Real estate investment trusts (REITs) often make great dividend stocks. They tend to generate stable rental income, which enables them to pay attractive dividends and invest in expanding their portfolios. Those growth investments often allow REITs to steadily increase their dividend payments.

Simon Property Group (SPG 0.03%) and Federal Realty Investment Trust (FRT 0.82%) are two of the largest REITs focused on the retail sector. Both pay attractive and growing dividends. However, investors are likely to want to hold only one retail REIT in their portfolio. With that in mind, here's a look at which is the better dividend stock to buy right now.

Image source: Getty Images.

Contrasting their property portfolios

One factor investors should evaluate before buying a REIT is its real estate portfolio. Where a REIT invests its capital can play a significant role in its ability to pay sustainable and growing dividends. A REIT needs to own high-quality properties benefiting from resilient and rising rental demand.

The retail sector has had its share of ups and downs over the years. The growing adoption of e-commerce and the impact of recessions on retail sales have impacted retailers' ability to pay rent. These factors have weighed on demand for certain types of retail space.

NYSE: SPG

Key Data Points

For example, malls have gotten hit hard by the issues facing retailers. That's worth noting, given Simon Property Group's focus on investing in malls. The REIT owns 232 properties, primarily malls and premium outlets. However, the company owns high-quality shopping and entertainment destinations, not the smaller, fledgling regional malls that have become dilapidated shells of their former selves.

Open-air shopping centers have also faced headwinds from struggling retailers over the years. While these properties are the investment focus of Federal Realty, it doesn't own just any shopping center. The company focuses on quality over quantity, owning only high-quality open-air shopping centers and mixed-use properties in the first-ring suburbs of the country's largest cities, which have dense populations of high-income consumers. As a result, its properties are a magnet for high-quality retailers.

The key consideration is to ensure the REIT owns high-quality properties that benefit from durable and growing demand. Federal Realty and Simon Property both check this box.

Analyzing their financial profiles

Another factor investors should consider is a REIT's financial situation. Here's how these two retail REITs compare:

|

REIT | |||

|---|---|---|---|

|

Federal Realty Investment Trust |

4.6% |

61.4% |

BBB+/Baa1 |

|

Simon Property Group |

5.2% |

67.1% |

A-/A2 |

Data sources: Federal Realty Trust and Simon Property Group.

As that table shows, they have similarly strong financial profiles. Federal Realty has a slightly lower dividend payout ratio, while Simon Property's bond rating is a bit higher. As a result, the REITs have lots of financial flexibility to pay dividends and invest in expanding their retail portfolios.

Dividend histories

Another factor to consider when evaluating a REIT is its dividend history. Federal Realty leads the way here with its industry-leading 57 years of dividend increases. That places it in the elite group of Dividend Kings, companies that have increased their payouts for 50 years or more.

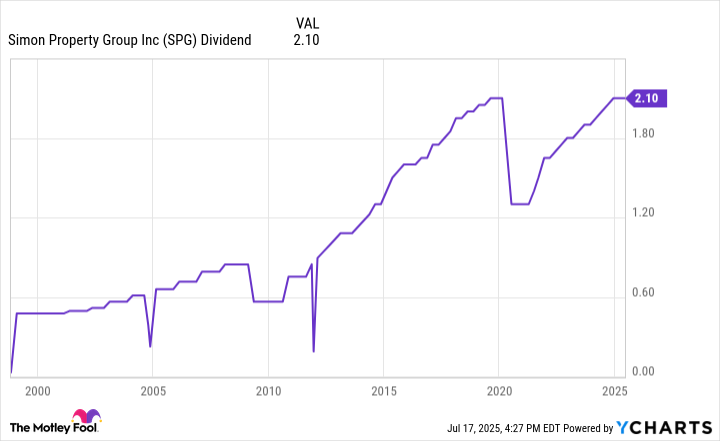

For comparison, Simon Property has had a spottier record of paying dividends:

SPG Dividend data by YCharts

As that chart shows, the company cut its payout during the earlier days of the pandemic. While it has steadily increased its payment since the reset, its payout has only recently returned to its pre-pandemic level.

A look at their growth profiles

A final factor to evaluate when considering a REIT investment is its growth profile. Federal Realty expects to deliver 5% to 6.8% growth in funds from operations (FFO) per share this year. Driving factors include 3% to 4% growth in its comparable property income from rental increases, the acquisition of the Del Monte Shopping Center, and incremental income from redevelopment and expansion projects. That might prove to be conservative guidance, given that the REIT recently acquired two more shopping centers.

NYSE: FRT

Key Data Points

Meanwhile, Simon Property Group expects to grow its FFO per share by 1.3%-3.3% this year. The company anticipates benefiting from rent growth, the acquisition of The Mall Luxury Outlets in Italy, and the successful opening of Jakarta Premium Outlets in Indonesia.

Federal Realty's faster growth rate could enable it to deliver higher dividend growth and total returns.

A top-tier dividend stock

Federal Realty and Simon Property are leading retail REITs. They have high-quality portfolios and financial profiles supporting their high-yielding dividends. Because of that, they're both solid dividend stocks to buy.

However, Federal Realty stands out between the two. It has a stronger dividend growth track record and expects to deliver faster earnings growth this year. It's a more durable dividend stock that could provide higher dividend growth and total returns in the future.