Since OpenAI commercially launched ChatGPT on Nov. 30, 2022, shares of semiconductor company Nvidia have soared by more than 900%. As of closing bell on July 16, Nvidia boasted a market capitalization of $4.2 trillion -- making it the most valuable company in the world.

While these trends suggest Nvidia is perhaps the most dominant force in the artificial intelligence (AI) landscape, the company has a number of strategic relationships that have helped contribute to its growth.

Let's explore some of the companies Nvidia has partnered with and analyze why these relationships are important. From there, I'll detail one particular Nvidia-backed data center stock that I think growth investors should keep an eye on right now.

What companies is Nvidia invested in?

According to Nvidia's latest 13F filing, the company has investments in the following businesses:

- CoreWeave

- Arm Holdings

- Applied Digital

- Recursion Pharmaceuticals

- Nebius Group (NBIS +4.80%)

- WeRide

Both CoreWeave and Nebius are major players in the data center infrastructure market. While I think each of these stocks are deserving of attention, I see Nebius as an under-the-radar bargain right now.

Image source: Getty Images.

What is Nebius?

Nebius had an interesting path to relevancy in the AI realm. The company listed on the Nasdaq Stock Market in late 2024 following a spin-off from Russian internet conglomerate Yandex. Subsequently, Nebius raised $700 million through a private placement with Nvidia being one of the participants.

Similar to CoreWeave, Nebius can be thought of as a neocloud. Through various data centers located across Europe and the U.S., companies have the ability to access Nvidia's GPUs through a cloud-based infrastructure services platform. While the company's infrastructure-as-a-service competes with CoreWeave and Oracle, I see plenty of room for multiple winners.

NASDAQ: NBIS

Key Data Points

Rising AI infrastructure spend bodes well for Nebius

Just this year alone, cloud hyperscalers Microsoft, Alphabet, and Amazon are expected to spend roughly $260 billion on capital expenditures (capex) -- much of which will be allocated toward AI data centers and additional chip access.

Moreover, Meta Platforms recently invested $14.3 billion into data labeling start-up Scale AI. In addition, the social media and metaverse behemoth has been on a hiring blitz -- poaching top researchers from OpenAI and other competing platforms to help create the Meta Superintelligence Labs (MSL) operation.

These investments underscore the idea that AI's largest developers are building sophisticated ecosystems in need of high-performance compute power and tightly integrated infrastructure services.

I see the tidal wave of capex investment from hyperscalers as a bullish secular tailwind for Nebius and the neocloud environment.

Is Nebius stock a buy right now?

As of the end of the first quarter, Nebius' AI infrastructure business was operating at an annual recurring revenue (ARR) run rate of $249 million. While this was good for 684% growth year over year, management is guiding for an ARR run rate between $750 million and $1 billion by the end of the year. To me, this forecast suggests that Nebius is well positioned to take advantage of rising infrastructure spend throughout the second half of the year as Nvidia continues rolling out its Blackwell architecture.

Just recently, equity research analyst Alexander Duval of Goldman Sachs placed a price target of $68 on Nebius -- implying 28% upside from prices as of closing bell on July 16. Andrew Beale of Arete Research is even more bullish, as his $84 price forecast implies that Nebius is trading for nearly a 60% discount.

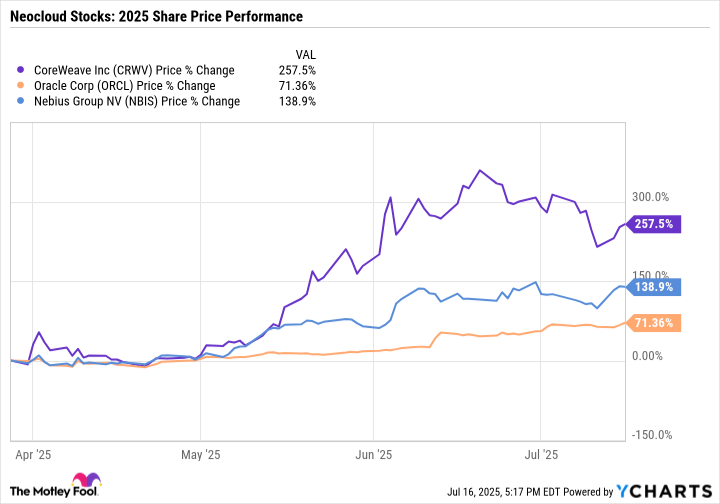

While Nebius stock's 139% share price appreciation might suggest the stock is overbought, I wouldn't turn my back on the company just yet. CoreWeave went public earlier this year and has been one of the AI infrastructure market's biggest storylines ever since. Moreover, Oracle's success in infrastructure services also adds a layer of credibility to the broader neocloud opportunity and helps underscore the need for these businesses as demand for chip access continues to surge.

In my eyes, Nebius -- which is far smaller than CoreWeave and Oracle -- has mostly gotten caught up in macro-driven momentum. With that said, considering the company's financial growth explored above, I'd make the case that its current valuation is less rooted in speculation and finally experiencing a long-overdue correction.

I see Nebius as a bargain right now compared to its peers and think the stock could carry significant upside, as the analysts on Wall Street suggest. To me, Nebius is a no-brainer opportunity and could swiftly emerge as a disruptive force across the cloud infrastructure and AI data center markets.