The massive spending on artificial intelligence (AI) infrastructure has supercharged the growth of several companies that build or design chips and deploy them in data centers, and the good part is that such companies are likely to sustain their solid momentum over the next five years.

That's because AI infrastructure spending is expected to hit $6.7 trillion by 2030. Nearly half of that amount is expected to be spent on chips and AI data centers. That's why now would be a good time to take a closer look at two companies -- Micron Technology (MU +3.77%) and CoreWeave (CRWV 1.73%) -- that are already benefiting from the huge AI infrastructure spending and seem built for impressive long-term growth.

Both stocks have been under pressure in July, which means that investors now have a chance to buy them on the dip. Let's look at the reasons why doing so could turn out to be a profitable move in the long run.

Image Source: Getty Images

1. Micron Technology

Memory manufacturer Micron has slipped over 6% this month, thanks to negative Wall Street sentiment on account of a potential slowdown in sales that could weigh on memory prices. However, not all Wall Street analysts seem to share the view.

Investment bank UBS is expecting the demand for high-bandwidth memory (HBM) used in AI chips to jump by 35% in 2026, along with an 18% increase in prices. Even Deutsche Bank is expecting more upside in Micron stock, which is evident from its $150 price target. The bank predicts HBM is going to be a key driver for the company's revenue and margin growth.

After all, Deutsche Bank points out that HBM reportedly carries a gross margin of 60%, compared to the 35% gross margin of non-HBM dynamic random access memory (DRAM). Bloomberg Intelligence estimates that the HBM market's revenue could increase at an annual rate of 42% through 2033, generating a whopping $130 billion in revenue at the end of the forecast period. It estimates that Micron could capture nearly a quarter of the HBM market in 2033, which would translate into $32 billion in revenue.

NASDAQ: MU

Key Data Points

That would be nearly 5 times the HBM revenue that Micron is expected to generate in the current fiscal year (which will end next month). For some perspective, Micron has generated just under $34 billion in revenue in the past 12 months, indicating that HBM alone has the potential to supercharge its growth in the long run.

And when we consider the superior margin profile of HBM, there is a good chance that Micron should be able to clock rapid growth in its bottom line as well. However, it won't be surprising to see Micron's HBM business turning out to be bigger than what's projected above, as the company has reportedly captured a fifth of this booming space already, thanks to its partnerships with Nvidia and AMD.

The company has an aggressive long-term capital expenditure plan worth $200 billion to ramp up its production capacity, and that could allow it to capture more than a quarter of the addressable revenue opportunity in HBM. All this indicates that buying Micron stock right now is an easy choice, considering that it is trading at just 20 times trailing earnings, as its terrific bottom-line growth could help it regain its mojo and fly higher in the future.

2. CoreWeave

CoreWeave's stock price has dropped nearly 25% in July as of this writing, with a recent report from HSBC weighing heavily on the stock of late. The bank has a price target of $32 on CoreWeave, which is nearly a fourth of the current stock price. HSBC analyst Abhishek Shukla believes that the AI graphics processing unit (GPU) infrastructure provider's reliance on just two customers -- Microsoft and OpenAI -- for 72% of its revenue is a risk.

NASDAQ: CRWV

Key Data Points

Additionally, the analyst points out that CoreWeave will be weighed down by a high cost structure as it will have to spend over a third of its revenue on the maintenance of GPUs. CoreWeave has built its business by acquiring AI data center GPUs from Nvidia and renting them out to customers for a fee. HSBC also believes that CoreWeave needs to sell software-centric services rather than just renting out hardware to become more competitive, attract new customers, and retain existing customers.

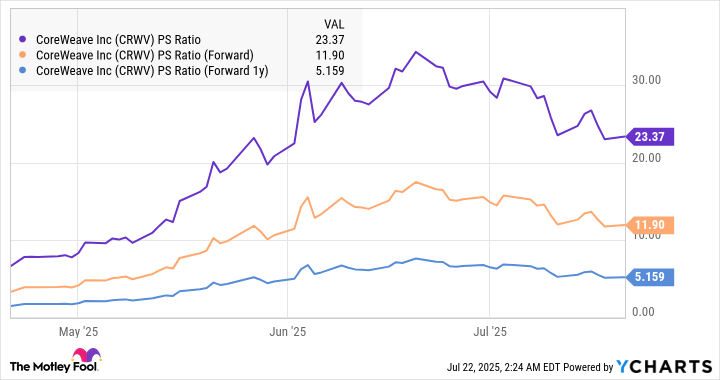

Throw in CoreWeave's expensive valuation -- it is trading at 23 times sales -- and it is easy to see why customers have panicked of late following negative Wall Street sentiment. However, CoreWeave's numbers clearly indicate that it isn't all that expensive when its remarkable growth is taken into account. Its revenue shot up more than fivefold in the first quarter to $981 million, while the revenue backlog stood at an impressive $26 billion.

CoreWeave landed a new contract worth over $11 billion from OpenAI in the quarter, while another $4 billion came from the expansion of an existing contract. Moreover, the company has been working on the software side of the AI infrastructure as well. It completed the acquisition of AI developer platform Weights and Biases a couple of months ago to offer more AI software solutions to customers.

The good part is that the company's software focus seems to be paying off as it recently introduced new developer tools, such as monitoring the performance of AI agents and providing access to popular models from DeepSeek and Llama. So, CoreWeave is gradually making the right moves that should pave the way for healthy growth in the long run, especially considering the massive capacity investments that it is making.

Also, investors should note that CoreWeave estimates that its addressable opportunity in the cloud infrastructure-as-a-service market could hit $400 billion by 2028. That's big enough for multiple players to operate in this market and allow CoreWeave to become a substantially bigger company in the future. Not surprisingly, CoreWeave's forward sales multiples are significantly lower than the trailing multiple on account of the tremendous growth that it is expected to deliver.

Data by YCharts.

So, investors looking to buy a growth stock probably see CoreWeave's dip this month as a buying opportunity since the company's massive revenue pipeline, its focus on expanding its software offerings, and the massive addressable market are likely to help it regain its momentum.