Arista Networks (ANET 0.37%) has been in red-hot form on the stock market of late, jumping an impressive 61% from the 52-week low it hit on April 7. This terrific rally in Arista stock can be attributed to the broader recovery in tech stocks in the past three-and-a-half months, which is evident from the 34% surge in the tech-laden Nasdaq Composite index.

But is Arista's business growing at a good enough pace to justify this recent surge? More importantly, would it be a good idea to buy Arista Networks in anticipation of more upside? Let's try to find out.

Image source: Getty Images.

Arista's improving growth should be a tailwind for the stock

Arista is known for providing hardware and software to enable networking in the cloud. It sells hardware components such as high-speed switches and routers that are deployed in data centers and enterprise networks, while it also offers network management and software tools to ensure that the cloud networks perform optimally.

In fact, Arista has played a key role in enabling the growth of cloud computing. The company counts major cloud computing providers such as Meta Platforms and Microsoft as its customers, with these two companies accounting for just over a third of its revenue last year. Its offerings are also used by educational, financial, and medical institutions, apart from other service providers.

The growing demand for high-speed networking in data centers, driven by applications such as artificial intelligence (AI), has turned out to be a tailwind for Arista's business. Its revenue in the first quarter of 2025 increased an impressive 28% year over year to just over $2 billion. The company's non-GAAP net income jumped 30% to $0.65 per share.

The company expects its momentum to continue in the second quarter, forecasting a 25% year-over-year increase in its top line. Arista has guided for a 17% increase in its revenue for the full year, but its trajectory in the first half of the year suggests that it could end up exceeding its expectations.

Of course, management was coy about raising guidance in May, citing the potential impact of tariffs. But savvy investors should note that the need for faster connectivity in servers and data centers, thanks to catalysts such as AI, has opened up a huge addressable opportunity for Arista. The company believes that it can sell $750 million worth of AI-related networking solutions this year, and there is a good chance that this business will grow at an incredible pace.

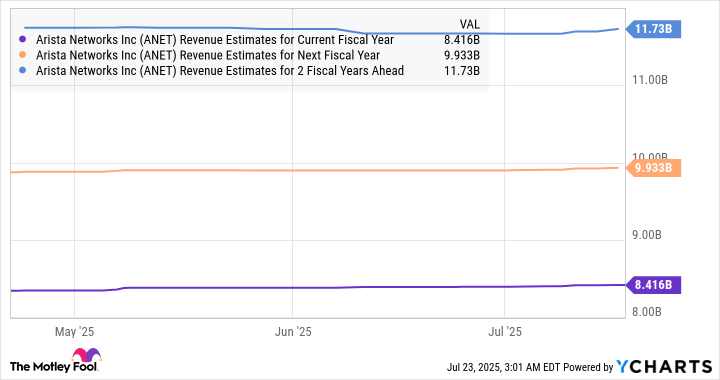

Data center switch sales are expected to grow at an annual rate of 40% through 2029. This is probably why analysts are expecting Arista's revenue growth rate to pick up -- and there is a possibility that it could exceed those estimates.

ANET Revenue Estimates for Current Fiscal Year data by YCharts

But what about the valuation?

Arista's recent surge has made the stock a bit expensive to buy right now. It trades at 47 times trailing earnings, while the forward earnings multiple of 43 isn't cheap, either, when we consider that the tech-laden Nasdaq-100 index has an average earnings multiple of 32. So, the valuation indicates that Arista stock is priced for perfection.

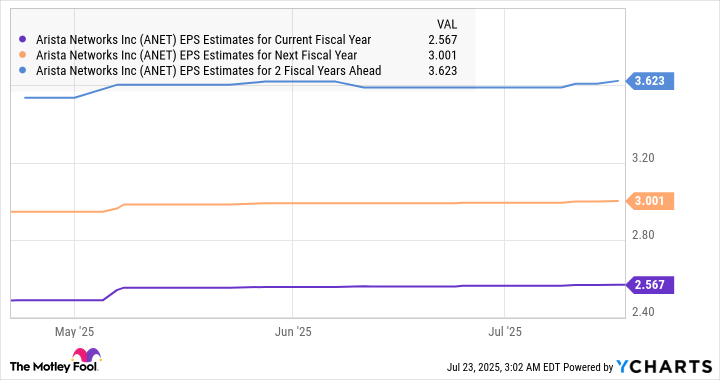

However, it may still be able to deliver more upside by delivering stronger-than-expected growth in the future, as drivers such as AI could help it exceed Wall Street's growth expectations. In fact, Arista's bottom-line performance has been better than consensus expectations in each of the past four quarters.

What's more, analysts have increased their earnings growth expectations for the company, as evident from the following chart.

ANET EPS Estimates for Current Fiscal Year data by YCharts

Arista's earnings are likely to keep crushing Wall Street's expectations since the switching and routing market is on track to register stronger growth in the future because of factors discussed above. So, growth investors can still consider buying Arista Networks as it may be able to justify its current premium.