"Dirt cheap" and artificial intelligence (AI) aren't typically mentioned in the same sentence. There's a preconceived notion that many of the AI stocks in the market are quite expensive, which is, for the most part, a fair assessment.

However, there are still plenty of dirt cheap stocks that look like screaming buys in the AI space. Two of them are Alphabet (GOOG 0.80%) (GOOGL 0.83%) and Adobe (ADBE 2.62%), and each looks like an incredible buy right now.

Image source: Getty Images.

Why are these two dirt cheap?

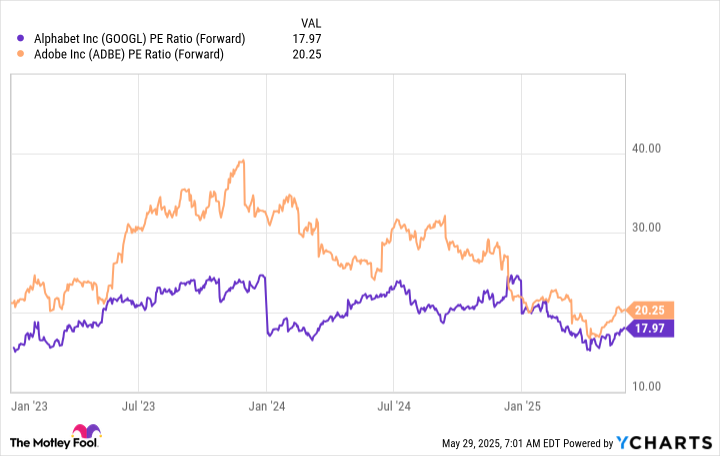

I consider both of these stocks cheap because they meet two criteria. First, both stocks are cheaper than the broader market, as measured by the S&P 500 (^GSPC 0.06%). The S&P 500 has a forward price-to-earnings (P/E) ratio of 22.1, and both stocks are currently cheaper than that mark.

GOOGL PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

Furthermore, both stocks have rarely been this cheap, which is another sign for investors that now may be an excellent time to scoop up shares.

My second factor for determining whether a stock is dirt cheap is its ability to grow earnings per share (EPS) faster than the market. If a stock is cheaper than the broader market, yet growing more slowly, there is a good reason why it's priced below the market. Both companies are projected to post strong earnings growth over the next two years, exceeding the S&P 500's usual 10% growth rate.

| Company | 2025 EPS Growth Projections | 2026 EPS Growth Projections |

|---|---|---|

| Alphabet | 19% | 6% |

| Adobe | 11% | 12% |

Data source: Yahoo! Finance. EPS = earnings per share.

However, I believe these analyst projections are flawed, as they don't account for both companies having massive stock buyback plans. With both companies having record-low stock prices, don't be surprised if they increase their share buyback amounts. A cheaper stock makes these buybacks more effective and can cause the share count to fall quickly, which boosts EPS.

Both stocks look cheap, yet they have growth that should make them premium to the market. So, why is the market valuing them in this way?

The market assumes both companies are victims of the AI trend

Both Alphabet and Adobe's primary businesses are at risk of being disrupted by AI. Alphabet's primary business is Google Search, and there has been no shortage of predictions about replacing traditional search with AI. However, Google has already introduced AI search overviews and released an AI search mode. Both options may bridge the gap and keep Alphabet in the leadership position. Furthermore, generative AI has been around for nearly three years, and Google Search's revenue still rose by 10% in the previous quarter. So, clearly, it isn't dead yet.

NASDAQ: GOOGL

Key Data Points

Adobe is in a similar boat. Its suite of graphic design products has become the industry standard and is used worldwide. However, investors are worried that generative AI image generation could make Adobe's software obsolete.

While this may produce some headwinds, Adobe has already launched its incredibly popular Firefly AI, which allows its users to generate images and easily modify existing designs. Furthermore, generative AI tools don't offer the same level of control that Adobe's software provides, and graphic designers aren't willing to give up full creative control to a randomly generated image.

NASDAQ: ADBE

Key Data Points

While both companies will encounter some headwinds popping up from time to time as a result of generative AI, these are mostly headline-induced worries. The actual businesses are doing just fine. Their consistent execution, combined with a cheap stock price, gives me confidence in their long-term ability to provide market-beating returns, which is why I think these two are excellent buys now.