Animal spirits have returned to the stock market in a big way. Stocks are ripping higher left and right, with investors as optimistic as they have been in years. Opendoor Technologies (OPEN +1.17%) is the latest example of this theme, with the left-for-dead real estate company soaring over 300% in the last month. The highly shorted stock was recently trading below $1.00 but is now at $2.25 a share even though the company has given no fundamental updates to its business, which has never generated a profit.

Should you get in on the party and buy Opendoor Technologies stock today? Let's investigate further to see if this rapid stock turnaround means Opendoor is a buy for your portfolio.

NASDAQ: OPEN

Key Data Points

Struggling to scale in real estate transactions

Opendoor pegs itself as an e-commerce portal for residential real estate transactions, pitching itself to homebuyers and sellers who are frustrated with the slow traditional buying process for homes. With instant cash offers on homes, Opendoor can give customers rapid liquidity and speed up the process of selling a home, then flip it to a buyer. With the speed and ease-of-use with the platform, Opendoor believes it can buy homes at a slight discount and sell them at a premium, earning a profit in the small difference between the buying and selling prices for its housing inventory.

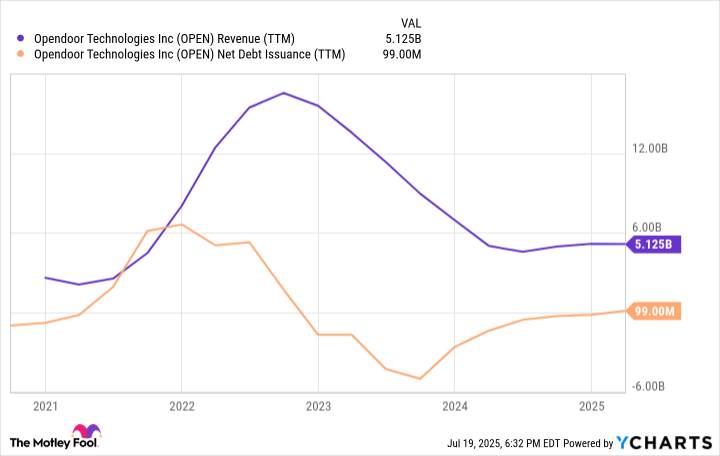

This is a unique business model that was popular in the COVID-19 housing boom but has struggled to scale. At one point, Opendoor generated over $15 billion in revenue, but that has since fallen to $5 billion over the last 12 months as its home sales have slowed down. When housing prices peaked in early 2022, the company struggled to buy and sell homes for a profit, leading to inventory write downs and forcing of management to scale down the business.

The number of existing home sales in the United States has fallen off a cliff too due to rising mortgage loan rates and high prices, making a purchase unaffordable for most buyers. This has reduced Opendoor's addressable market, which should indicate to investors that this iBuying model the company proselytized may not have mainstream appeal. Ninety-nine percent of transactions are still done through the traditional real-estate-agent model after all this hype.

Image source: Getty Images.

Profits remain elusive

More alarming than a limited market size is Opendoor's poor unit economics and lack of profitability.

Opendoor may earn $5 billion in annual revenue compared to a market cap of just $1.64 billion, but this does not tell the full story of whether the stock is cheap. Last quarter, the company had a measly gross profit of $99 million, or a gross profit margin of 8.6%. These are razor-thin unit economics that show the thin difference Opendoor is able to obtain between its buying and selling prices for homes on its balance sheet.

Making matters worse are the large overhead costs the company carries, along with debt financing that adds interest expenses. Last quarter alone Opendoor had $155 million in operating expenses, which wipes out its entire gross profit. In order to finance home purchases, it needs to take on debt, which added $33 million in interest payments last quarter. This is why Opendoor generates an annual net loss of $368 million and has never generated a profit.

This example should illustrate a core problem with Opendoor's business model: In order to scale, it needs debt. As revenue ballooned higher in the COVID-19 pandemic, so did the company's debt issuance, as it needed more capital to finance home purchases that would sit as inventory on the company's balance sheet. As this unwound and home prices fell, the company paid back this debt but had a much lower revenue level and could still not cover its fixed operating and debt costs.

The entire time, Opendoor lost money for shareholders, which shows the flaws in its business.

OPEN Revenue (TTM) data by YCharts.

A rising stock does not tell the whole story

Up 325% this month, Opendoor stock is becoming a short-term traders dream. It has a high-estimated short interest, which may be putting a short squeeze on the stock and reinforcing its rising share price in the last month. Investors are getting optimistic about a turning Opendoor stock price, with momentum getting on its side again.

The actual business fundamentals tell a different story. Opendoor has never generated a profit and has a flawed business model. The stock may continue to rise if investors start piling into it, but this does not change anything about its actual viability as a business. Long-term investors care about earnings growth and valuation, which should keep you away from buying Opendoor stock for your portfolio. There are much better stocks to buy right now.