More than 20 years ago, the world was introduced to a portable device that changed music consumption forever. Not long after, the way people communicate was completely revolutionized by way of a next-generation smartphone. From the iPod to the iPhone, Apple (AAPL +0.16%) was once considered the pinnacle of innovation.

For quite some time now, however, the company has fallen short at creating a sense of excitement. Products such as Vision Pro flopped, and the once-upon-a-time technology darling has been suspiciously late to the artificial intelligence (AI) party.

With growth in core segments stalling, Apple has managed to keep investors happy through ongoing share buyback programs and dividend payments. But in the age of AI, these rewards are becoming less enticing.

Let's explore Apple's activity in recent years and why the company's investment in AI has so far failed at captivating investors. From there, I'll explore how Apple may be able to turn things around and reignite the business.

NASDAQ: AAPL

Key Data Points

Share buybacks and dividends just aren't cutting it anymore

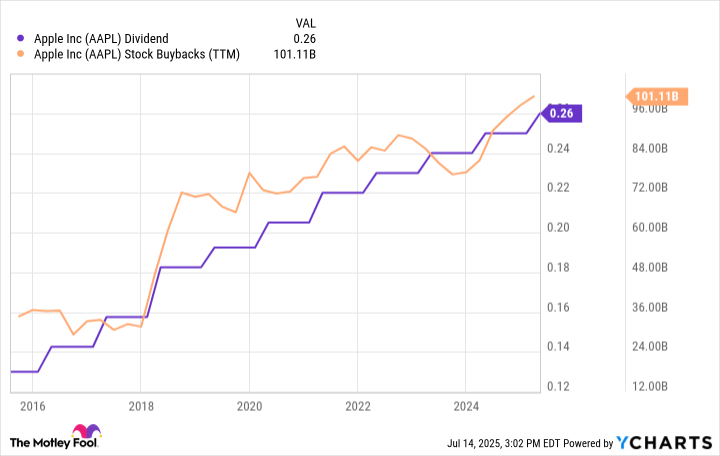

The chart below illustrates Apple's dividend and stock buyback activity over the past 10 years. On the surface, it's hard to complain about a company that consistently rewards shareholders by raising its dividend and simultaneously buying back its own stock -- which might imply that management thinks shares are undervalued.

AAPL Dividend data by YCharts.

Nevertheless, even one of Apple's largest supporters, Warren Buffett, has reduced exposure to the iPhone maker over the past year through continuous stock sales. At some point, investors need more reasons than dividends and share buybacks to stick around.

Apple's foray into AI has been uninspiring so far

Ironically, however, ever since the AI megatrend burst onto the scene a few years ago, Apple's once-innovative impulses have remained muted. Its most direct foray into AI has been through a partnership with ChatGPT maker OpenAI. OpenAI is integrated into Apple Intelligence, which was supposed to be a major selling point for the company's newest devices.

It wasn't long ago that some on Wall Street thought that Apple Intelligence would usher in a new wave of iPhone upgrades and propel Apple into a leading AI investment opportunity.

While concerns surrounding new tariff policies and an uncertain economic outlook are likely playing a role in Apple's mundane growth profile at the moment, my view is that Apple Intelligence is just not enough of a value-add feature to inspire mass device upgrades.

As such, I think Apple needs to open the pocketbook and begin allocating capital in more strategic ways beyond dividends and stock buybacks.

Image source: Getty Images.

What can Apple do to get investors excited again?

Wedbush Securities technology research analyst Dan Ives recently suggested the idea that Apple should acquire Perplexity. Perplexity is a large language model (LLM) akin to ChatGPT.

We believe Apple needs to acquire Perplexity for AI capabilities. Likely $30 billion range would be a no brainer deal given treadmill AI approach in Cupertino. Perplexity would be a game changer on the AI front and rival ChatGPT given the scale and scope of Apple's ecosystem🍎

-- Dan Ives (@DivesTech) July 9, 2025

Given the rise of ChatGPT and the popularity of LLMs over traditional search in general, I think integrating Perplexity as a native component of Apple's operating system makes a lot of strategic sense. There are multiple ways that Apple could strengthen its services through a product such as Perplexity.

For example, adding Perplexity as a new layer of Siri could help Apple create more sophisticated voice assistant functionality across its installed base. In addition, Apple could use Perplexity in Safari to power AI-generated answers to search queries -- ultimately opening the door to more directly rivaling Microsoft Copilot or Alphabet's Google search.

Beyond Perplexity, I see two moonshot opportunities that Apple could consider exploring. First, Safe Superintelligence could be somewhat of a logical fit, as one of its co-founders actually used to lead AI projects at Apple. Unlike OpenAI, Anthropic, or Perplexity, Safe Superintelligence is still very much in research and development (R&D) mode. While it would be interesting for Apple to buy the company, I think the road to monetization would still be years away.

Another interesting area for Apple could be to join its "Magnificent Seven" peers Nvidia, Tesla, and Amazon in the world of AI-powered robotics. Humanoid robotics start-up Figure AI is one of the more mainstream businesses breaking ground in this pocket of the AI realm.

The drawback I see with humanoid robotics is that it does not directly complement Apple's roster of hardware products and the services they provide. Much of Apple's technology is either easily portable (iPhone, MacBook Pro) or wearable (AirPods, iWatch). To me, Figure AI opens up a lot of doors for Apple, but ultimately may be a distraction from the company's consumer electronics empire.

Overall, I agree with Ives that Apple should make an acquisition to supercharge its position in the AI race.