Shares of SentinelOne (S +0.70%) have lost 22% of their value so far in 2025 as of June 15 on account of the company's underwhelming results in recent months, which can be attributed to a slowdown in customer spending on its cybersecurity solutions.

SentinelOne stock was down in March this year when its full-year guidance turned out to be lower than Wall Street's expectations. A similar story unfolded in May following the release of the cybersecurity specialist's fiscal 2026 first-quarter results (for the three months ended April 30). Investors pressed the panic button as SentinelOne slashed its full-year revenue forecast.

Each share of the company is now trading at less than $20. If you're someone with just $20 in your pocket and are looking to buy a growth stock, SentinelOne could turn out to be a good bet.

Let's see why this stock is worth buying despite the challenges it's facing.

Image source: Getty Images.

SentinelOne's short-term problems shouldn't last for long

SentinelOne has reduced its full-year revenue guidance to $998.5 million at the midpoint, down from the earlier estimate of $1.09 billion. The updated forecast points toward year-over-year revenue growth of 21%, which would be a substantial drop over the 32% revenue growth the company clocked last fiscal year.

NYSE: S

Key Data Points

SentinelOne management attributes the reduced guidance to a cautious spending environment caused by an increase in macro uncertainty that has led its customers to tighten their purse strings. SentinelOne is quite exposed to small and medium-sized enterprise customers, which can be quick to reduce their outlay on cybersecurity spending at the sight of macroeconomic uncertainty.

However, investors shouldn't miss the silver lining. Though SentinelOne has been cautious with its guidance for this year, the company's future revenue pipeline suggests that its growth is likely to pick up in the future. The company exited the previous quarter with remaining performance obligations (RPO) worth $1.2 billion, a jump of 33% from the year-ago period.

This metric refers to the total value of its unfulfilled contracts at the end of a period. SentinelOne's RPO growth was 10 percentage points higher than the increase in its revenue during the quarter. So the company is getting more business than it is fulfilling right now, and that's boosting its future revenue pipeline. As such, there is a good chance that SentinelOne's growth will pick up once again in the future as the spending environment improves.

One of the reasons the company's RPO improved at a faster pace than its revenue is the improving traction of its AI offerings. SentinelOne offers an AI-powered cybersecurity platform that includes tools such as a generative AI security assistant and agentic AI solutions, among other functions. The company points out that its AI offerings are increasing its average deal size by around 25%.

That trend is likely to continue as the demand for AI tools within the cybersecurity market is expected to increase at an annual rate of 24% over the next decade. The company is estimating a total addressable market worth more than $100 billion in 2025 across various sectors, including AI. So the likelihood of an acceleration in SentinelOne's growth cannot be ruled out thanks to the potential lift that technologies such as AI could give its business.

The company's terrific earnings growth can send it soaring

SentinelOne carries a 12-month median price target of $23 as per 38 analysts covering the stock, pointing toward 33% gains from current levels. The pace at which the company's earnings are set to grow suggests that it could indeed deliver such gains in the coming year or do even better than that. The company has guided for a non-GAAP operating margin of 3% to 4% for fiscal 2026, which would be a big improvement over the negative operating margin of 3% last year.

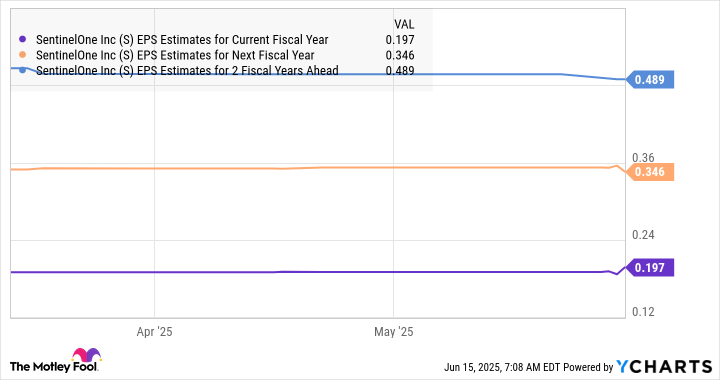

As a result, SentinelOne's earnings are expected to jump big time from last year's level of $0.05 per share. What's more, its bottom line is projected to take off over the next couple of fiscal years.

S EPS Estimates for Current Fiscal Year data by YCharts

SentinelOne could very well achieve the impressive earnings growth that analysts are expecting thanks to its rapidly growing revenue pipeline and improving cross-selling opportunities because of new offerings such as AI, which is currently in its early phases of growth. That's why investors looking to add a growth stock trading for less than $20 to their portfolios can consider accumulating SentinelOne before its fortunes turn around.