There is a list of stocks that got caught up in the stock market bubble of 2020-2021. Among them is Block (XYZ +1.59%), formerly known as Square.

Today, the fintech stock is down nearly 80% from its high, reached at the peak of the aforementioned bubble. Naturally, such a miserable stretch for investors following the stock's collapse has likely given Block quite a sullied reputation, making the idea of buying and holding it tough to stomach.

Yet, here I am. While Block hasn't been perfect, the sum of its parts offers investors a compelling growth engine inside of a vast addressable market that could generate lucrative investment returns for years to come. Well, what are you waiting for? You will find what you need to know about this opportunity below.

Image source: The Motley Fool

Block's businesses, broken out into three groups

As a company, Block has a lot going on. There are three primary areas of the fintech that investors want to focus on:

First, there is its Square ecosystem, Block's original business. Square is a hardware and software platform that helps merchants operate their businesses. It includes payment terminals and devices, as well as a range of software for point of sale, customer management, marketing, payroll, staffing, and more. More than 4 million businesses worldwide use Square today.

Next is Cash App, the company's peer-to-peer payment app that has evolved to become a digital banking platform. Today, its users have access to basic banking services, peer-to-peer payments; buy now, pay later loans; stock trades and Bitcoin, and even tax filing. The app currently has about 57 million monthly active users.

Square and Cash App are Block's bread and butter. The third group comprises a mix of business projects that have potential, but don't move the needle for the company right now. That includes Tidal, a high-fidelity music streaming service; Bitkey, a digital wallet for Bitcoin; and Proto, which offers Bitcoin mining products and services. Block also holds Bitcoin as an asset on its balance sheet.

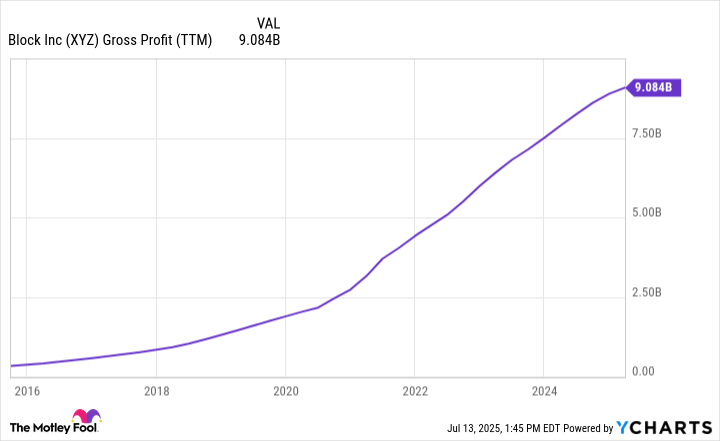

With so many businesses, investors want to look at gross profit over time to see how the company as a whole has grown:

XYZ Gross Profit (TTM) data by YCharts; TTM = trailing 12 months.

Despite the stock's steep decline, the company's gross profit has gone in the opposite direction.

A long runway for growth, just what investors want in a buy-and-hold opportunity

The benefit of having such a widespread business model is that it exposes you to numerous growth opportunities.

That's especially true in the financial sector, where Block deals in commerce, payments, and banking. These are competitive industries, but they also are so large that the company has a very high growth ceiling if it performs well. It isn't the largest player at anything it does, but it can grow for years just from monetizing its 4 million Square users and 57 million Cash App users.

NYSE: XYZ

Key Data Points

Block is increasing its gross profit by targeting larger customers in its Square business. In Cash App, growth is coming from increased user engagement. That means getting a user to go from using Cash App occasionally to send a friend money, to a financial hub used daily.

Increases in users have slowed over the past couple of years, but the monetization continues to drive profit higher. Block's gross profit has increased nearly fourfold since 2020, and management anticipates 12% growth in gross profit this year. It would be all the more promising if the company can reignite user growth in the future.

There are risks, but the valuation is compelling

In all fairness, Block isn't for every investor, and the company hasn't been without its imperfections. It isn't shy about venturing into speculative areas in pursuit of growth. That includes its support of Bitcoin and its $13.9 billion all-stock acquisition of the buy now, pay later company Afterpay.

It's also fair to wonder how focused the company is and whether having so much happening will ultimately weigh on financial performance.

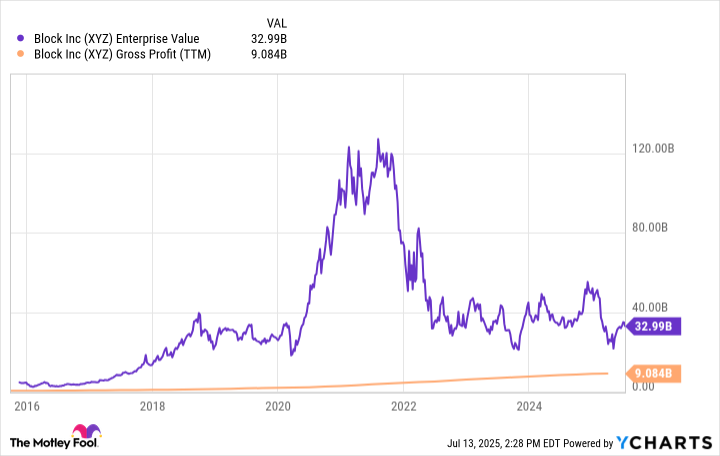

On the other hand, the stock's valuation has arguably become attractive enough that investors can afford to take on the risk. Back during the COVID market bubble, Block's gross profit was a tiny sliver of its enterprise value at the time. Today, the company is only trading at about 3.5 times its gross profit:

XYZ Enterprise Value data by YCharts.

It's worth noting that Block is also profitable; analysts on average estimate the company will earn $2.73 per share this year and $3.81 next year. Therefore, valuing it using its gross profit doesn't conceal any net losses.

As long as Block can continue to increase profitably, the stock appears poised to perform well over the long term. Its performance over the past several years has been quite disappointing, but things are finally looking up.