One of the big reasons to like Pfizer (PFE 0.08%) today is its huge 7.1% dividend yield. To put that yield into context, the S&P 500 index is yielding roughly 1.3% and the average healthcare stock a bit over 1.7%. Pfizer competitor Merck (MRK 0.98%) is yielding a little more than 4%, yet dividend investors will probably be better off with Merck. Here's why.

Pfizer and Merck have similar business models

While Pfizer's dividend yield is clearly much higher than Merck's, both have relatively attractive yields today. And you could easily make the argument that the two pharmaceutical companies basically do the same thing. Thus, you might as well buy the higher-yielding stock here. That isn't an unreasonable position to take.

Image source: Getty Images.

Essentially, these two industry giants make drugs. They make different drugs, of course, but both are focused on conducting research intended to create new blockbuster drugs that they can sell exclusively until the patents run out. Both have massive and well-funded research and development teams. Both have global distribution systems and strong marketing groups. And both have the scale to buy smaller competitors with promising drugs, if they need to.

In the short term, there will be differences between the two with regard to the drugs they have. So at times Pfizer will be better positioned than Merck, and vice versa. Given their vastly different yields, it is pretty clear that Wall Street believes Merck is better positioned right now.

NYSE: PFE

Key Data Points

The problem with Pfizer is the dividend, not the yield

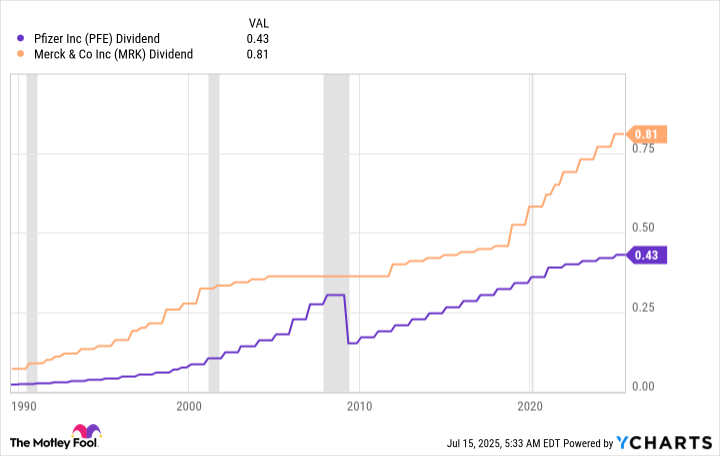

Right now, Pfizer has a streak of 15 consecutive dividend increases. Merck's streak is also 15 years long. The issue is what happened roughly 15 years ago. As the chart below shows, Pfizer cut its dividend and Merck did not.

PFE Dividend data by YCharts

That was a long time ago, of course, and the business environment was much different. The cut came in the middle of the Great Recession, when there were very real concerns that global financial systems would collapse. Notably, Pfizer cut the dividend at the same time it made a large acquisition.

And yet Merck didn't cut its dividend; it has also made large acquisitions in the past, including its own sizable merger in 2009. To be fair, Merck's dividend was static for a long period of time, but going without a dividend increase is much more attractive for an income investor than suffering through a dividend cut.

Why investors buy Pfizer and Merck

If you are like me, you are not a healthcare specialist. Buying small drugmakers with novel products that are still in the testing phase is likely a non-starter. I just don't know enough to understand what is going on at such companies. And I certainly don't know how to analyze the likelihood that a new drug will get approved.

NYSE: MRK

Key Data Points

Pfizer and Merck both have portfolios of already approved drugs. So there's a core business supporting their research efforts. On that front, they have both proven over time that they can successfully perform the R&D needed to find new drugs. And if their drug pipeline is soft, they have proven that they will go out and buy smaller companies to bolster it. In essence, Pfizer and Merck let you own a pharmaceutical company without having to spend a huge amount of time and effort trying to dig deeply into the drug business.

But if you are trusting a company in this way, which is perfectly fine to do, you need to make sure you can trust it in other ways, too. If you are a dividend investor, Pfizer's dividend cut during the deep 2007 to 2009 recession just doesn't provide the same level of trust that Merck's steadily, though not annually, growing dividend does. Most investors will probably be better off erring on the side of caution here and buying Merck over Pfizer.