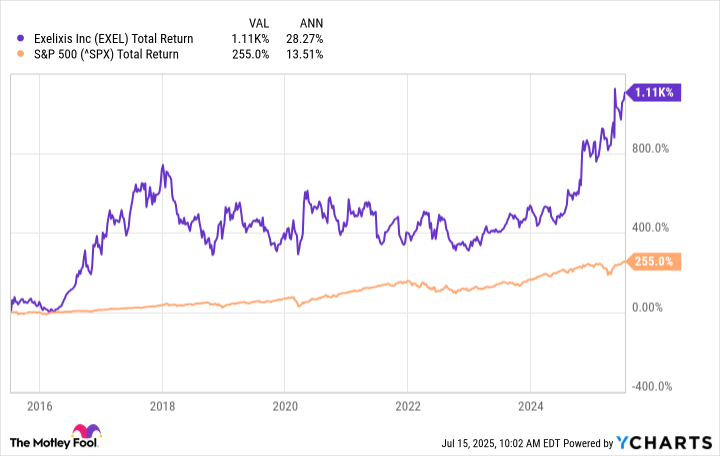

A decade ago, shares of Exelixis (EXEL 2.18%), a biotech company specializing in oncology, were trading for under $10 per share. Today, the drugmaker's shares are changing hands for about $45 apiece. In other words, Exelixis has crushed the market since 2015.

Some might think there is little upside left for the stock after this run, but that's not the case. Read on to find out why Exelixis still has plenty of growth fuel left in the tank.

EXEL Total Return Level data by YCharts.

Cabometyx is still doing the heavy lifting

Exelixis is best known for its cancer medicine, Cabometyx. First approved in the U.S. in 2016 for patients with renal cell carcinoma (RCC, a form of kidney cancer), it was a bit of a breakthrough as the first therapy to show significant improvements for RCC patients in three important measures: overall survival, progression-free survival, and objective response rate (the percentage of patients who respond to treatment).

Cabometyx has since earned numerous label expansions, and it continues to help drive solid top- and bottom-line growth for Exelixis. In the first quarter, the company's revenue jumped by 30.6% year over year to $555.4 million. The company's adjusted earnings per share (EPS) more than tripled to $0.62.

Image source: Getty Images.

Cabometyx has proven to be a successful pipeline drug, becoming the most prescribed tyrosine kinase inhibitor (a type of cancer drug that targets and kills cancer cells) among RCC patients, while making headway in hepatocellular carcinoma (liver cancer) and other markets.

Despite Cabometyx's success, though, Exelixis will need more to continue delivering above-average returns over the long run. Generic competition for the medicine is expected to enter the U.S. market by 2030. Thankfully, Exelixis is already preparing for that eventuality.

The next stage of growth

Exelixis aims to apply the same blueprint that has made it successful over the past decade: developing a cancer medicine that can become a standard of care in a niche with a high unmet need, while earning label expansions in many other markets. The company appears to have already discovered its next gem. Exelixis recently reported positive top-line phase 3 results for zanzalintinib in patients with metastatic colorectal cancer (CRC).

Despite having a high 5-year survival rate when caught early, CRC is the second-leading cause of cancer death worldwide partly because, once it has metastasized, there are few effective treatment options.

Exelixis is looking to change that with zanzalintinib, and the company's apparent phase 3 success suggests it might be able to pull it off. Furthermore, zanzalintinib is being investigated across other indications, including those where Cabometyx is dominant, such as RCC. The former seems to have a better safety profile than its predecessor, among several other advantages.

Beyond RCC and CRC, Exelixis plans to start several other late-stage studies for its next crown jewel this year, all of which will test it against current standards of care.

NASDAQ: EXEL

Key Data Points

As they say, to be the best, you have to beat the best. That's what Exelixis aims to do with zanzalintinib. Exelixis expects zanzalintinib to generate about $5 billion in sales eventually, far exceeding Cabometyx's current total or, for that matter, Exelixis' annual revenue. There is still some work to be done to get there, but early signs suggest that zanzalintinib is an excellent candidate.

Exelixis' recent clinical progress also reinforces its leadership in oncology. The biotech company has several other early-stage candidates in development that could help it move beyond Cabometyx once it starts facing generic competition.

Can Exelixis get to $200?

From its current stock price of approximately $45, Exelixis needs a compound annual growth rate (CAGR) of at least 16.1% to reach $200 within the next decade and 10.5% to achieve this in 15 years. The former goal is ambitious, but the stock has delivered even better returns than that over the past decade. Although the past is no guarantee of future success, Exelixis' MO has remained the same and could, once again, allow it to generate monster returns over the long run as it makes significant clinical and regulatory progress with zanzalintinib and other pipeline candidates.

Even if it falls short of this goal, though, my view is that Exelixis is well-positioned to deliver market-beating returns to patient investors -- the 15-year path to $200 would still be impressive. Either way, the stock looks like a buy.