Despite the waves of turbulence in recent weeks, the S&P 500 (^GSPC 0.14%) has experienced a record-breaking few years. In the past five years alone, the index has surged by more than 103%, as of this writing.

But many individual stocks and funds have outperformed the S&P 500 in that time, and with a careful curation of investments, it's possible to beat the market by a significant margin. While nobody can say for certain where the market is headed in the coming months, there's one growth ETF with the potential to crush the S&P 500 over the next decade.

Image source: Getty Images.

An ETF that has stood the test of time

If you're looking for a growth ETF that has a proven track record of recovering from tough times while still earning above-average returns, Invesco QQQ (QQQ 0.56%) could be a smart buy right now.

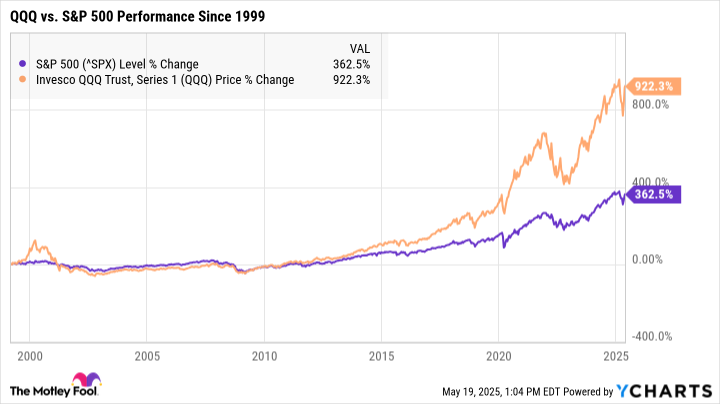

Launched in 1999, QQQ has decades of experience surviving even severe downturns. It pulled through the dot-com bubble burst of the early 2000s, the Great Recession, the COVID-19 crash in 2020, the bear market throughout 2022, and all of the smaller corrections along the way.

But this fund not only survived those rough patches. In spite of them all, it also managed to significantly outperform the market. Over the last 10 years, QQQ has more than doubled the total returns of the S&P 500.

Now, there are no guarantees that this ETF will continue performing at this rate. Around 57% of QQQ is allocated to stocks in the tech industry, which tends to be more volatile than many other sectors.

That said, many of the largest holdings are power players in their industries and are thus more likely to survive periods of market turbulence. Microsoft, Nvidia, and Apple make up around 25% of the entire fund, with the top 10 holdings making up just over 50% of the ETF.

With more weight toward these juggernaut corporations, there's a better chance this fund will pull through rough patches.

A word of caution before you buy

With any investment, it's wise to keep a long-term outlook. The market can be unpredictable in the short term, and if we eventually face a recession or bear market, even strong stocks and funds may be hit hard.

This is especially true with growth ETFs like QQQ. Although its long-term performance is staggering, there were several years when it underperformed the market.

After the dot-com bubble burst in 2000, for example, QQQ faced a brutal crash and would consistently earn below-average returns for most of the next decade. But by today, it's nearly tripled the total returns of the S&P 500.

The past 10 years have been phenomenal for QQQ, and at the rate it's going, it has a good chance of continuing to beat the S&P 500 over the next decade. But keeping a long-term outlook is key. Historically, those who have earned the most with this investment were the ones who stayed in the market for the long haul -- even when things looked bleak.

Again, there are never any guarantees in the stock market, so there's no telling precisely where Invesco QQQ will be in the coming decade. But this ETF has an extensive track record of surviving periods of volatility and earning positive long-term returns, making it a good choice if you're looking to balance risk and reward.