Over the last several months, artificial intelligence (AI) enthusiasts have become intrigued by an emerging technology known as quantum computing.

Although quantum applications are not yet operating at scale, industry research suggests the technology could be a game changer. Management consulting firm McKinsey & Company forecasts that quantum computing could add trillions in economic value in the coming decades, signaling this technology could revolutionize the AI megatrend over the long run.

One company that has received quite a bit of attention in the quantum arena is Quantum Computing (QUBT +1.75%). Quite an apropos name, if you ask me.

With shares trading just below $20 as of this writing, is now a good time to scoop up shares of Quantum Computing stock?

NASDAQ: QUBT

Key Data Points

What's with all the hype around Quantum Computing stock?

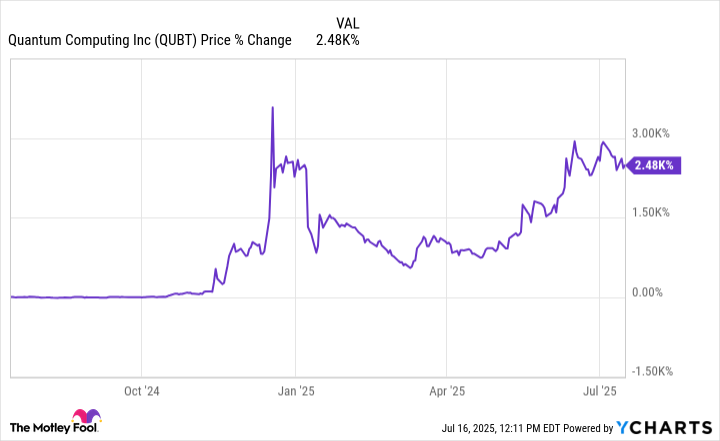

Over the last year, shares of Quantum Computing have risen by 2,480% -- handily outperforming the S&P 500 and Nasdaq Composite.

With such tantalizing gains, Quantum Computing's business must be on a roll, right? Well, not quite.

Over the last 12 months, Quantum Computing has only generated about $385,000 in revenue. To me, the meteoric rise in Quantum Computing's share price can be attributed to a number of macro-oriented narratives as opposed to anything company-specific.

For example, Nvidia CEO Jensen Huang has spoken favorably about the prospects of quantum computing on multiple occasions. Considering how important Nvidia's technology stack is for the broader AI narrative, investors likely find it encouraging that the visionary CEO appears bullish on the quantum computing opportunity.

On top of that, some economists think an interest rate cut from the Federal Reserve could be on the horizon. Diminishing rates could be viewed positively by investors, and growth stocks such as Quantum Computing would likely be particular beneficiaries of renewed investor enthusiasm.

Image source: Getty Images.

Assessing Quantum Computing's valuation

Per the chart below, Quantum Computing boasts a price-to-sales (P/S) ratio over 5,200. When you assess Quantum Computing from this perspective, the company's nominal revenue levels really come into focus. How can a company generating only a few hundred thousand dollars in sales achieve a multibillion-dollar market cap?

QUBT PS Ratio data by YCharts

In my eyes, Quantum Computing stock is largely trading on a bullish narrative at the intersection of AI and quantum applications. To drive home how silly Quantum Computing's valuation really is, consider the following:

- Dot-com bubble: During the most euphoric days of internet hype during the late 1990s, companies such as Amazon, Microsoft, and Cisco witnessed peak P/S multiples in the range of 31 to 43.

- COVID-19 bubble: In more recent history, companies such as Zoom Communications and Peloton Interactive witnessed stratospheric valuations as investors bought into the narrative that these companies would capitalize on remote work trends and the at-home economy. Zoom's P/S peaked at around 124 while Peloton's high was roughly 20.

Is Quantum Computing stock a buy right now?

According to recent company filings, Quantum Computing recently issued 14,035,089 shares at a purchase price of $14.25 in an effort to raise capital. Considering the company barely generates revenue and is unprofitable, it was only a matter of time before Quantum Computing faced a liquidity crunch.

I see this share issuance as a sign that management understands how stretched the company's valuation has become; therefore, it took strategic advantage of current inflated prices.

While Quantum Computing stock might appear cheap at $18 per share, the valuation analysis explored above underscores that the company is trading well past the point of a bubble. Furthermore, the recent stock issuance could subtly imply that management does not believe the current valuation is sustainable.

To me, Quantum Computing is a highly speculative opportunity that is best avoided for now.