas utilities, Enbridge expects debt to EBITDA to increase toward the middle of that range, as the graphic below highlights.

Image source: Enbridge.

The distributable cash flow payout ratio, meanwhile, is currently in the middle of the company's 60% to 70% target range. That won't change even after the acquisition. There's a lot of room for adversity here before the dividend looks like it would be at risk.

4. Enbridge is planning on slow and steady growth

One negative about Enbridge is that the dividend is likely to grow slowly. The most recent increase, as noted above, was a modest 3%. And the company is projecting distributable cash flow growth of roughly 3% a year through 2025 even though EBITDA is projected to rise 4% to 6% a year. Post-2025, the plan is for distributable cash flow and EBITDA to climb at roughly the same 5% rate.

| Metric |

Projected Growth Rate Through 2025 |

Post-2025 Growth Rate |

|---|---|---|

|

EBITDA |

4% to 6% |

~5% |

|

Distributable cash flow |

3% |

~5% |

Data source: Enbridge.

A dividend growth rate of 3% will keep the income generated from the dividend on pace with the long-term rise of inflation. So it is hard to complain too much about that given Enbridge's elevated starting yield. A 5% dividend growth rate will increase the buying power of the dividend (slowly) over time. This isn't a company that's going to excite you, but it has plans to reward you in tortoise-like fashion in the long term. That's going to be attractive to many income investors.

Enbridge is for dividend lovers

Enbridge isn't for everyone. For example, if you like dividend growth stocks, you'll probably be very disappointed by this company. But if you are trying to augment your Social Security check in retirement with reliable and high-yield dividend stocks, it could be exactly what you're looking for.