Does it make more sense to buy an investment directly, or to invest in a company that's taking out loans to accommodate another investment? That's the (somewhat confusing) question facing investors considering XRP (XRP 4.97%), the native token of its own chain, and MicroStrategy (MSTR 7.76%), a company that has effectively stapled its fortunes to trading debt and equity for Bitcoin (BTC 4.78%).

These assets sport multibillion-dollar market caps, so neither looks like a moonshot. Still, each has a compelling narrative that could, in theory, propel it far enough to mint new millionaires. Let's analyze both of them and see which has the better shot.

Image source: Getty Images.

Strategy ties its fate to Bitcoin more with each day

MicroStrategy, which is now doing business as Strategy, has a market cap near $126 billion, up more than 188% year over year.

The reason for its meteoric climb is simple. It owns 601,550 Bitcoins purchased for $42.8 billion, and it keeps issuing zero coupon convertible notes to buy more and more. Bitcoin itself is up 86% in the last year, so the company's use of leverage does indeed enable it to capture larger returns than its main asset.

NASDAQ: MSTR

Key Data Points

In other words, the stock behaves like a turbocharged Bitcoin exchange‑traded fund (ETF). When Bitcoin rises 10%, Strategy's stock often jumps far more because of embedded leverage and the market premium investors pay for instant Bitcoin exposure in their traditional financial accounts rather than on their crypto wallets.

That leverage is a double‑edged sword, however.

If Bitcoin stumbles, Strategy's equity value could collapse faster than the underlying asset. Still, the risk of Strategy being forced to one day liquidate its Bitcoin holdings to pay off its creditors is, for the most part, overstated. At this point, even a deep collapse in the coin's price probably wouldn't trigger any forced liquidations.

CRYPTO: BTC

Key Data Points

Assuming Bitcoin continues its march higher over the long term, Strategy's upside could easily outpace XRP's. But anyone chasing millionaire status here is really betting on two stacked variables: Bitcoin's price and Strategy's ability to keep raising cheap capital.

At the moment, that looks like a fairly good bet.

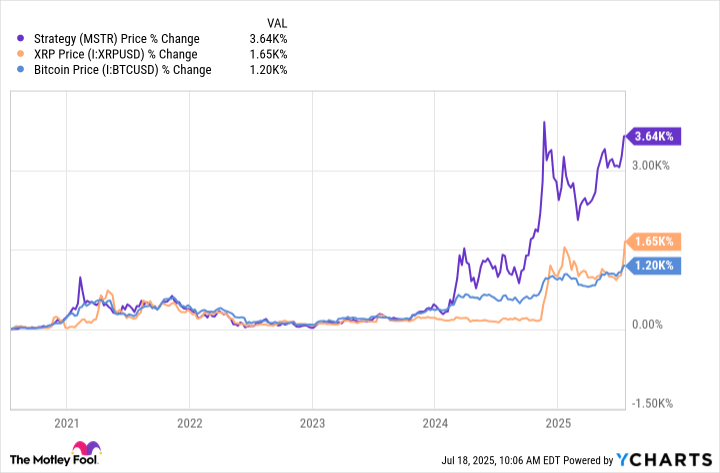

As shown in the chart below, the company's performance over the last five years -- once again, essentially just a leveraged version of Bitcoin's performance -- indicates that there is indeed millionaire-maker potential here.

XRP is more lucrative than ever

Whereas Strategy is a company, XRP is a blockchain that's issued by Ripple, a fintech business.

XRP's market cap is brushing $195 billion after a sharp July rally. Unlike Strategy, its growth path does not depend on leverage, but rather on Ripple convincing banks, financial institutions, and governments to build on the XRP Ledger (XRPL).

That pitch is gaining traction.

Bhutan's central bank is piloting a central bank digital currency (CBDC) on Ripple's tech, and Palau just completed an audit of its XRP‑based stablecoin pilot. Many banks are already using XRP to settle their international money transfers, as it helps them to avoid currency exchange fees as well as long delays. Each time a sovereign or major institution integrates XRP, more settlement volume and float migrate onto the network, driving demand for the coin.

CRYPTO: XRP

Key Data Points

Crucially, regulatory compliance is baked into the protocol, which makes it a much better fit for institutional investors and professional money handlers compared to other blockchain-based financial solutions. That lowers friction for heavyweight capital to allocate itself onto the chain.

Still, XRP's growth curve is undeniably gentler than Strategy's, and it's possible that its millionaire-maker trajectory is largely in the past rather than the future. Ripple needs to roll out additional services, court more governments and regulators, and withstand political pushback if it happens again.

If everything clicks, it could siphon trillions in tokenized assets onto its chain over the next decade, lifting XRP steadily rather than spectacularly. That makes it feel more like a marathon than a sprint, which is to say, friendly to the patient accumulators, and less so to gamblers seeking a 50‑bagger investment in a year.

You might not want to bet on the winner here

If the pace and odds of achieving millionaire status is your only yardstick and you are willing to accept extreme volatility to get there, Strategy offers the parabolic upside you're looking for. Its structurally leveraged Bitcoin hoard means a 100% move in Bitcoin, over the course of months or years, could translate into something dramatically higher in the stock.

Just remember that leverage magnifies losses the same way -- and that's why, for most investors, buying Strategy stock is not a reasonable move, even if it technically wins the millionaire-maker match-up with XRP.

XRP, by contrast, presents a lower‑volatility route tied to the development and deployment of real payment rails and institutional adoption.

Returns will likely be substantial over a longer horizon, but the odds of a 10‑fold surge from here are materially lower unless Ripple lands multiple CBDC deals and asset tokenization truly explodes. Those things might well happen, and the coin is worth owning even if they don't. But even a tenfold performance probably won't be enough to make investors into millionaires, as the starting capital involved would still be prohibitively large, so it's better to think of it as a smart investment to buy and hold rather than a lottery ticket.