Warren Buffett is retiring as CEO of Berkshire Hathaway (BRK.A 0.74%)(BRK.B 0.69%) at the end of the year. He leaves behind an unbelievable track record, as Berkshire delivered an overall return of 5,502,284% from 1965 through 2024. The S&P 500 returned 39,054%.

Since Buffett is a long-term investor, the Berkshire portfolio has plenty of fundamentally sound businesses. If you're looking for companies you can buy and hold for a decade or longer, here are two Buffett stocks that fit the bill.

Image source: Getty Images.

1. Apple

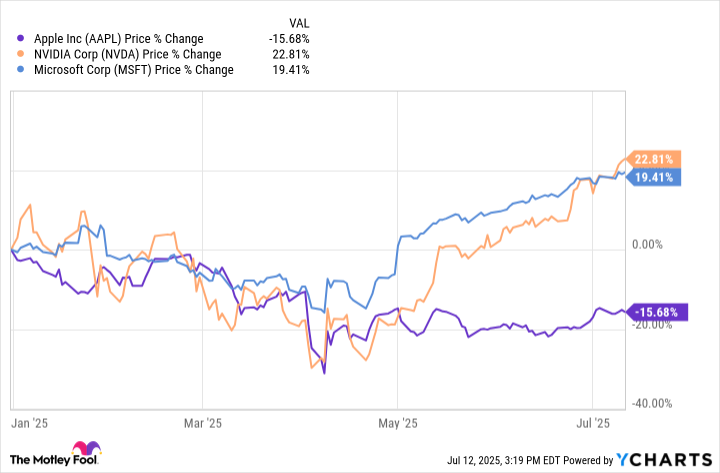

Apple (AAPL +0.26%) is Berkshire's largest holding, currently accounting for 21.7% of its portfolio. While it previously topped the list of the largest companies in the world, Apple has fallen to third this year behind Nvidia and Microsoft. Both companies have better incorporated artificial intelligence (AI) into their businesses, which is why they're up double-digits on the year and Apple is down double-digits.

Even though Apple's share price isn't doing well, its business is. Net sales were up 5% year over year to $95.4 billion in its second fiscal quarter, which ended on March 29, 2025. Services, in particular, had a sizable jump, with net sales increasing by 12%.

Apple hasn't produced any exciting AI innovations, but being first hasn't traditionally been its strategy. It makes high-quality products that build its brand value.

There could also be positive news on the AI front for Apple this year, as it has reportedly been exploring partnerships with OpenAI, the developer of ChatGPT, and Anthropic, the developer of Claude. And it made some ambitious AI announcements at its Worldwide Developers Conference this year. New AI-powered features include a live translation tool that works with messages, Facetime, and phone calls, an AI workout coach that can mimic a personal trainer's voice and analyze your workouts, and a visual analysis tool that can get information about places and objects with the iPhone's camera.

NASDAQ: AAPL

Key Data Points

Although Apple stock still isn't cheap, the recent dip has made it more affordable, as it's trading at a price-to-earnings (P/E) ratio of 33. Apple might not skyrocket in value, barring a blockbuster new product. But with its brand reputation, it should be a steady performer that you can keep in your portfolio for decades.

2. American Express

Berkshire's second-largest holding is bank and payments company American Express (AXP 0.47%). Although it's in a completely different market sector, American Express has some similarities to Apple. It has established a highly regarded brand and its premium products are seen as status symbols, most notably the Platinum card. American Express charges a $695 annual fee for that card, and that may go up soon, given that rival Chase just raised the fee on its Sapphire Reserve from $550 to $795.

American Express has traditionally catered to wealthy clients, which has a few important benefits. Wealthier clients are willing to pay higher annual fees, and they're less likely to pay late or not pay at all. In an analysis by S&P Global last year, American Express had a 30-day delinquency rate of 0.78%, compared to the overall average of 1.34%. And these clients spend more on average, resulting in more processing fees paid to American Express.

Regarding processing fees, American Express has a key advantage over most of its competitors. It's both a payment network, like Visa and Mastercard, and a card issuer, like Chase. Normally, the payment network and the bank share the processing fees on every transaction. American Express gets to keep the full fee on the cards it issues.

NYSE: AXP

Key Data Points

American Express is growing faster than you might expect for a blue chip company in the financial sector. Revenue has nearly doubled over the last five years, and its share price is up 219%. And there's another big growth opportunity it hasn't fully tapped into yet -- the international market.

International acceptance of American Express is far behind Visa and Mastercard. American Express reported in 2024 that its cards are accepted at over 89 million locations worldwide. Visa and Mastercard are accepted at over 150 million locations, according to the Nilson Report.

However, American Express still had a threefold increase in international acceptance from 2017 to 2024, and it's far from finished. Earlier this year, CEO Steve Squeri pointed out international markets as an opportunity for growth and said that the card issuer is targeting specific cities where it can reach 80% coverage.

Apple and American Express are Berkshire's top holdings for a reason. They're companies you can add to your portfolio and trust that they'll still be going strong in five years, 10 years, and beyond.