Nvidia (NVDA -2.87%) stock has soared over 435% since the beginning of 2023 as companies flock to the tech giant for its top-performing suite of artificial intelligence (AI) chips. Its top and bottom lines have exploded, rising at triple-digit rates quarter after quarter. In the fiscal 2024 fourth quarter, revenue reached a record high $22.1 billion, and net income rose to $12.3 billion.

But even amid this good news, investors have worried about one thing: competition. Nvidia faces challenges from fellow chip designers like Advanced Micro Devices and even some of its partners like Amazon Web Services (AWS). But before you worry too much about rivals dethroning this market giant, it's important to look at one particular number -- one that may ensure Nvidia's AI chip dominance going forward.

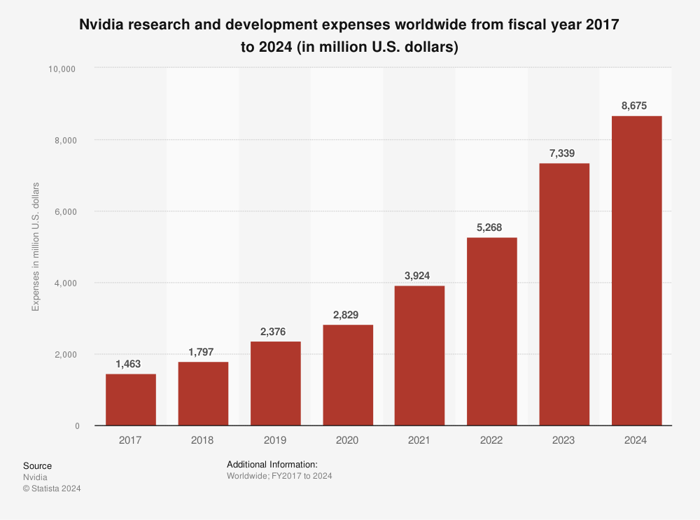

I'm talking about research and development (R&D) spending. As you can see below, Nvidia's R&D expenses have climbed over the years, reaching $8.7 billion in fiscal 2024. That's up nearly 500% in just seven years, indicating Nvidia has been focused on driving innovation over that period.

Data source: Statista.

Nvidia's 80% market share

Today, Nvidia controls more than 80% of the AI chip market, so the company has a clear advantage. But at the same time, rivals are doing what they can to chip away at Nvidia's lead.

AMD released a new high-performance chip late last year, and though it's slower than Nvidia's top product, it may win over some cost-conscious customers. AWS is also aiming for customers on a budget with its offering of chips for training language models and inference. And these are just two examples.

This is why it's essential for Nvidia to pour resources into R&D to keep innovating so its chips will continue to lead the market. That gives the company pricing power, and it should ensure its AI chip dominance over the long term.

And these efforts, along with an excellent earnings track record, make Nvidia a great growth stock to buy today.