Artificial intelligence (AI) investing is still a dominant theme in the market. A substantial amount of money is being invested in building out AI production capabilities, and a select group of stocks is benefiting from this spending.

Two of my favorites are Nvidia (NVDA 0.05%) and Taiwan Semiconductor Manufacturing (TSM +1.77%). These two are both expected to experience monster growth over the next few years, making them among my favorite AI stocks to buy right now.

Image source: Getty Images.

Nvidia

Nvidia manufactures graphics processing units (GPUs), specialized computing devices that excel at handling demanding workloads. This is because they can process multiple calculations in parallel and be connected in clusters to amplify that effect. With AI computing clusters sometimes housing 100,000 or more Nvidia GPUs, this creates the ultimate AI training machine.

With AI hyperscalers planning to spend record amounts on data centers in 2025, this bodes well for Nvidia's long-term prospects. Data centers aren't built in a year. The process of building them is lengthy and complex, and if a company decides to build one today, it can take years before it becomes operational. As a result, investors can expect this record-setting data center spend to persist for multiple years, indicating that Nvidia's massive data center GPU sales are likely to continue.

NASDAQ: NVDA

Key Data Points

Nvidia also received fantastic news from the U.S. government recently. Back in April, Nvidia's export license for H20 chips was revoked. These chips were specifically designed to meet export restrictions to China, and the revocation of its export license was slated to cost Nvidia about $8 billion in sales during the second quarter. While Nvidia still expects to generate $45 billion in revenue, this was a huge blow. However, Nvidia announced that it is reapplying for an export license and has assurances from the U.S. government that it will be approved. This will lead to increased sales for Nvidia and enable it to continue its impressive growth.

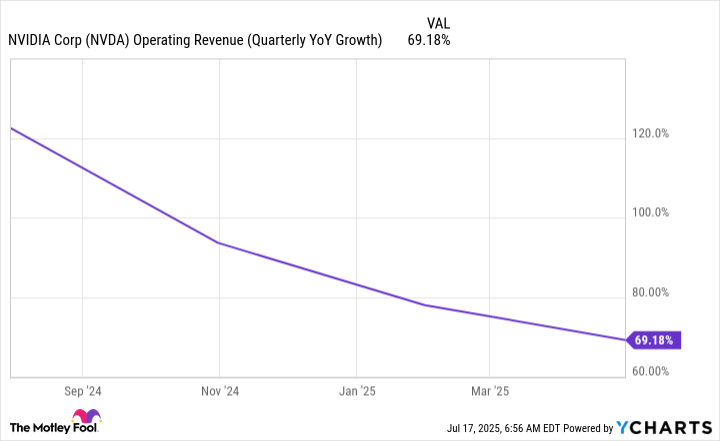

While there is no time for H20 chips to impact Q2's sales numbers, it will likely have some effect on Q3's figures. While Nvidia expects 50% revenue growth in Q2, that number would have been 77% if projected H20 sales were included. That would indicate that Nvidia's sales aren't slowing down as quickly as the market expects, showcasing the unbelievable growth in the AI field.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts

Nvidia will continue to be a top AI investment option, and I think every investor should have some exposure to Nvidia.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor manufactures Nvidia's chips, as Nvidia can't produce them in-house. TSMC also has other major tech companies on its client list, including Apple and Broadcom. Nearly every company utilizing cutting-edge technology is now working with Taiwan Semiconductor, which bodes well for its market position.

Taiwan Semiconductor established its leadership position in a few ways. First, it's not competing against its customers. Taiwan Semiconductor is a chip foundry only, and isn't trying to undercut its clients by offering chips directly to consumers. Second, it is always at the forefront of new chip technology, which assures its clients that they can remain long-term customers with TSMC instead of needing to hop between foundries to gain access to new tech. Lastly, Taiwan Semiconductor has industry-leading processes that allow it to achieve best-in-class yields. This is currently playing out in the 3nm (nanometer) chip node realm, as TSMC's yield is around 90%, while the only other foundry with this technology, Samsung, is reportedly stuck at 50%.

NYSE: TSM

Key Data Points

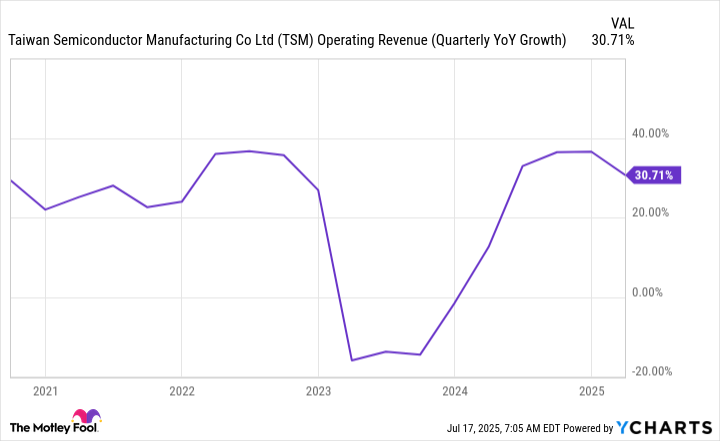

With Taiwan Semiconductor's leadership position, its clients often place orders years in advance. This provides management with an excellent view into what the future holds, allowing it to make bold predictions, such as the one it made at the start of 2025. For the five-year period starting in 2025, management expects AI-related revenue to grow at a 45% compounded annual growth rate (CAGR). TSMC serves more customers than just AI-centric ones, but it still projects its total revenue to grow at a CAGR of nearly 20%.

TSM Operating Revenue (Quarterly YoY Growth) data by YCharts

That's incredible growth, highlighting why Taiwan Semiconductor is a must-own in the AI investment world.

Both Taiwan Semiconductor and Nvidia are fantastic investment options in the AI realm right now. Each is expecting massive growth, giving investors a great opportunity to outperform the market over the next five years.