Dividends can provide you with stable income through all market environments. Today, the broad market S&P 500 index has a tiny dividend yield of 1.2%, which is significantly less than what you can earn through buying United States Treasury bonds. So what is the best way for stock investors to add dividend income to their portfolios?

There are still plenty of stocks out there that can help you build your dividend dream. Here are three high-yield dividend stocks that can turn your portfolio into an income machine.

NYSE: BTI

Key Data Points

Gaining in nicotine categories

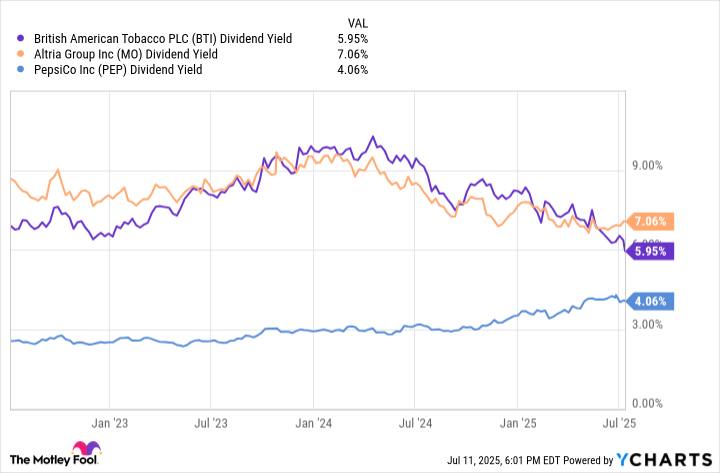

One of the best-performing stocks of 2025 has been what some may call a stodgy tobacco giant: British American Tobacco (BTI +1.69%). The owner of an international portfolio of cigarette brands such as Camel, Lucky Strike, and American Spirit is up 40% year to date. It currently has a dividend yield of around 6% despite these massive gains.

Investors have not fallen in love with British American Tobacco because of its cigarette business. Volumes in the United States have fallen aggressively in recent years, leading to stagnant revenue growth. Global volumes are not nearly as bad -- expected to fall 2% in 2025 -- but it is still a declining market headed for the dustbin of history.

No, investors are all over British American Tobacco because of its growth in new nicotine categories such as vaping, nicotine pouches, and heat-not-burn cigarettes. Nicotine pouches are on fire at the moment, a category that is seeing rapid global adoption. The company's Velo brand has an estimated 30% market share of nicotine pouches globally in its key markets, with United States revenue growing in the triple digits at the moment and hitting an estimated 12% market share in the country. As investors have seen with the leading nicotine pouch brand Zyn owned by Philip Morris International, these are highly profitable products that can help replace cash flows lost from cigarettes.

At a dividend yield of 6%, investors are in a sweet spot with British American Tobacco right now. Sit tight and watch the growing income hit your portfolio every year.

Image source: Getty Images.

A rising dividend yield amid a stock drawdown

There are a lot of high dividend yields in the consumer goods space, including at PepsiCo (PEP +1.50%). The owner of Pepsi and Frito-Lay snack foods has hit a dividend yield of 4% after its stock entered a 30% drawdown. Shares are down because of slowing volume growth for its brands around the world, with fears that popular weight loss drugs like Ozempic are the cause of reduced demand for soda and snack foods.

Despite these fears, PepsiCo is projecting organic revenue -- which excludes acquisitions and divestitures -- to be up in 2025, as these brands typically enjoy a lot of pricing power. While the weight loss drugs do present a headwind to PepsiCo, it is the historical pricing power of snack foods that will help the company keep growing its earnings in the years to come.

Over the last 10 years, Pepsi's dividend per share has grown a cumulative 100%. Today, you can buy the stock at its highest dividend yield of the last 10 years. Despite these weight loss drug fears, I believe that these brands such as Lays, Tostitos, and Mountain Dew that have stood the test of time over decades will continue to earn a ton of profits for shareholders. This drawdown gives investors a prime opportunity to buy the dip on PepsiCo stock.

BTI Dividend Yield data by YCharts

An ultra-high dividend payout

The highest dividend yield on this list belongs to another tobacco stock: Altria Group (MO +2.75%). This is the America-focused tobacco company that owns Marlboro cigarettes, the leading premium brand in the country. Shares currently trade at a dividend yield of 7%, one of the highest in the entire stock market.

As mentioned above, cigarette volumes in the United States have started falling at a quick pace. Unlike British American Tobacco, Altria Group has struggled to gain momentum with its forays into new nicotine categories. The vast majority of its profits still come from cigarettes. However, this decline has not affected the company's ability to generate a profit.

Through price increases, Altria is able to counteract volume declines with margin expansion on remaining sales, leading to operating income growth of 1% last quarter. It is returning capital to shareholders through share buybacks, which have brought shares outstanding down by 15% in the last 10 years. Through these buybacks and fewer shares outstanding, Altria Group will be able to keep growing its dividend per share (and therefore dividend yield) because there are fewer remaining shares to make a payment to.

Cigarettes are declining, but not going away entirely anytime soon. Even with volume declines prevalent, Altria Group can remain a steady income payer with its sky-high dividend yield of 7%.