The $3 trillion stock club isn't a big list; it's just Nvidia (NVDA +1.53%), Microsoft (MSFT +3.45%), and Apple (AAPL 0.13%). Amazon (AMZN +2.12%) is the fourth-largest company in the world, but it is currently valued at around $2.2 trillion, which showcases how large a gap there is between third and fourth place.

Of this $3 trillion trio, is there any worth owning right now? After all, they're already quite large; could they get even bigger?

Image source: Getty Images.

Nvidia may be the world's largest company, but its products aren't as familiar as Apple's or Microsoft's

Apple and Microsoft are easily the most recognizable companies of this trio. Many people use Apple products daily, whether it's an iPhone or some other hardware Apple creates. Microsoft is similar, as many people utilize one of the Microsoft Office products at work. However, Microsoft is a much broader company than that, as its various cloud computing products make up a significant amount of the company's revenue.

NASDAQ: AAPL

Key Data Points

Nvidia is even more obscure, as few people interact with the bulk of Nvidia's products. You may have an Nvidia graphics card in your laptop or PC, but the bulk of Nvidia's revenue comes from its data center graphics processing units (GPUs), which have been widely deployed to train and run AI models. Nvidia has a dominant hold on this market, with most estimates stating that Nvidia's market share is greater than 90%.

NASDAQ: NVDA

Key Data Points

These three businesses have dominated their respective industries, which makes sense, as only the best rise to the top. However, I think these three companies will take very different paths over the next five years, with one company clearly being the best buy.

Nvidia's growth makes it stand out from the other two

From a revenue standpoint, Apple is the largest company, but that gap closes when profits are considered.

AAPL Revenue (TTM) data by YCharts

However, one notable thing is that Nvidia is still significantly smaller than the other two, despite being the largest company in the world currently. That's because Nvidia has one thing that the others don't: growth.

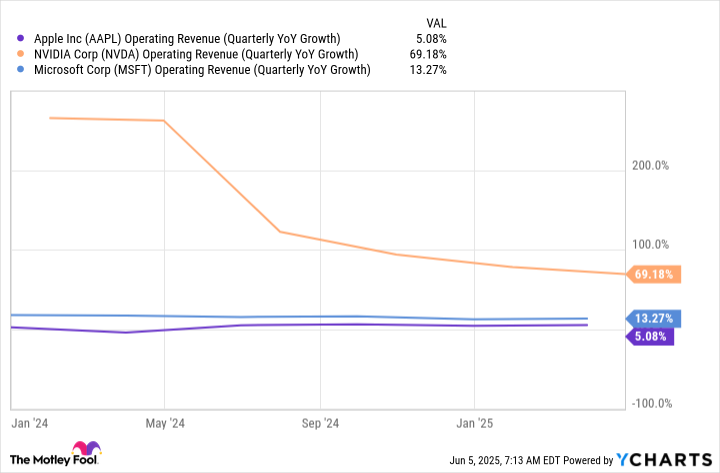

Although Nvidia's growth has started to slow a bit, it's still incredibly rapid.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts

Next quarter also looks promising for Nvidia, with revenue expected to rise 50% year over year. Part of this slowdown can be attributed to the U.S. government banning exports to China of its H20 chip, which was specially designed to meet old regulations. Still, 50% growth is nothing to be worried about, as it showcases the strong demand for Nvidia's products.

Demand for Nvidia's products is expected to persist. Third-party estimates stated that data center buildouts reached $400 billion last year but will rise to $1 trillion by 2028. Should that occur, Nvidia's growth will continue to be rapid and far outpace Microsoft and Apple.

This makes Nvidia my top pick moving forward, but Microsoft isn't a bad option either, as the demand for its cloud computing servers, thanks to AI, is also booming.

Apple is the only stock I'd be worried about owning from this trio. It is barely growing and hasn't showcased the ability to release an innovative product for some time. Despite this, it still doesn't trade at much of a discount to the other two from a forward price-to-earnings (P/E) ratio standpoint.

AAPL PE Ratio (Forward) data by YCharts

With how slow Apple is expected to grow (Wall Street analysts estimate 4.1% revenue growth in fiscal year 2025 and 5.9% in fiscal year 2026), I'd argue that Apple deserves no more than a market-average premium. With the S&P 500 trading at 22.4 times forward earnings, Apple could have a long way to fall before trading at that level.

Over the next five years, I project that Nvidia will massively outperform the market, Microsoft will slightly beat it, and Apple will underperform. Nvidia's growth is unprecedented, and it could propel it to become the first $5 trillion company.