Medical device specialist DexCom (DXCM 1.22%) has encountered significant headwinds in the past year. The company's financial results haven't been quite up to the market's standards, and broader market volatility caused by President Donald Trump's trade policies isn't helping either. The stock is down 26% over the trailing-12-month period.

Yet even with all these challenges, DexCom could be a terrific performer in the next five years. Here's why.

There's plenty of white space ahead

DexCom markets continuous glucose monitoring (CGM) systems, which are devices that help track blood sugar levels in patients with diabetes. CGMs have at least two advantages: They make measurements automatically, and they make them as often as every five minutes. Consistently monitoring blood glucose levels helps people with diabetes make better health decisions. That's why CGM devices lead to improved outcomes, including less time spent in hyperglycemia.

Image source: Getty Images.

DexCom has significantly increased its installed base over the years. In 2024, it had over 2.5 million customers worldwide. However, the company remains well-positioned to capitalize on a massive global opportunity.

In the U.S., DexCom estimates that there are more than 4.5 million diabetes patients on insulin therapy who aren't on CGM yet despite being eligible for third-party coverage for the technology. And that's just the U.S., one of the more advanced countries in terms of CGM penetration. DexCom has typically targeted patients who use insulin, and third-party payers have been more willing to cover these populations.

However, last year, it launched Stelo, an over-the-counter CGM option for diabetes patients who aren't on insulin and for people with prediabetes. This move significantly expanded the company's addressable market. CGM penetration in the U.S. for type 2 diabetes patients not on insulin is about 5%, and for prediabetes patients less than 1%.

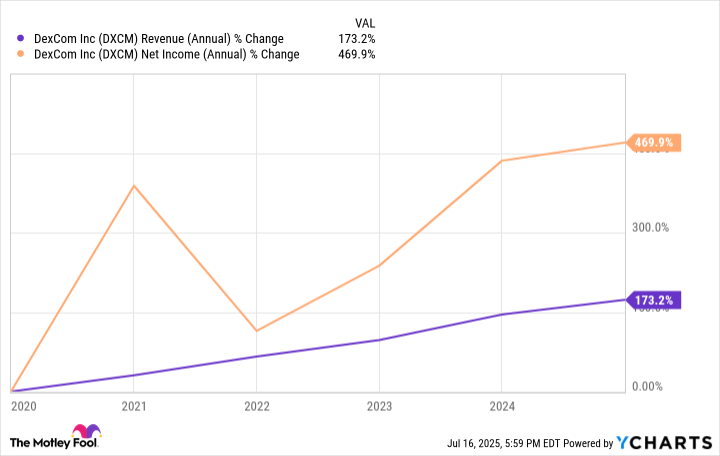

DexCom's opportunities both within and outside the U.S. are massive. The increased adoption of CGM technology has helped its revenue and earnings grow steadily over the past decade, and this trend is likely to continue.

DXCM Revenue (Annual) data by YCharts.

DexCom's shares declined last year due to poor financial results; in the U.S., more patients than the company expected took advantage of rebates, leading to lower-than-expected revenue per customer. However, since there's still plenty of work to be done in the CGM market, DexCom can address that issue as it continues to make even more headway in this field. That will allow its financial results to improve.

NASDAQ: DXCM

Key Data Points

Are DexCom's shares too expensive?

The stock's forward price-to-earnings ratio was recently 41.5, much higher than the healthcare sector's average of 15.8. But that forward P/E is on the low end compared to DexCom's average over the past few years:

DXCM PE Ratio (Forward) data by YCharts.

The medical device specialist has historically had steep valuation metrics, but has delivered market-beating returns anyway. In my view, DexCom can do the same in the next five to 10 years.

Investors might also be concerned about DexCom's main competitor in the CGM market, Abbott Laboratories. But these rivals have battled it out for years, and there's more than enough space for both to be successful, given the large worldwide CGM opportunity.

Furthermore, DexCom benefits from a network effect, as multiple companies have developed devices for diabetes patients that are compatible with its technology; these include insulin pens and pumps, third-party apps, and the Apple Watch. The more DexCom's installed base increases, the more attractive its ecosystem becomes to device or app developers looking to target a large population of patients.

And as these companies launch more technologies compatible with DexCom's CGM devices, they also become more appealing to patients. This dynamic makes it likely that DexCom will remain a leader in CGM well beyond the next five years. In the meantime, the stock could rebound from its poor performance last year, and deliver superior returns through the end of the decade.