Investors often look to Warren Buffett for inspiration, due to his decades of investment success. The billionaire, as chairman of Berkshire Hathaway, has helped produce a compounded annual gain of nearly 20% over 59 years. Meanwhile, the S&P 500 delivered a 10% increase. That's very good, which makes Buffett's outperformance even more impressive.

All of this happened because of Buffett's keen eye for a quality stock and his unending patience. The Oracle of Omaha is known for buying a stock while it's down -- and even out of favor among other investors -- and holding on for the long term, which often has scored wins for him.

Today, two stocks in Buffett's portfolio offer you a similar opportunity. Both companies have declined in the double-digits so far this year, leaving them trading at reasonable valuations.

With $1,000 or even a little less, you can get in on these stocks that offer solid long-term prospects. Here's a look at these two Buffett stocks to buy now.

Image source: The Motley Fool.

1. Apple

Though Buffett cut his holding in Apple (AAPL 0.13%) last year, the consumer goods and tech giant remains his top position. Buffett praised Apple chief Tim Cook during the latest Berkshire Hathaway shareholder meeting, thanking him for Apple's strong performance over the years. This shows the billionaire still is a big fan of the company and its leadership.

Apple is the world's smartphone leader, selling the iconic iPhone and other major products, such as the Mac and iPad. Importantly, this tech giant has built a solid brand moat, so customers are extremely loyal and will wait for Apple's new releases and pay higher prices just to have these sought-after products. All of this has helped Apple grow revenue and net income over the years.

NASDAQ: AAPL

Key Data Points

Why has Apple slipped in recent times? Investors worry that eventual import tariffs -- part of President Donald Trump's tariff plan -- will eat into the company's profit.

That is a risk -- and a risk for other tech players, too -- as they rely on manufacturing abroad. But I'm optimistic the U.S. will aim for reasonable tariff levels in order to protect American businesses and the U.S. consumer's wallet.

With this in mind, I see Apple, trading for only 29x forward earnings estimates, as a bargain right now.

As mentioned, the company has a long track record of success and an enormous base of loyal fans. And thanks to this installed base of more than 2.2 billion active devices, Apple's services revenue has exploded higher -- reaching records quarter after quarter. All of this makes me confident this Buffett favorite will rebound and take off once again.

Image source: Getty Images.

2. Pool Corp

Pool Corp (POOL 0.68%) is the world's biggest distributor of swimming pool related products -- from building materials to pool care -- and works with a large network of commercial and retail clients. Buffett initially bought shares of the company in the third quarter of 2024 and added to his holding in the first quarter of this year. In fact, he increased his holding by 145% to more than 1.4 million shares.

Buffett is a big fan of moats, or a company's competitive advantage, and probably likes that Pool has developed such a broad range of products and services over the years and is well-established in the field. This makes it very difficult for rivals to upset its position. Buffett may have viewed a dip in the stock and a declining valuation as a buying opportunity.

Pool faced some headwinds in recent times, such as economic uncertainty, which hurt demand, and weather troubles that impacted business in Florida and Texas, for example. But these are temporary challenges, and this market giant has the strength to manage such situations and continue to grow over the long haul.

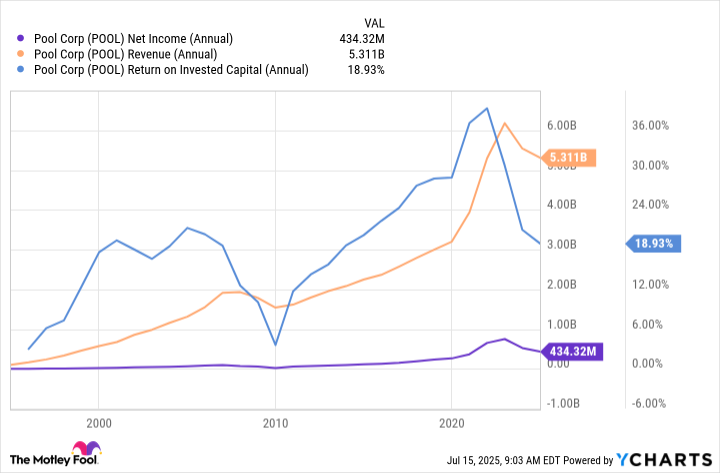

A look at Pool's earnings shows growth over the years. In addition, return on invested capital always has rebounded strongly after declines, showing Pool has made wise investments. It's likely we'll see the same pattern continue.

POOL Net Income (Annual) data by YCharts.

This market giant, in spite of a dip in sales in recent times, has reaffirmed its full-year earnings-per-share guidance of $11.10 to $11.60. And this spring, Pool increased its dividend and lifted its share repurchase authorization to the level of $600 million. All three of these moves suggest the company is optimistic about its future.

Today, Pool shares trade for 27x forward earnings estimates, down from more than 35x last year, offering you a Buffett-style entry point into this great long-term stock.