Warren Buffett once said, "If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes." This applies to any stock, but especially dividend stocks, because most of the value typically comes from holding long term and taking advantage of the compound effect.

To get an above-average dividend yield (compared to the S&P 500) while minimizing the risks that come with investing in individual stocks, investors should consider a dividend-focused exchange-traded fund (ETF). They can be the best of both worlds with good payouts and relative stability.

If you're looking for a high-yield dividend ETF you can comfortably hold for a decade, look no further than the Schwab U.S. Dividend Equity ETF (SCHD 0.10%). It's one of the more popular dividend ETFs on the stock market, and for good reason.

NYSEMKT: SCHD

Key Data Points

The fund's criteria help to vet companies beforehand

The Schwab U.S. Dividend Equity ETF mirrors the Dow Jones U.S. Dividend 100 Index. Unlike some dividend indexes that focus mainly on dividend yields, the Dow Jones U.S. Dividend 100 Index has a more rigorous criteria for being included. To make the cut, a company must show the following things:

- At least 10 years of dividend payouts

- A history of annual dividend increases

- A strong balance sheet and consistent cash flow

Due to the criteria, you can be sure the companies in this ETF are thoroughly vetted, which is important when you're investing long term and plan to hold on to the stock for at least a decade. Below are the Schwab fund's top 10 holdings and how much of the ETF they make up:

| Company | Percentage of the ETF |

|---|---|

| Texas Instruments | 4.36% |

| PepsiCo | 4.24% |

| Chevron | 4.23% |

| ConocoPhillips | 4.15% |

| Cisco Systems | 4.08% |

| Merck | 4.00% |

| Amgen | 3.99% |

| AbbVie | 3.93% |

| Bristol Myers Squibb | 3.85% |

| Coca-Cola | 3.80% |

Data source: Charles Schwab. Percentages as of July 18.

These may not be flashy companies, but they're reliable and have businesses set up for the long term.

A history of consistently good dividend yields

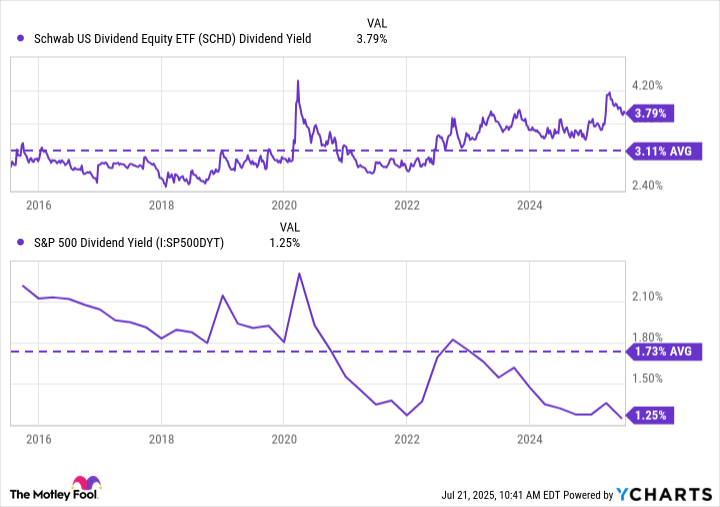

Dividend yields will inevitably fluctuate as stock prices change, but the Schwab fund has averaged a dividend of at least 3% over the past decade. This is a much better average than the S&P 500 during that span.

SCHD Dividend Yield data by YCharts

If we assume that the Schwab U.S. Dividend Equity ETF maintains a yield of at least 3% (emphasis on "assume"), that could pay investors at least $30 per $1,000 invested annually. That won't make you the next Jeff Bezos, but it adds up over time, especially when reinvested to buy more shares.

Unlike an individual company that has consistent dividend payout amounts, payouts from this ETF (and most dividend ETFs) fluctuate because companies pay out dividends at different times. Still, it should continue to fit the "high yield" criteria.

Low fees ensure you keep more money to yourself

An aspect of the Schwab U.S. Dividend Equity ETF that shouldn't be overlooked is its low expense ratio of 0.06%, which works out to $0.60 per $1,000 invested. Although small differences in expense ratios may not seem like a big deal, they noticeably add up.

For perspective, let's assume you invest $500 monthly into two ETFs, one with a 0.06% expense ratio and one with a 0.25% expense ratio. If you average 10% annual returns for 10 years, here's how your investments would stack up with each:

| Expense Ratio | Amount Paid in Fees | Investment Total |

|---|---|---|

| 0.06% | $887 | $94,737 |

| 0.25% | $3,664 | $91,960 |

Data source: Author's calculations using the SEC compound interest calculator.

What seems like a slight 0.19% difference on paper turns out to cost thousands more over a decade. That's money that could've been used to make more money, cover expenses, or put toward a personal purchase you've had in mind.

Dividends are a great way to earn money in the stock market without depending solely on a stock or ETF's price appreciation.