Picking stocks can be a lot of fun. But it can also be constant work. The irony? The more active a portfolio is, the higher the odds of it underperforming. Something simpler and far more passive like buying and holding exchange-traded funds (ETFs) for the long haul is far more likely to build real wealth.

To this end, if you're ready to make such a strategic shift, here's a rundown of four complementary index ETFs that could make you a millionaire. You just need to be willing and able to leave them alone long enough to let them.

Start with the basics

It should come as no surprise that this list starts with ETFs meant to mirror the S&P 500. It's the quintessential buy-and-hold equity investment. After all, this index reflects about 80% of the U.S. stock market's collective market capitalization and boasts a long-term average annual gain of about 10%.

The SPDR S&P 500 ETF Trust (SPY +0.66%) or the Vanguard S&P 500 ETF (VOO +0.65%) are your easiest and most liquid choices here. Vanguard's version of the index fund is technically cheaper to own with an annual expense ratio of only 0.03%. But both are a cost-effective enough way of plugging into the index's long-term upside.

NYSEMKT: VOO

Key Data Points

You can afford to be a little speculative

Exchange-traded funds don't exactly lend themselves to speculation -- at least not in the same way that investors speculate on individual stocks. But that doesn't mean you can't successfully use strategic exposure to certain kinds of ETFs.

You could deliberately hold an oversized stake in the technology sector via the Technology Select Sector SPDR Fund (XLK +0.48%) or a similar fund. After all, just as they have for the past three decades, technology companies are likely to introduce the most game-changing and lucrative innovations for the next 30 years.

NYSEMKT: XLK

Key Data Points

But wouldn't the popular Invesco QQQ Trust (QQQ +0.41%) do the job just as well, if not better? Maybe, but not necessarily.

While it is true that the underlying Nasdaq-100 includes many of the market's best-performing technology tickers of the past several years (like Nvidia, Microsoft, and Apple), this may not always be the case. Remember, the Nasdaq-100 isn't inherently meant to be a technology index -- it just so happens that most of the market's top tech names right now are Nasdaq listings.

As time marches on and new companies grow bigger than the market's biggest players right now, these new titans might not be technology outfits, or even Nasdaq-listed names! They could be listed on the New York Stock Exchange instead. Since the Technology Select Sector SPDR Fund is specifically built to reflect the performance of the S&P 500's technology stocks, though, you'll be plugged into the tech sector no matter where these tickers are listed.

While the Invesco QQQ Trust has produced some amazing gains since its launch back in 1999, it has also missed out on many technology companies' growth that got them there in the first place. By including the smaller tech names found within the S&P 500, you'll be invested at key periods of their growth.

You need international stocks more than you have in a long, long time

Do you really need to own foreign stocks? It's a prudent question to begin asking again. International stocks were considered a must-have well before and a little after the turn of the century. Since then, though, so many U.S. companies have performed so consistently well and become so international on their own, there's been no meaningful benefit in specifically adding foreign exposure to your portfolio.

But now that pendulum seems to be swinging back in the other direction. With most nations starting to back off on their pro-international trade policies and refocusing more on domestic trade, we're seeing foreign nations and regions' economies -- and stock markets -- start to perform independently of U.S. stocks. And in many cases, they're performing better than their U.S. counterparts. The Organization for Economic Co-operation and Development, for instance, believes worldwide GDP growth averages will roll in at 2.9% this year and next. The United States' GDP is expected to grow by only 1.6% this year, however, before slowing to a growth pace of 1.5% next year.

In this vein, foreign stocks have easily outperformed U.S. stocks so far this year largely because of these disparate outlooks.

Image source: Getty Images.

Sure, the domestic economy might perk up in the foreseeable future. Or it might not. That's the point -- nobody knows. We only know enough to know a stake in something like the iShares Core MSCI EAFE ETF (IEFA +1.10%) is a smart way of curbing some of the risk of betting on a less-than-certain U.S. economy.

NYSEMKT: IEFA

Key Data Points

Better than U.S. large caps

Finally, if you want your best shot at becoming a millionaire using ETFs at the core of your portfolio, add an often-overlooked dimension to your holdings. That is, make a point of buying more U.S. mid-cap stocks. The Vanguard Mid-Cap ETF (VO +1.36%) meant to mirror the performance of the CRSP US Mid Cap Index will do the job nicely.

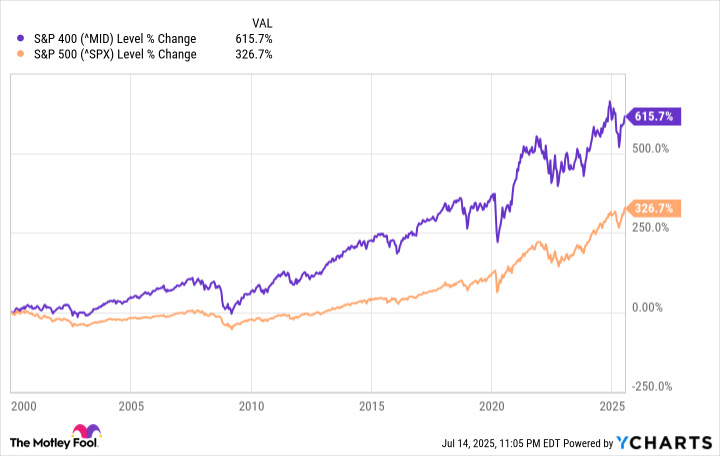

Does it really matter? Actually, it does. Given enough time, mid-cap stocks significantly outperform their large-cap counterparts. The S&P 400 Mid Cap Index, in fact, has nearly doubled the performance of the S&P 500 since the beginning of this century.

What gives? Mid-cap names are often in their sweet spot of growth -- past their wobbly start-up years, but not yet in their prime. Sometimes mid-cap companies are recent spinoffs from large-cap outfits that recognize the entity in question would be more valuable as a stand-alone company. Whatever the case, these names clearly pay off in the long run.

The only downside to consider here is that while these names collectively produce stronger gains, they also dish out for more volatility than large-cap stocks. You'll need to mentally plan on holding this mid-cap ETF for decades just to make these big swings bearable in the meantime.