XRP (XRP 1.11%) and MicroStrategy (MSTR -6.06%) both soared during crypto's 2025 revival, with the fintech coin rising by 46% and the crypto treasury company climbing by 49% this year so far (as of July 18).

Yet one earns its keep by processing real transactions for banks and institutions, while the other is a listed company whose sole trick is piling more Bitcoin onto an already mountainous stack.

But which route is going to lead to higher returns for investors with a moderately sized amount of starting capital to invest -- say, $5,000?

XRP is building utility today, and it's working

The XRP Ledger (XRPL) is gradually turning into an institutional finance support layer as a result of the consistent development work performed by its issuing company, Ripple.

Last month, Ripple and Circle ported Circle's stablecoin onto the XRPL to grease the wheels of on‑chain payments for users in the traditional financial sector, as well as for the decentralized finance (DeFi) sector. The overarching strategy here is to beef up the chain's platforms for stablecoins, tokenized U.S. Treasuries, and other real-world assets (RWAs), and then build out the compliance and identity-tracking features that banks and asset managers crave. The idea is that once the financial and regulatory infrastructure is in good condition, the target users will be heavily incentivized to show up because there aren't other blockchains that are as carefully tailored to their particular needs.

Why does that matter for those considering an investment in XRP?

Image source: Getty Images.

Each ledger transfer requires a sliver of XRP crypto that is permanently burned upon the transaction's completion. The busier the network, the scarcer the coin becomes. If stablecoin liquidity and real-world asset settlement grow in volume, demand for fees and for escrow collateral should keep pace, creating a modest-to-moderate upward pressure on the coin's price.

Legal overhang is fading too, which lowers the risk of making an investment now.

In March, the Securities and Exchange Commission (SEC) signaled that it would abandon its appeal in its long-running lawsuit against Ripple, effectively ending a four‑year skirmish that once scared away institutions and a number of rightly cautious investors. Regulatory clarity doesn't directly feed through into short-term price appreciation, but it takes away the largest known tripwire for adoption, so it removes a significant drag on the asset's long-term potential.

Strategy is a levered bet on Bitcoin

Strategy is the corporate embodiment of the stereotypical diehard Bitcoin evangelical (some would say cultist) crowd. This means that it's all about buying as much Bitcoin as it can possibly afford, including by issuing new stock and taking out fresh debt, regardless of the coin's price.

As of July 14, it held about 601,550 bitcoins, purchased for $42.9 billion at an average cost of $71,268 each. At today's Bitcoin price of about $119,000, that holding is worth roughly $72 billion.

To expand the stack, management keeps issuing zero‑coupon convertible notes, including another $2 billion in February alone. It's going to continue in this same pattern until the cows come home.

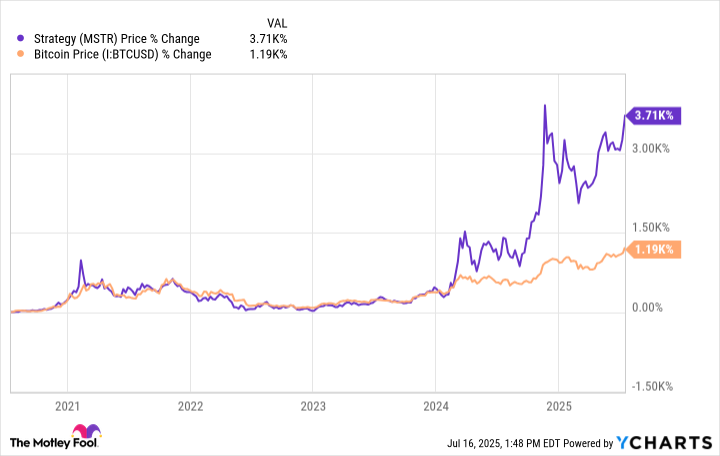

For shareholders, that has paid off fairly well during the past five years.

Investors must understand that leverage supercharges Strategy's stock returns if Bitcoin rises, but it also magnifies pain. A 25% slide in the big orange coin would erase a vast amount of the company's value.

There's also a subtle timing mismatch. Strategy's convertible bonds mature years from now, starting in 2030, but historically, Bitcoin has shown that it can drop significantly in days and weeks. Strategy Executive Chairman Michael Saylor's conviction in the asset is legendary, but conviction doesn't repay debtors.

Finally, remember that Strategy is not Bitcoin -- there are actually a few ancillary activities the company still does related to its former identity as a software business. In other words, you're paying for its overhead in the name of getting exposure to Bitcoin, which you could replicate more cleanly with holding the coin itself.

Where $5,000 probably works harder

If your goal is to capture some upside in the crypto sector while taking on a moderate amount of risk, XRP looks like the preferable bet here.

The ledger is luring real revenue sources, like stablecoin float, cross‑border payment settlement, and tokenized treasuries, all while its biggest legal cloud just cleared. Assuming Ripple hits its roadmap milestones, institutional demand could continue to increase sharply during the next few years, sending XRP's price higher. It might not be a wealth-maker investment overnight, but the risk of a big implosion feels lower than during the lawsuit era, and it's undeniably finding traction right where it wants to.

Strategy is more of a racehorse for adrenaline seekers, which is to say that it's not a great play for the average investor. Should Bitcoin sprint to $200,000 by 2026, the stock's leverage could make XRP's gains look small. Yet that same leverage could become very cruel for shareholders if Bitcoin revisits $60,000, a level that would wipe out a huge chunk of the company's balance sheet and trigger harsh volatility. Most mainstream investors do not need that kind of insomnia-provoking asset in a retirement portfolio.

Therefore, for a $5,000 allocation today, XRP is the better option. Leave Strategy for those comfortable underwriting both Bitcoin's swings and a heavily indebted software company that moonlights as a crypto hedge fund.