Plug Power (PLUG 1.65%) appears to be a trailblazer in the hydrogen economy, boasting a diverse portfolio of technologies including fuel cells, electrolyzers, and hydrogen infrastructure. The company's vision of a decarbonized future has garnered considerable attention.

However, ambition alone does not guarantee success, and the company has a long history of underdelivering for investors. If you're considering scooping up Plug Power stock, here's what you should know first.

NASDAQ: PLUG

Key Data Points

Plug Power's ambitious end-to-end hydrogen ecosystem

Plug Power aims to revolutionize the green hydrogen sector and is creating an end-to-end ecosystem that encompasses every facet of the industry: energy generation, production, storage, and delivery.

Plug Power's fuel cell technology harnesses hydrogen and oxygen to power everything from material-handling vehicles, such as forklifts, to power stations and electric delivery vans. It also produces proton exchange membrane (PEM) fuel cell systems like GenDrive and GenSure. PEMs split water into hydrogen and oxygen using clean electricity, or can run in reverse to produe eletricity from hydrogen and oxygen (water is the byproduct).

To support the growing demand for hydrogen, Plug Power also manufactures powerful hydrogen liquefiers capable of processing 15 to 30 tons per day, along with advanced cryogenic solutions for safe storage and transportation, including high-tech liquid storage tanks and delivery trailers. It counts retail heavyweights Amazon and Walmart among its primary customers.

Image source: Getty Images.

Plug Power operates hydrogen production plants in Charleston, Tennessee, and Kingsland, Georgia. Additionally, it has a new joint venture with Olin Corporation called Hidrogenii, which operates a 15-ton-per-day hydrogen production plant in St. Gabriel, Louisiana, that began operations earlier this year.

The Georgia plant is the largest electrolytic liquid hydrogen production facility in the United States, achieving a record output of 300 metric tons in April 2025. The company aims to increase its total hydrogen capacity to 40 tons per day while reducing fuel costs, since management expects internally producing hydrogen to be one-third the cost of purchasing it.

A long history of losing money

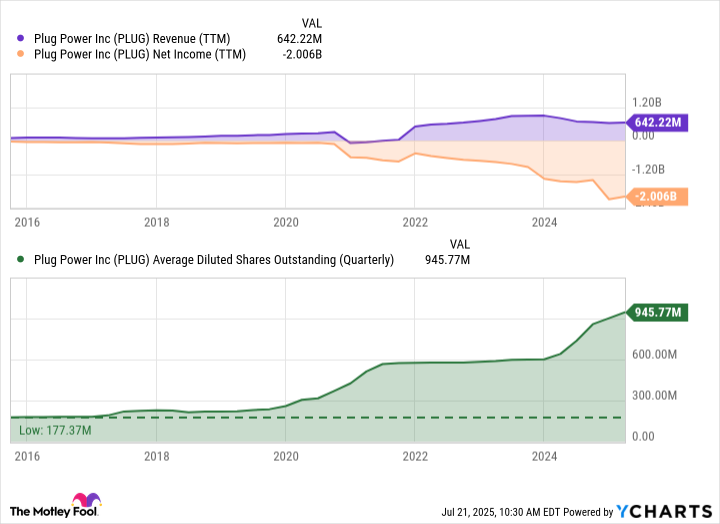

Funding plays a crucial role in Plug's business, particularly given its long-term financial struggles. Since going public over twenty-five years ago, Plug Power has never recorded a full-year net profit. Last year, the company posted a $2.1 billion net loss.

To stay afloat, Plug Power has repeatedly resorted to raising capital through the equity markets, meaning that share dilution has been its primary means of financing its operations. Over the past decade, the average number of diluted shares outstanding has soared from 177 million to over 945 million. This relentless increase in share count means that existing shareholders have seen the value of their investments decrease significantly due to dilution alone.

PLUG Revenue (TTM) data by YCharts

The company is addressing this with what it calls "Project Quantum Leap," a comprehensive cost-reduction initiative aimed at achieving annual savings of $150 million to $200 million. These measures include workforce reductions, facility consolidations, and cuts to discretionary spending and capital expenditures. Management aims to achieve a positive gross margin by the end of the fourth quarter of this year, with operating income projected to be positive in 2027 and overall profitability expected in 2028.

The company has secured much-needed funding

Plug has had some positive developments on the funding front. Earlier this year, it secured a $1.66 billion loan from the U.S. Department of Energy to construct up to six state-of-the-art clean hydrogen factories across the United States.

In addition to this substantial backing, Plug Power raised nearly $280 million through an upsize underwritten offering in March 2025. This involved the sale of 46,500,000 shares of common stock and prefunded warrants to purchase an additional 138,930,464 shares.

The company also established a $525 million secured credit facility with Yorkville Advisors, drawing an initial $210 million tranche in May 2025. This move enabled the company to retire $60 million of its existing convertible debentures, thereby reducing some dilution to shareholders from these instruments.

Is Plug Power stock a buy now?

Plug Power operates in a clean energy market with promising long-term potential. That said, it has a long history of consistent losses, shareholder dilution, and an inability to translate its opportunity into profitable growth.

Analysts project that the company will continue to operate at a loss over the next four years. They anticipate an improvement in its bottom line during that period, from a net loss per share of $2.67 last year to one of $0.59 this year and one of $0.38 in 2026.

Plug Power is making progress in expanding its operation and building out its end-to-end hydrogen ecosystem. With that said, the company continues to spend significantly, and its losses have only increased over the past few years; therefore, dilution in the coming years remains a risk. Given its extended history of losses, investors are better off waiting to see visible improvements to Plug Power's bottom line before buying the stock.