Shares of quantum computing company IonQ (IONQ 6.35%) skyrocketed 37% on Thursday, after CEO Niccolo de Masi sat down with Barron's for an interview. During the interview, he outlined a lofty goal for the company, and even said that IonQ would be the "Nvidia" of quantum computing.

However, a mere aspirational comment like that shouldn't put this speculative stock up by this much. Delving into the interview, there really wasn't anything tangible to warrant this kind of stock price increase.

NYSE: IONQ

Key Data Points

An Nvidia mention gets you far

As we've seen over the past two years, whenever a stock is compared with Nvidia or has been shown to have received an investment from or partnership with the company, speculators tend to pile in. This happened just last week with respect to newly public "neo-cloud" CoreWeave, which skyrocketed after it was disclosed Nvidia had increased its position in the stock.

However, that can be a double-edged sword. After all, SoundHound AI plunged earlier this year when it was disclosed Nvidia had sold its entire stake in the company. SoundHound's stock hasn't recovered.

In the Barron's interview, De Masi said of the quantum computing industry: "I believe IonQ will be the Nvidia player. There will be other people that copy us and follow us; they have always copied and followed us."

No doubt, IonQ was the first publicly traded quantum stock, with IonQ's strategy focused on early commercialization through its trapped-ion process. Meanwhile, other competitors have taken other approaches they believe will ultimately win out, but may take longer to commercialize.

Later in the interview, de Masi predicted that someone would "pay hundreds of billions of dollars to buy IonQ," because he anticipates a major cloud computing provider will want IonQ's quantum technology in-house as a differentiator.

Given that the company's market cap was only around $8.75 billion heading into today, it's perhaps not surprising the stock is seeing a big surge on those comments.

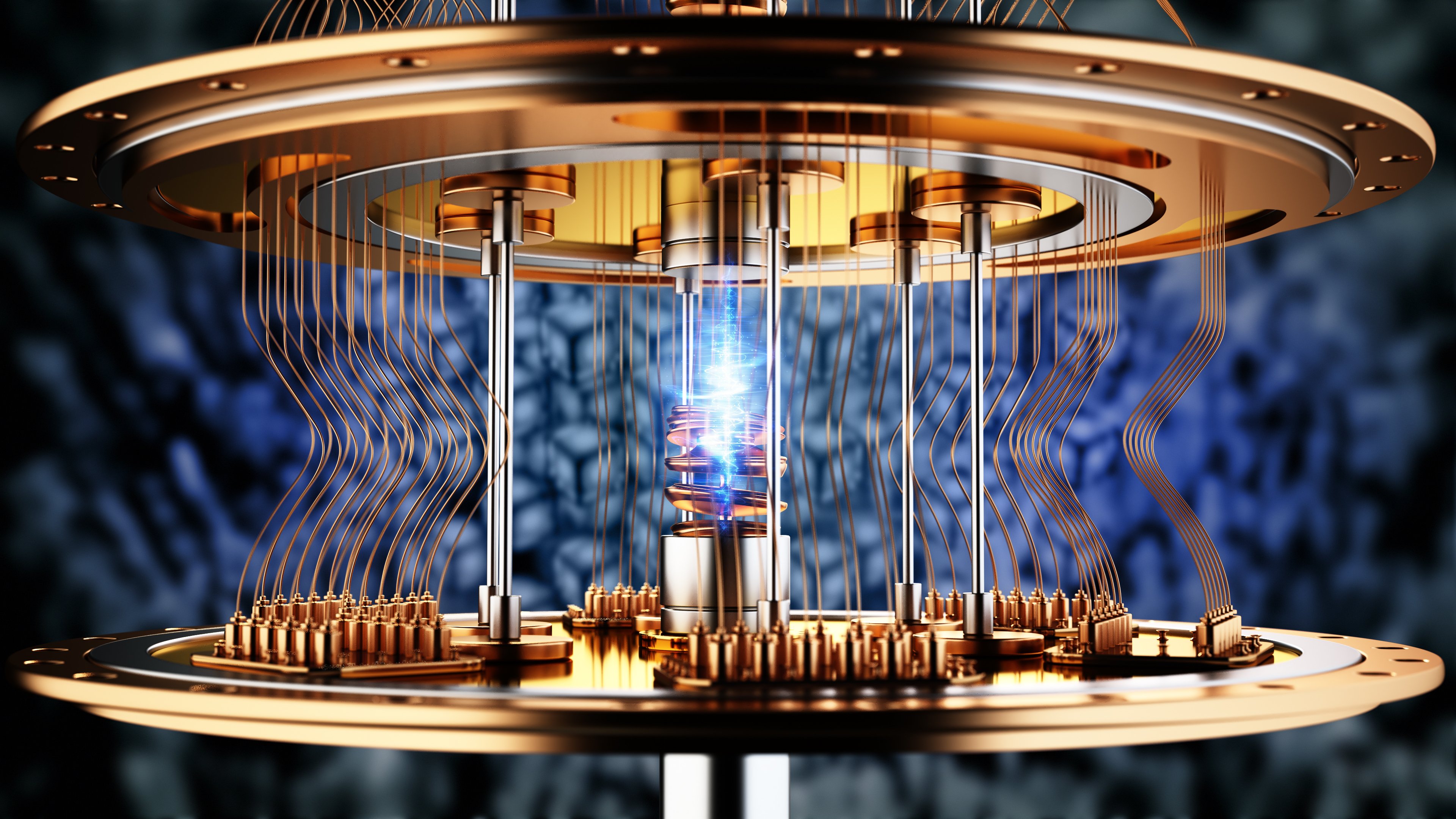

Image source: Getty Images.

But there's no "there" there -- yet

Investors should be very cautious of any quantum computing stock, and especially of chasing one on a day like today. For all of de Masi's talk, IonQ only generated $7.6 million in revenue last quarter, with a $32.3 million loss.

And for all the "Nvidia" parallels, it's very unclear how big the quantum computing market will be. Furthermore, Nvidia was able to develop its artificial intelligence (AI) GPUs and CUDA software almost completely unchallenged for 15 years, prior to the explosion of AI technology. However, IonQ not only has a slew of start-up competitors, but the large cloud players De Masi references mostly also have their own in-house quantum research as well.

Needless to say, this rally is largely based on hype, and could be driven by meme stock investors trying to force a short squeeze, with about 18% of IonQ's stock sold short. But as we've seen in the past, big surges like this can be fleeting. Quantum commercialization is still years away -- perhaps many years.