It's hard to find many stocks involved with artificial intelligence (AI) that haven't worked out, but SentinelOne (S 1.37%) is one. The upstart cybersecurity company went public in the summer of 2021. Today, the stock is down over 50% from its initial share price and over 70% from its all-time high.

Are things as bad at SentinelOne as the stock's performance might have you believe? I dove deep into the business to find out.

What I discovered could be a game-changer for your portfolio. It wouldn't surprise me to see SentinelOne's share price double over the next three years -- that's a 100% return from today's price.

Here is why I believe that to be the case.

Image source: Getty Images.

The aftermath of market bubbles

At first glance, SentinelOne seems like a stock that should be knocking it out of the park.

The company is part of a new generation of cybersecurity companies with advanced technology that performs far better than the legacy antivirus software programs from a decade or two ago. SentinelOne's proprietary Singularity Platform uses artificial intelligence to detect and respond to security threats autonomously.

Singularity's high-end performance has earned SentinelOne industry recognition from Gartner and helped the company win business with multiple Fortune 10 companies and hundreds in the Global 2000.

SentinelOne went public in mid-2021 during the COVID-19 recovery, when zero-percent interest rate policies helped inflate a massive stock market bubble. The stock's market cap peaked at over $20 billion shortly after SentinelOne began trading, on just over $200 million in revenue that year.

All bubbles burst at some point, and SentinelOne's excessive valuation is the primary reason the stock has performed so poorly, even as the company continues to grow.

NYSE: S

Key Data Points

A company can have a fantastic product, but it won't be a good investment if the price is irrationally expensive.

From bubble to bargain? There is a caveat.

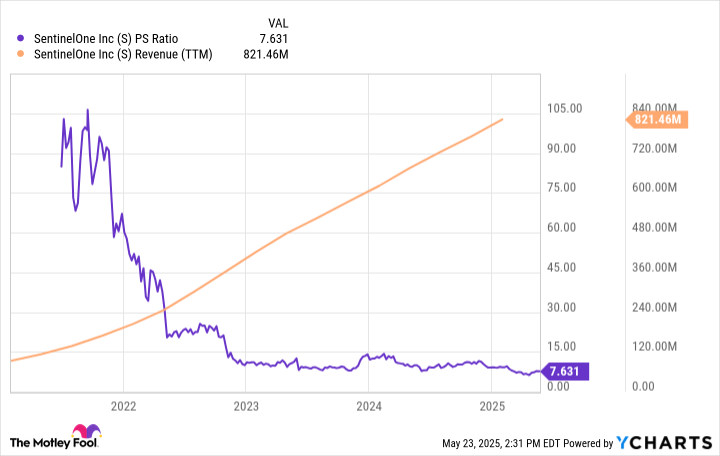

The share price has declined for several years while SentinelOne continues to grow. As a result, the stock's valuation has dramatically shifted. SentinelOne's price-to-sales (P/S) ratio was once over 105, but has plunged to just 7.6 today.

S PS Ratio data by YCharts

The pendulum may have swung too far in the other direction. CrowdStrike, SentinelOne's chief competitor, trades at a P/S ratio of 28.7, while industry peer Palo Alto Networks trades at nearly 15 times its revenue. SentinelOne grew revenue faster than both companies last quarter.

Therefore, SentinelOne looks unjustifiably undervalued at face value, but there is a caveat. CrowdStrike and Palo Alto Networks are more profitable, with superior operating margins.

S Operating Margin (TTM) data by YCharts

SentinelOne is getting there, though. Its profit margins have improved with revenue growth, and it has been cash flow-positive over the past four quarters. SentinelOne also has no debt and $1.1 billion in cash and investments.

There are no obvious financial red flags here. If SentinelOne continues to grow, the profits should come.

Yes, SentinelOne could rise 100% over the next few years

SentinelOne's technology and growth are too good to think the market won't reward the stock with a higher valuation as margins improve.

The company concluded its fiscal year 2025 at the end of January 2025, with $821 million in revenue. Analysts estimate SentinelOne's revenue at $1.0 billion this year and $1.2 billion next year. Doing the math, that's 22% growth this year, then 20% the following year. Suppose SentinelOne grows by just 15% the year after, putting its annual revenue at roughly $1.4 billion three years from now.

The stock's market cap is $6.6 billion today. Assuming the company grows to $1.4 billion in annual revenue, the stock would only need a P/S ratio of 9 to 10 to double its market cap over the next three years, depending on the degree of share dilution from stock-based compensation.

That doesn't seem at all out of the realm of reasonable.

It doesn't mean that it will happen. It's on SentinelOne to continue growing and improving its margins. But there is no shortage of opportunity in cybersecurity, and SentinelOne has shown it can compete. That makes the stock an intriguing and potentially underrated AI stock with tantalizing upside if things go right.