Wolfspeed (WOLF +0.00%) has been one of the most volatile stocks on the market this year. As of Monday's close, it was down around 80% since the start of the year, and in the early stages of Chapter 11 bankruptcy proceedings. Yet, despite seemingly atrocious returns and no shortage of headwinds, investors have been buying up the stock in the early part of July.

The company, which refers to itself as "pioneers of silicon carbide, and creators of the most advanced semiconductor technology on earth," has amassed losses totaling more than $1.1 billion over the past four quarters. However, it has brought on a new chief financial officer with an extensive track record of transforming and restructuring businesses, which has made investors bullish on its ability to turn things around.

Could Wolfspeed be an attractive stock to buy on weakness, or has it simply become the latest meme stock?

Image source: Getty Images.

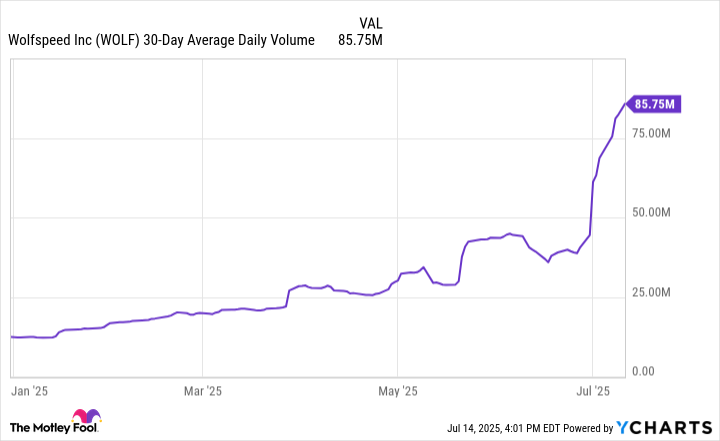

Wolfspeed's trading volumes have spiked

On June 30, Wolfspeed said it would be taking steps to strengthen its capital structure, which include filing for Chapter 11 bankruptcy. The company hopes to reduce its debt by $4.6 billion (70%). The business believes it will "be better positioned to execute on its long-term growth strategy and accelerate its path to profitability."

While a bankruptcy filing is not great news for a business, it has resulted in a spike in Wolfspeed's trading volumes. From June 30 through to July 8, the tech stock surged by a staggering 530%.

WOLF 30-Day Average Daily Volume data by YCharts.

A new finance leader gives investors some hope

Another positive catalyst for the stock was news that it was appointing Gregor van Issum as its new chief financial officer, which the company announced on July 7. It notes that van Issum has "more than 20 years of experience in transformational restructuring and strategic financing positions across the technology industry."

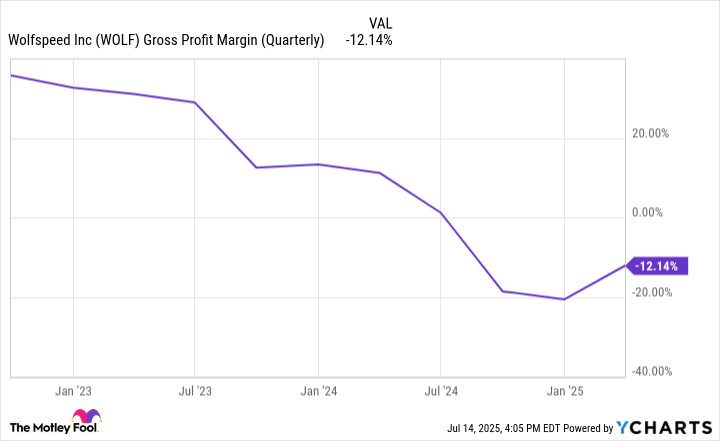

Having an experienced leader to help turn around the business is good for the company, but that doesn't necessarily mean it's going to be smooth sailing from here on out. The big problem: Wolfspeed's gross margins need drastic improvement.

WOLF Gross Profit Margin (Quarterly) data by YCharts.

In the company's most recent quarter, which ended on March 30, even its adjusted gross margin percentage (after factoring out stock-based compensation and restructuring costs) was minuscule at 2%.

Even if the company reduces its debt load, its fundamentals are a big concern. Wolfspeed has incurred steep net losses, and it has burned through $709 million in the trailing 12 months over the course of its day-to-day operating activities. There are a lot of problems with the business, and a turnaround won't be easy, regardless of who's in charge.

NYSE: WOLF

Key Data Points

Wolfspeed is an incredibly risky stock to buy

Existing Wolfspeed shareholders will only receive between 3% and 5% of the new restructured company. Even if its debt load is significantly reduced, the fundamental issues around its abysmal gross margins make it highly unlikely that the business will be worth investing in once the restructuring is complete.

Wolfspeed resembles more of a high-risk meme stock than a company worth investing in today. While it may experience short-term gains, there are far better options for growth investors to consider.